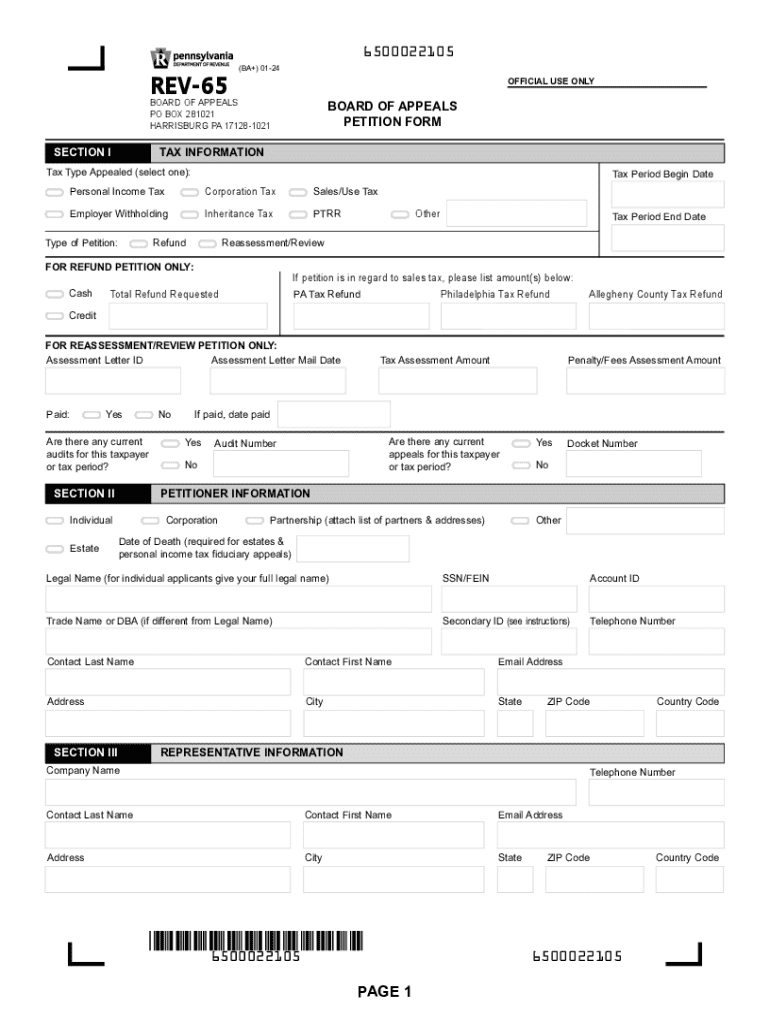

Tax AppealsDepartment of Revenue Form

Understanding the Pennsylvania Board of Appeals Petition

The Pennsylvania Board of Appeals petition is a formal request submitted by taxpayers who seek to challenge decisions made by the Pennsylvania Department of Revenue. This petition is essential for individuals or businesses that believe they have been unfairly assessed taxes or denied tax benefits. The process allows taxpayers to present their case and seek a resolution regarding their tax obligations.

Steps to Complete the Pennsylvania Board of Appeals Petition

Completing the Pennsylvania Board of Appeals petition involves several key steps:

- Gather necessary documentation, including any correspondence from the Pennsylvania Department of Revenue related to the tax issue.

- Fill out the Pennsylvania Board of Appeals petition form accurately, ensuring all required information is provided.

- Attach relevant supporting documents that substantiate your claim, such as financial records or prior tax returns.

- Review the completed petition for accuracy and completeness before submission.

- Submit the petition to the appropriate office, either electronically or by mail, adhering to any specified deadlines.

Required Documents for Filing

When filing a Pennsylvania Board of Appeals petition, certain documents are essential to support your case. These may include:

- The completed Pennsylvania Board of Appeals petition form.

- Any notices or correspondence from the Pennsylvania Department of Revenue regarding the tax assessment.

- Financial statements or tax returns relevant to the appeal.

- Any additional documentation that supports your argument.

Eligibility Criteria for Filing a Petition

To file a petition with the Pennsylvania Board of Appeals, you must meet specific eligibility criteria:

- You must be a taxpayer who has received a notice of assessment or denial from the Pennsylvania Department of Revenue.

- The issue must pertain to state tax matters, such as income tax, sales tax, or property tax.

- You must file the petition within the designated timeframe, typically within thirty days of receiving the notice.

Form Submission Methods

There are several methods for submitting your Pennsylvania Board of Appeals petition:

- Online submission through the Pennsylvania Department of Revenue's official website.

- Mailing the completed petition to the appropriate regional office.

- In-person submission at designated Department of Revenue offices, if applicable.

Filing Deadlines and Important Dates

Timeliness is crucial when submitting a Pennsylvania Board of Appeals petition. Key deadlines include:

- The petition must be filed within thirty days of the date on the notice of assessment or denial.

- Additional deadlines may apply depending on the specific circumstances of your case, so it is important to verify these dates with the Pennsylvania Department of Revenue.

Legal Use of the Pennsylvania Board of Appeals Petition

The Pennsylvania Board of Appeals petition serves as a legal mechanism for taxpayers to contest tax decisions. It is important to follow the legal procedures outlined by the Pennsylvania Department of Revenue to ensure your appeal is considered valid. Adhering to the guidelines and providing accurate information is essential for a successful outcome.

Handy tips for filling out Tax AppealsDepartment Of Revenue online

Quick steps to complete and e-sign Tax AppealsDepartment Of Revenue online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant solution for optimum efficiency. Use signNow to e-sign and send out Tax AppealsDepartment Of Revenue for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax appealsdepartment of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA Board of Appeals petition?

A PA Board of Appeals petition is a formal request submitted to challenge a decision made by a local zoning board or other governmental authority in Pennsylvania. This petition allows individuals or businesses to seek a review of decisions that may affect their property rights or land use. Understanding the process is crucial for ensuring compliance and achieving favorable outcomes.

-

How can airSlate SignNow assist with my PA Board of Appeals petition?

airSlate SignNow provides a streamlined platform for preparing, signing, and submitting your PA Board of Appeals petition. With its user-friendly interface, you can easily create and manage documents, ensuring that all necessary information is included. This efficiency helps you focus on your case rather than paperwork.

-

What are the pricing options for using airSlate SignNow for my PA Board of Appeals petition?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including options for individuals and businesses. You can choose a plan that best fits your budget while ensuring you have access to all the features necessary for managing your PA Board of Appeals petition effectively. Check our website for the latest pricing details.

-

Are there any features specifically designed for handling PA Board of Appeals petitions?

Yes, airSlate SignNow includes features tailored for legal documents, such as templates, eSignature capabilities, and document tracking. These tools simplify the process of preparing your PA Board of Appeals petition, ensuring that you can submit it accurately and on time. Additionally, you can collaborate with others involved in the petition process seamlessly.

-

Can I integrate airSlate SignNow with other tools for my PA Board of Appeals petition?

Absolutely! airSlate SignNow integrates with various applications, including cloud storage services and project management tools. This integration allows you to manage your PA Board of Appeals petition alongside other important documents and workflows, enhancing your overall productivity and organization.

-

What benefits does airSlate SignNow offer for my PA Board of Appeals petition?

Using airSlate SignNow for your PA Board of Appeals petition provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are securely stored and easily accessible, allowing you to focus on your case rather than administrative tasks. Additionally, eSigning speeds up the process signNowly.

-

Is airSlate SignNow compliant with legal standards for PA Board of Appeals petitions?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management. This compliance ensures that your PA Board of Appeals petition is valid and recognized by authorities. You can confidently use our platform knowing that it meets the necessary legal requirements.

Get more for Tax AppealsDepartment Of Revenue

- Extrajudicial settlement with waiver of rights sample philippines form

- Cigarette inventory count sheet form

- Anatomy of a wave worksheet form

- Monthly maintenance report truck form

- Job application form jamaica

- Ada authorization for release of medical information form

- Section 5 taxes amp other forms districts need to michigan

- Dsmv312 medical card mailingdoc nh form

Find out other Tax AppealsDepartment Of Revenue

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast