Form ST 13 Contractor's Exempt Purchase Certificate Form ST 13 Contractor's Exempt Purchase Certificate

Understanding the ST 13 Contractor's Exempt Purchase Certificate

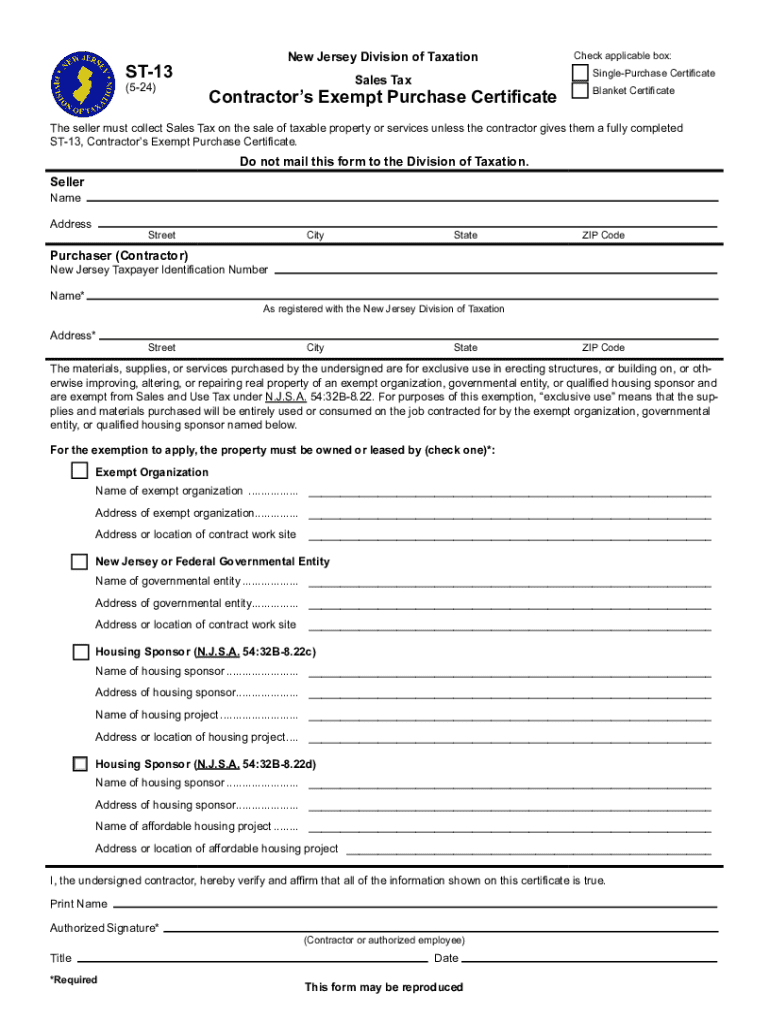

The ST 13 form, also known as the Contractor's Exempt Purchase Certificate, is a crucial document used in New Jersey for tax-exempt purchases by contractors. This form allows contractors to buy materials and supplies without paying sales tax, provided the items will be used in the performance of their contracts. The exemption is applicable only when the contractor is acting in the capacity of a contractor and not as a retailer of the goods purchased.

How to Complete the ST 13 Form

Filling out the ST 13 form requires specific information to ensure compliance with New Jersey tax regulations. Contractors must provide their name, address, and tax identification number. Additionally, details about the purchase, including the description of the items and the intended use, should be clearly stated. It is important to ensure that all information is accurate to avoid potential issues with tax authorities.

Legal Considerations for Using the ST 13 Form

The use of the ST 13 form is governed by New Jersey tax laws. Contractors must ensure that they are eligible to use this form and that the purchases made with it are indeed for tax-exempt purposes. Misuse of the form can lead to penalties, including back taxes and fines. It is advisable for contractors to keep records of all transactions made under this exemption to support their claims in case of an audit.

Obtaining the ST 13 Form

The ST 13 form can be obtained from the New Jersey Division of Taxation's website or through various tax-related resources. It is available in a fillable format, allowing contractors to complete it digitally for convenience. Ensuring that the most current version of the form is used is essential, as outdated forms may not be accepted by tax authorities.

Key Elements of the ST 13 Form

Several key elements must be included in the ST 13 form for it to be valid. These include:

- Contractor's name and address

- Tax identification number

- Description of the items being purchased

- Intended use of the items

- Signature of the contractor or authorized representative

Each of these components plays a vital role in ensuring that the form is completed correctly and meets all legal requirements.

Examples of Using the ST 13 Form

Contractors may use the ST 13 form in various scenarios, such as purchasing building materials for a construction project or acquiring equipment that will be used in the execution of a contract. For instance, if a contractor is hired to build a residential home, they can use the ST 13 form to purchase lumber and fixtures without incurring sales tax, provided these items are integral to the project.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 13 contractors exempt purchase certificate form st 13 contractors exempt purchase certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 13 form and how can airSlate SignNow help?

The st 13 form is a document used for various administrative purposes, and airSlate SignNow simplifies the process of sending and eSigning this form. With our platform, you can easily upload, send, and track the st 13 form, ensuring a seamless experience for all parties involved.

-

Is there a cost associated with using airSlate SignNow for the st 13 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to manage the st 13 form and other documents efficiently, with options that fit any budget.

-

What features does airSlate SignNow offer for managing the st 13 form?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning for the st 13 form. These tools enhance your document workflow, making it easier to manage and complete forms quickly.

-

Can I integrate airSlate SignNow with other applications for the st 13 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when handling the st 13 form. This integration capability enhances productivity by connecting your existing tools with our eSigning solution.

-

How does airSlate SignNow ensure the security of the st 13 form?

Security is a top priority at airSlate SignNow. We use advanced encryption and authentication methods to protect your st 13 form and other documents, ensuring that your sensitive information remains confidential and secure.

-

Can I track the status of my st 13 form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your st 13 form in real-time. You will receive notifications when the document is viewed, signed, or completed, providing you with full visibility throughout the signing process.

-

Is it easy to use airSlate SignNow for the st 13 form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage the st 13 form. Our intuitive interface allows you to navigate the platform effortlessly, even if you have no prior experience with eSigning solutions.

Get more for Form ST 13 Contractor's Exempt Purchase Certificate Form ST 13 Contractor's Exempt Purchase Certificate

Find out other Form ST 13 Contractor's Exempt Purchase Certificate Form ST 13 Contractor's Exempt Purchase Certificate

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF