Form 3885 Corporation Depreciation and Amortization Form 3885 Corporation Depreciation and Amortization

Understanding Form 3885 for Corporation Depreciation and Amortization

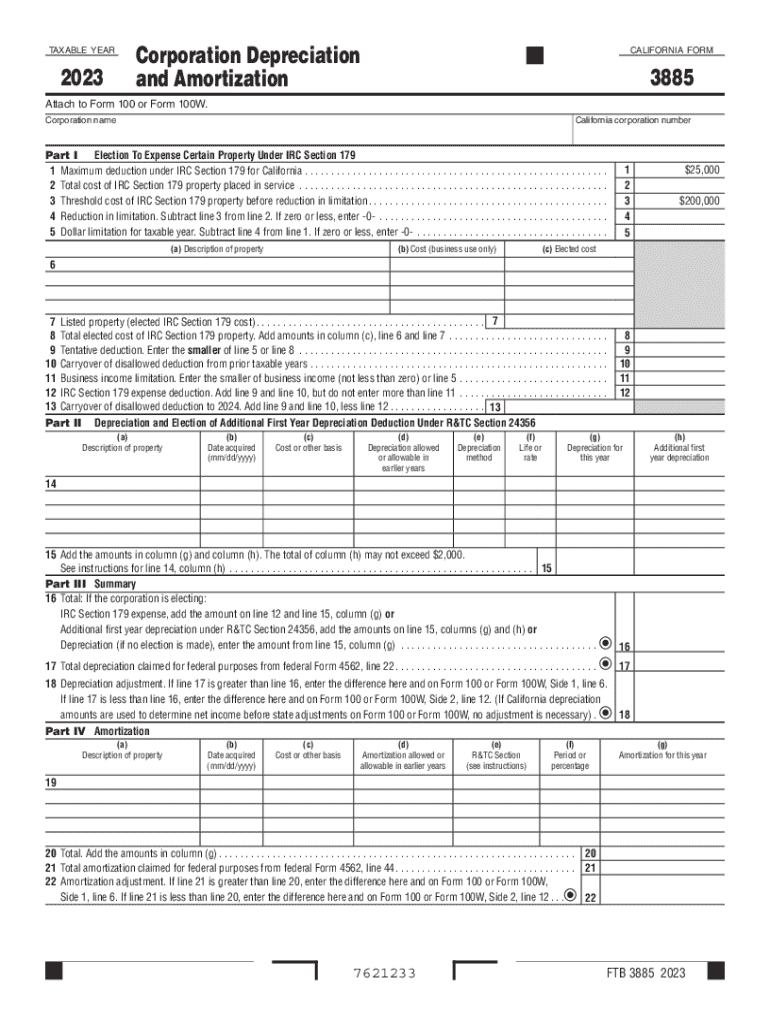

The Form 3885 is a crucial document used by corporations in the United States to report depreciation and amortization of assets. This form allows businesses to calculate the depreciation of their tangible assets, such as machinery and equipment, as well as amortization for intangible assets like patents and trademarks. Properly completing this form ensures compliance with IRS regulations and helps in accurately reporting financial information.

Steps to Complete Form 3885

Completing Form 3885 involves several key steps:

- Gather necessary information about the assets, including acquisition dates, costs, and useful lives.

- Determine the appropriate depreciation method, such as straight-line or declining balance.

- Fill out the relevant sections of the form, including asset descriptions and calculations for depreciation and amortization.

- Review the completed form for accuracy and ensure all required information is included.

Legal Use of Form 3885

Form 3885 is legally required for corporations that need to report their depreciation and amortization expenses. Accurate reporting is essential to comply with federal tax laws. Misreporting or failing to file this form can lead to penalties and interest on unpaid taxes. Corporations should maintain records that support the information reported on the form, as these may be required in case of an audit.

Obtaining Form 3885

Form 3885 can be obtained from the IRS website or through authorized tax preparation software. It is essential to ensure that you are using the most current version of the form to comply with the latest tax regulations. Businesses may also consult with a tax professional to ensure they have the correct form and understand any updates that may affect their filings.

Key Elements of Form 3885

Several key elements must be included on Form 3885:

- Identification of the corporation, including name, address, and Employer Identification Number (EIN).

- Detailed descriptions of the assets being depreciated or amortized.

- Calculation of depreciation and amortization amounts based on the selected methods.

- Signatures of authorized representatives to validate the form.

IRS Guidelines for Form 3885

The IRS provides specific guidelines regarding the use of Form 3885. These guidelines outline acceptable methods for calculating depreciation and amortization, as well as the types of assets that qualify. Corporations should familiarize themselves with these guidelines to ensure compliance and to optimize their tax benefits related to asset depreciation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3885 corporation depreciation and amortization form 3885 corporation depreciation and amortization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA depreciation and how does it affect my business?

CA depreciation refers to the systematic reduction in the value of an asset over time for tax purposes. Understanding CA depreciation is crucial for businesses as it impacts financial statements and tax liabilities. Properly accounting for CA depreciation can lead to signNow tax savings and improved cash flow.

-

How can airSlate SignNow help with CA depreciation documentation?

airSlate SignNow streamlines the process of sending and signing documents related to CA depreciation. With our easy-to-use platform, you can quickly create, send, and eSign necessary forms, ensuring compliance and accuracy in your financial reporting. This efficiency helps you focus on maximizing your tax benefits.

-

What features does airSlate SignNow offer for managing CA depreciation?

Our platform offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing CA depreciation documentation. These tools simplify the process of maintaining accurate records and ensure that all necessary documents are easily accessible. This can save you time and reduce errors in your financial reporting.

-

Is airSlate SignNow cost-effective for handling CA depreciation?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing the time spent on paperwork and improving document management related to CA depreciation, you can save money in the long run. Our competitive pricing plans ensure that you get the best value for your investment.

-

Can I integrate airSlate SignNow with my accounting software for CA depreciation?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage CA depreciation alongside your financial data. This integration allows for automatic updates and ensures that your depreciation calculations are always accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for CA depreciation?

Using airSlate SignNow for CA depreciation provides numerous benefits, including enhanced efficiency, improved accuracy, and better compliance with tax regulations. Our platform simplifies the documentation process, allowing you to focus on strategic financial planning. Additionally, the secure eSigning feature ensures that your documents are legally binding and protected.

-

How does airSlate SignNow ensure the security of my CA depreciation documents?

airSlate SignNow prioritizes the security of your documents, including those related to CA depreciation. We utilize advanced encryption methods and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

Get more for Form 3885 Corporation Depreciation And Amortization Form 3885 Corporation Depreciation And Amortization

Find out other Form 3885 Corporation Depreciation And Amortization Form 3885 Corporation Depreciation And Amortization

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template