PA Schedule NRH Compensation Apportionment Form and Instructions PA 40 NRH FormsPublications

Understanding the PA Schedule NRH Compensation Apportionment Form

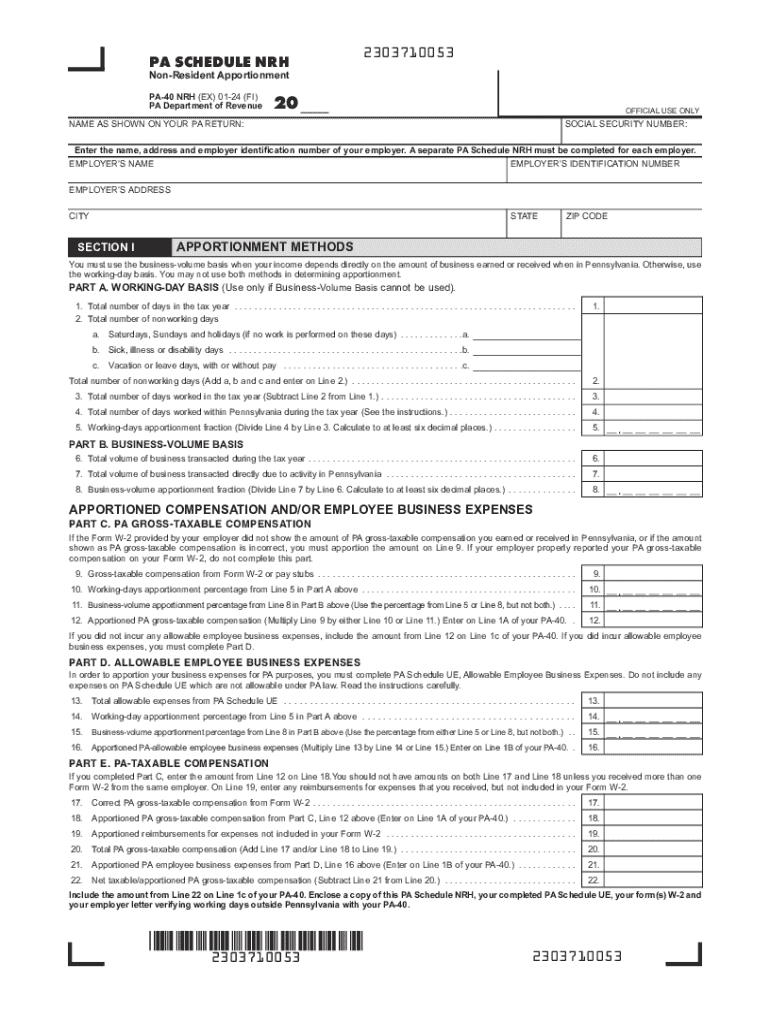

The PA Schedule NRH Compensation Apportionment Form is a crucial document for individuals and businesses operating in Pennsylvania. This form is specifically designed to allocate income earned in Pennsylvania to ensure accurate state tax reporting. It is essential for taxpayers who have income from multiple states or who are working in Pennsylvania but reside elsewhere. Understanding this form helps ensure compliance with state tax laws and can prevent potential penalties.

Steps to Complete the PA Schedule NRH Compensation Apportionment Form

Completing the PA Schedule NRH requires careful attention to detail. Here are the main steps to follow:

- Gather all relevant financial documents, including W-2s and 1099s.

- Identify the total compensation earned in Pennsylvania and from other states.

- Calculate the percentage of income attributable to Pennsylvania using the appropriate formulas provided in the form instructions.

- Fill out the form accurately, ensuring all figures are correct and match your supporting documents.

- Review the completed form for any errors before submission.

State-Specific Rules for the PA Schedule NRH Compensation Apportionment Form

Pennsylvania has specific regulations governing the use of the PA Schedule NRH. Taxpayers must be aware of the following rules:

- The form must be filed alongside the PA-40 Individual Income Tax Return.

- Only individuals who earn compensation from multiple states or who are non-residents need to complete this form.

- Failure to accurately report income may result in penalties or additional tax liabilities.

Legal Use of the PA Schedule NRH Compensation Apportionment Form

The PA Schedule NRH is legally recognized by the Pennsylvania Department of Revenue. It serves as an official document for reporting income and ensuring compliance with state tax laws. Taxpayers must use this form to substantiate their claims for income earned in Pennsylvania versus other states, which is essential for accurate tax calculations.

Filing Deadlines for the PA Schedule NRH Compensation Apportionment Form

Timely filing of the PA Schedule NRH is crucial to avoid penalties. The form must be submitted by the same deadline as the PA-40 Individual Income Tax Return, typically April 15 for most taxpayers. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year.

Examples of Using the PA Schedule NRH Compensation Apportionment Form

Consider a scenario where a resident of New Jersey works in Pennsylvania and earns income from both states. This individual would need to complete the PA Schedule NRH to accurately report their Pennsylvania income. Another example includes a Pennsylvania resident who works remotely for a company based in another state. They would also need to use the form to allocate their income properly and ensure compliance with Pennsylvania tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule nrh compensation apportionment form and instructions pa 40 nrh formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Pennsylvania revenue apportionment?

Pennsylvania revenue apportionment refers to the method used to allocate a business's income among different jurisdictions for tax purposes. Understanding this process is crucial for businesses operating in multiple states, as it affects their tax liabilities. Utilizing tools like airSlate SignNow can streamline the documentation process related to Pennsylvania revenue apportionment.

-

How can airSlate SignNow assist with Pennsylvania revenue apportionment?

airSlate SignNow provides an efficient platform for businesses to manage and eSign documents related to Pennsylvania revenue apportionment. By simplifying the document workflow, businesses can ensure compliance and accuracy in their tax filings. This not only saves time but also reduces the risk of errors in the apportionment process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial for managing documents related to Pennsylvania revenue apportionment, ensuring that all necessary paperwork is completed accurately and efficiently. Additionally, the platform is user-friendly, making it accessible for all team members.

-

Is airSlate SignNow cost-effective for small businesses dealing with Pennsylvania revenue apportionment?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Pennsylvania revenue apportionment. With flexible pricing plans, companies can choose a package that fits their budget while still accessing essential features. This affordability allows small businesses to efficiently handle their document needs without overspending.

-

Can airSlate SignNow integrate with other software for Pennsylvania revenue apportionment?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the efficiency of managing Pennsylvania revenue apportionment. These integrations allow for automatic data transfer, reducing manual entry errors and saving valuable time. This connectivity ensures that all aspects of revenue apportionment are handled smoothly.

-

What are the benefits of using airSlate SignNow for Pennsylvania revenue apportionment?

Using airSlate SignNow for Pennsylvania revenue apportionment offers numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. The platform's intuitive design allows users to easily navigate the document signing process, ensuring that all necessary forms are completed correctly. This leads to a more streamlined approach to managing tax obligations.

-

How secure is airSlate SignNow for handling sensitive documents related to Pennsylvania revenue apportionment?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents related to Pennsylvania revenue apportionment. Users can trust that their information is safeguarded throughout the signing process. This commitment to security ensures that businesses can confidently manage their tax-related documents.

Get more for PA Schedule NRH Compensation Apportionment Form And Instructions PA 40 NRH FormsPublications

Find out other PA Schedule NRH Compensation Apportionment Form And Instructions PA 40 NRH FormsPublications

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy