Substitute Tax Form Requirements West Virginia Tax Division

Understanding the Substitute Tax Form Requirements

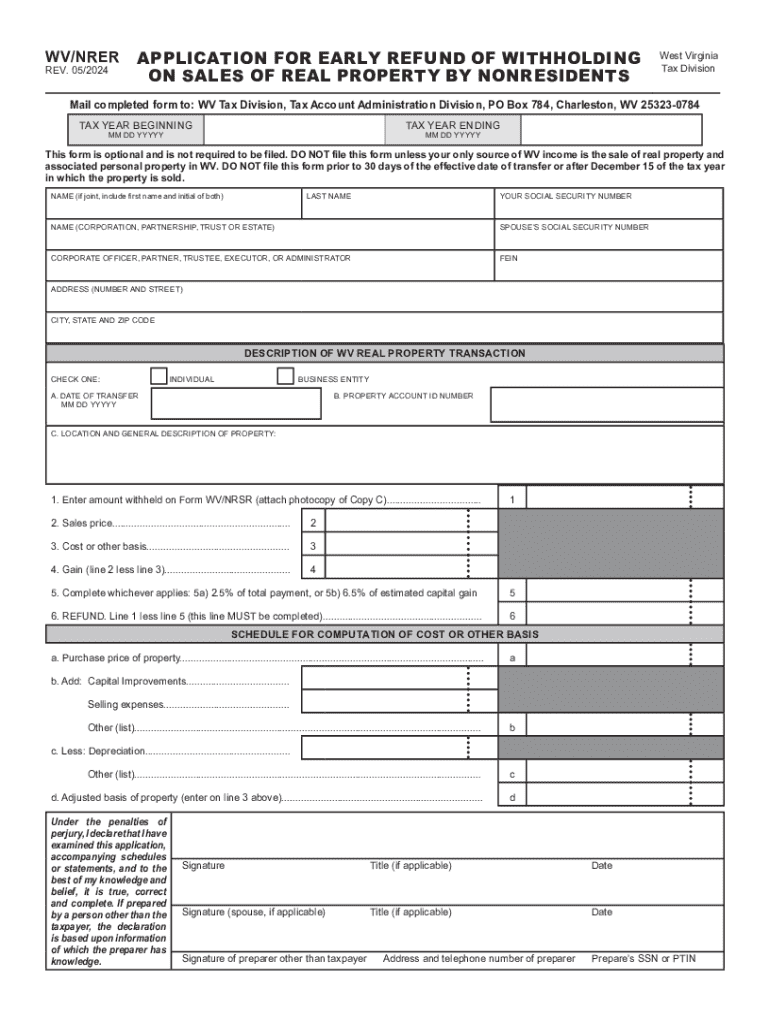

The Substitute Tax Form, often referred to in the context of the West Virginia Tax Division, is essential for individuals and businesses that need to report income and calculate their tax obligations. This form is particularly relevant for non-residents earning income in West Virginia. It allows taxpayers to accurately report their income and claim any eligible deductions or credits. Understanding the specific requirements for this form is crucial for compliance with state tax laws.

Steps to Complete the Substitute Tax Form Requirements

Completing the Substitute Tax Form involves several key steps. First, gather all necessary documentation, including proof of income and any relevant tax documents. Next, accurately fill out the form, ensuring that all information is correct and complete. Pay special attention to sections that require details about income sources and deductions. Once the form is filled out, review it for accuracy before submission. It is advisable to keep a copy for your records.

Filing Deadlines and Important Dates

Timely filing of the Substitute Tax Form is essential to avoid penalties. Generally, the filing deadline for most taxpayers is April fifteenth, but specific circumstances may alter this date. It is important to stay informed about any changes in deadlines that the West Virginia Tax Division may announce. Additionally, if you anticipate needing more time, consider filing for an extension to ensure compliance without incurring late fees.

Required Documents for Submission

When submitting the Substitute Tax Form, certain documents are required to support your claims. These typically include W-2 forms, 1099 forms, and any other documentation that verifies income. Additionally, receipts for deductible expenses should be included when applicable. Ensuring that all required documents are submitted can help expedite the processing of your tax refund.

Eligibility Criteria for the Substitute Tax Form

Eligibility for using the Substitute Tax Form primarily hinges on your residency status and income sources. Non-residents who earn income within West Virginia are generally required to file this form. It is important to review the specific eligibility criteria established by the West Virginia Tax Division to ensure compliance and avoid any potential issues during the filing process.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Substitute Tax Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the ramifications of non-compliance is crucial for taxpayers to avoid unnecessary financial burdens. Regularly reviewing your tax obligations can help maintain compliance and ensure that you meet all necessary requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the substitute tax form requirements west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wvnrer tax refund process?

The wvnrer tax refund process involves filing your tax return accurately to ensure you receive any eligible refunds. By using airSlate SignNow, you can easily eSign and send your tax documents securely, streamlining the process. This ensures that your wvnrer tax refund is processed quickly and efficiently.

-

How can airSlate SignNow help with my wvnrer tax refund?

airSlate SignNow simplifies the documentation needed for your wvnrer tax refund by allowing you to eSign forms and send them directly to the IRS or your tax preparer. This reduces the chances of errors and delays, ensuring that your refund is processed as quickly as possible. Our platform is designed to make tax filing easier for everyone.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs, including options for individuals and teams. Each plan provides access to features that can assist with managing your wvnrer tax refund documentation. You can choose a plan that best suits your budget and requirements.

-

Are there any features specifically for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for tax forms and secure eSigning capabilities. These features help ensure that your wvnrer tax refund documents are organized and easily accessible. This makes it easier to manage your tax filings and refunds.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow can be integrated with various tax software solutions, enhancing your workflow for managing wvnrer tax refund documents. This integration allows for seamless data transfer and ensures that all your tax-related documents are in one place, making the filing process more efficient.

-

What benefits does airSlate SignNow offer for small businesses regarding tax refunds?

For small businesses, airSlate SignNow provides a cost-effective solution to manage tax documents, which can signNowly impact your wvnrer tax refund process. By streamlining document management and eSigning, small businesses can save time and reduce errors in their tax filings. This ultimately leads to faster refunds and improved cash flow.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax information is protected. Our platform uses advanced encryption and secure storage to safeguard your wvnrer tax refund documents. You can trust that your data is safe while using our services.

Get more for Substitute Tax Form Requirements West Virginia Tax Division

- Form no 15h

- Indo zambia bank internet banking form

- Form of declaration under the jharkhand value added

- After actioncorrective action report lacoa form

- Data sharing agreement template form

- Ei materials order form ri department of human services ri gov dhs ri

- Family evacuation disaster plan north dakota state form

- Sanford health plan sftp setup form

Find out other Substitute Tax Form Requirements West Virginia Tax Division

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy