Transient Occupancy Tax Online Filing Find Account 2024-2026

What is the Transient Occupancy Tax Online Filing Find Account

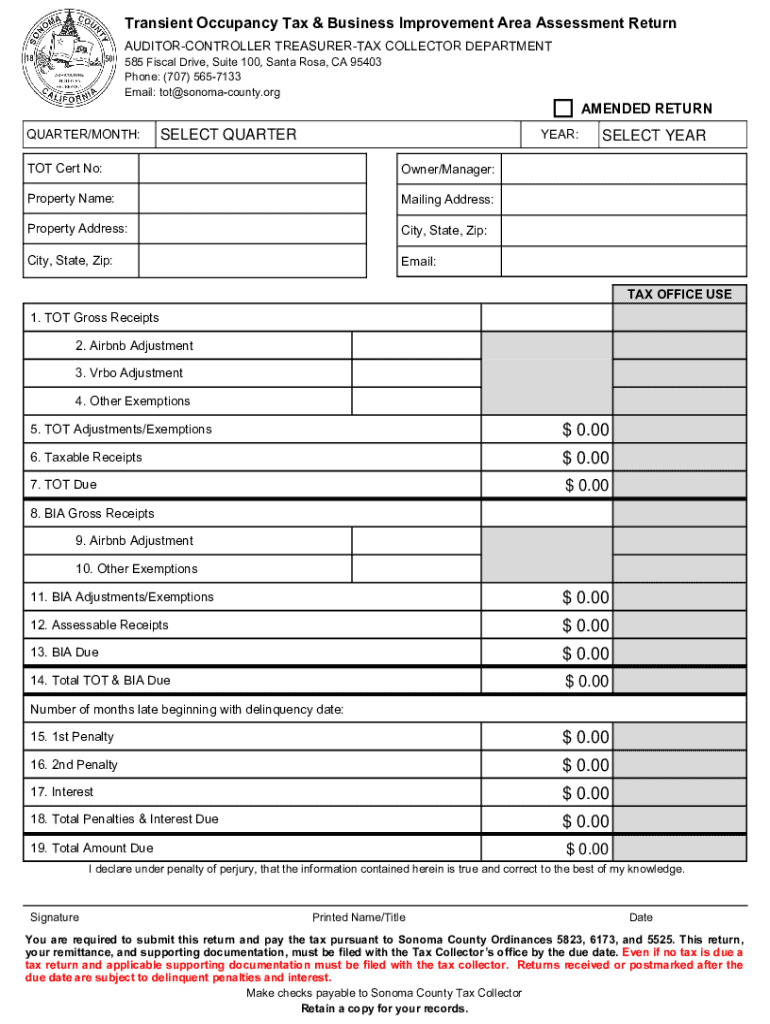

The Transient Occupancy Tax (TOT) is a tax imposed on guests who occupy lodging facilities for a short duration, typically less than thirty days. This tax is often collected by hotels, motels, and other short-term rental properties. The Transient Occupancy Tax Online Filing Find Account is a digital platform that allows property owners and managers to file their TOT returns electronically. This system streamlines the filing process, making it easier for users to manage their tax obligations efficiently.

How to use the Transient Occupancy Tax Online Filing Find Account

To utilize the Transient Occupancy Tax Online Filing Find Account, users must first create an account on the designated online platform. Once registered, users can log in to access their account dashboard. The dashboard provides options for filing returns, viewing past submissions, and checking payment statuses. Users can navigate through the filing process by following the prompts, entering required information, and submitting their tax returns electronically. The system also offers guidance and support for any questions that may arise during the filing process.

Steps to complete the Transient Occupancy Tax Online Filing Find Account

Completing the Transient Occupancy Tax Online Filing involves several steps:

- Create an account on the online filing platform.

- Log in to your account using your credentials.

- Navigate to the filing section of your dashboard.

- Enter the required information, including property details and occupancy data.

- Review the information for accuracy before submission.

- Submit your tax return electronically.

- Save or print the confirmation receipt for your records.

Required Documents

When filing the Transient Occupancy Tax online, certain documents may be necessary to ensure accurate reporting. These documents typically include:

- Records of occupancy for the reporting period.

- Invoices or receipts for any applicable lodging charges.

- Identification details of the property owner or manager.

- Any prior tax returns related to the Transient Occupancy Tax.

Filing Deadlines / Important Dates

Filing deadlines for the Transient Occupancy Tax can vary by state and local jurisdiction. It is essential for property owners to be aware of these deadlines to avoid penalties. Generally, returns are due monthly or quarterly, depending on the local regulations. Users should check their specific jurisdiction's requirements to ensure timely submissions and compliance with local tax laws.

Penalties for Non-Compliance

Failing to file the Transient Occupancy Tax on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for property owners to adhere to filing deadlines and ensure that all information is accurate to avoid these consequences. Regularly reviewing tax obligations and utilizing the online filing system can help maintain compliance.

Create this form in 5 minutes or less

Find and fill out the correct transient occupancy tax online filing find account

Create this form in 5 minutes!

How to create an eSignature for the transient occupancy tax online filing find account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Transient Occupancy Tax Online Filing?

Transient Occupancy Tax Online Filing is a streamlined process that allows businesses to file their occupancy tax returns electronically. With airSlate SignNow, you can easily manage your filings and ensure compliance with local regulations. This service simplifies the tax filing process, saving you time and reducing the risk of errors.

-

How can I find my account for Transient Occupancy Tax Online Filing?

To find your account for Transient Occupancy Tax Online Filing, simply visit the airSlate SignNow website and navigate to the account login section. If you have forgotten your credentials, you can use the 'Forgot Password' feature to recover your account. This ensures you can access your filings and manage your tax obligations efficiently.

-

What are the benefits of using airSlate SignNow for Transient Occupancy Tax Online Filing?

Using airSlate SignNow for Transient Occupancy Tax Online Filing offers numerous benefits, including ease of use, cost-effectiveness, and enhanced security. The platform allows you to eSign documents and manage your filings from anywhere, ensuring you stay compliant with tax regulations. Additionally, the user-friendly interface simplifies the entire process.

-

Is there a cost associated with Transient Occupancy Tax Online Filing through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for Transient Occupancy Tax Online Filing, but it is designed to be affordable for businesses of all sizes. The pricing structure is transparent, with no hidden fees, allowing you to budget effectively. Investing in this service can save you time and reduce the risk of costly mistakes.

-

What features does airSlate SignNow offer for Transient Occupancy Tax Online Filing?

airSlate SignNow provides a variety of features for Transient Occupancy Tax Online Filing, including document templates, eSignature capabilities, and automated reminders. These features help streamline the filing process and ensure you never miss a deadline. Additionally, the platform offers secure storage for your documents, enhancing your data protection.

-

Can I integrate airSlate SignNow with other software for Transient Occupancy Tax Online Filing?

Yes, airSlate SignNow can be integrated with various software solutions to enhance your Transient Occupancy Tax Online Filing experience. This includes accounting software and property management systems, allowing for seamless data transfer and improved efficiency. Integrations help you manage your finances and tax obligations more effectively.

-

How does airSlate SignNow ensure the security of my Transient Occupancy Tax Online Filing?

airSlate SignNow prioritizes the security of your Transient Occupancy Tax Online Filing by employing advanced encryption and secure data storage practices. This ensures that your sensitive information remains protected throughout the filing process. Regular security audits and compliance with industry standards further enhance the safety of your data.

Get more for Transient Occupancy Tax Online Filing Find Account

- Brain gym exercises pdf form

- Office expenses list pdf form

- Advanced accounting 2 guerrero solution manual pdf form

- Loan form nigeria

- Health safety and nutrition for the young child 10th edition form

- Muslim wedding card format pdf

- Brockport physical fitness test pdf form

- Pupil immunization record english minnesota dept of health form for parents to record a childs shot records that will be kept

Find out other Transient Occupancy Tax Online Filing Find Account

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast