FOOD and BEVERAGE TAX RETURN CITY of ALTON, ILLINO Form

Understanding the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

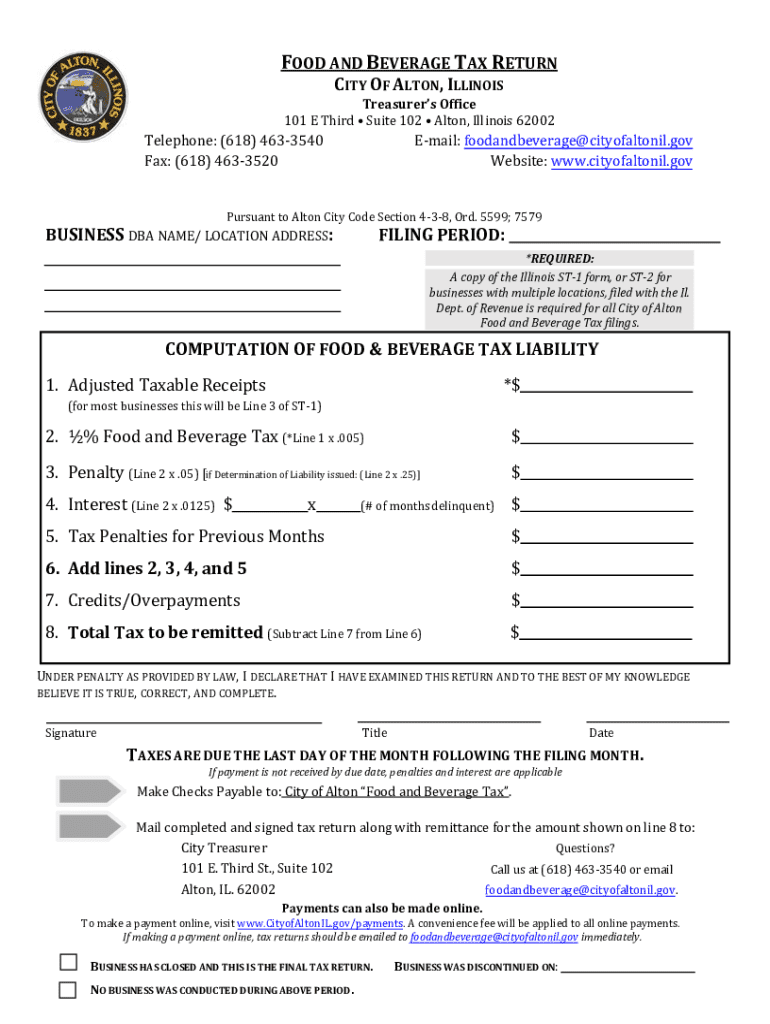

The FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO is a specific tax form used by businesses operating in the food and beverage sector within Alton, Illinois. This form is essential for reporting sales and calculating the appropriate taxes owed to the city. It is designed to ensure compliance with local tax regulations and helps maintain transparency in business operations. By accurately completing this form, businesses contribute to local revenue, which supports community services and infrastructure.

Steps to Complete the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

Completing the FOOD AND BEVERAGE TAX RETURN involves several key steps:

- Gather all necessary sales data for the reporting period, including total sales and taxable sales.

- Calculate the total food and beverage sales, ensuring to separate taxable from non-taxable sales.

- Determine the applicable tax rate for food and beverage sales in Alton.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the form for completeness and accuracy before submission.

How to Obtain the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

The FOOD AND BEVERAGE TAX RETURN can typically be obtained through the City of Alton's official website or directly from the city’s finance department. Businesses may also request a paper form via mail or in person. It is advisable to ensure that the latest version of the form is used to avoid any compliance issues.

Filing Deadlines and Important Dates

Businesses must be aware of specific deadlines for filing the FOOD AND BEVERAGE TAX RETURN. Generally, these returns are due quarterly, with specific dates set by the city. Missing these deadlines can result in penalties, so it is crucial to keep track of these important dates to ensure timely submissions.

Legal Use of the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

The legal use of the FOOD AND BEVERAGE TAX RETURN is governed by local tax laws in Alton, Illinois. Businesses are required to file this form to comply with city regulations. Failure to submit the form accurately and on time may lead to legal repercussions, including fines and penalties. Understanding the legal implications is essential for maintaining compliance and avoiding potential issues.

Key Elements of the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

Key elements of the FOOD AND BEVERAGE TAX RETURN include:

- Business identification information, including name, address, and tax identification number.

- Total sales figures for the reporting period.

- Breakdown of taxable versus non-taxable sales.

- Calculation of the total tax owed based on applicable rates.

- Signature of the business owner or authorized representative.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the food and beverage tax return city of alton illino

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO?

The FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO is a tax form that businesses in the food and beverage industry must file to report their sales and pay the applicable taxes. This return is essential for compliance with local tax regulations and helps ensure that businesses contribute to the city's revenue.

-

How can airSlate SignNow help with the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO?

airSlate SignNow simplifies the process of completing and submitting the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO by providing an easy-to-use platform for eSigning and managing documents. Our solution streamlines the workflow, making it easier for businesses to stay compliant and submit their returns on time.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features for occasional use or advanced functionalities for regular submissions like the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO, we have a plan that fits your needs and budget.

-

Are there any features specifically designed for tax return submissions?

Yes, airSlate SignNow includes features tailored for tax return submissions, such as customizable templates, secure eSigning, and document tracking. These features ensure that your FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO is completed accurately and submitted efficiently.

-

What benefits does airSlate SignNow provide for businesses filing tax returns?

Using airSlate SignNow for your FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform allows you to manage all your tax documents in one place, ensuring a smooth filing process.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, making it easier to manage your financial documents, including the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO. This integration helps streamline your workflow and ensures that all your data is synchronized.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive information, including the FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO, is protected. Our platform uses advanced encryption and security protocols to safeguard your data throughout the signing and submission process.

Get more for FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

- Meezan bank pay order form

- Rccg portal form

- Robbery suspect identification profile pmpv form

- Prudential life insurance surrender form 381723148

- Sap 69 form pdf

- Community based supplier registration form cape town capetown gov

- Sun van application1 doc cabq form

- Employee action request form state of california

Find out other FOOD AND BEVERAGE TAX RETURN CITY OF ALTON, ILLINO

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast