K 41 Fiduciary Income Tax Return Rev 7 17 Form

What is the West Virginia 141 Form?

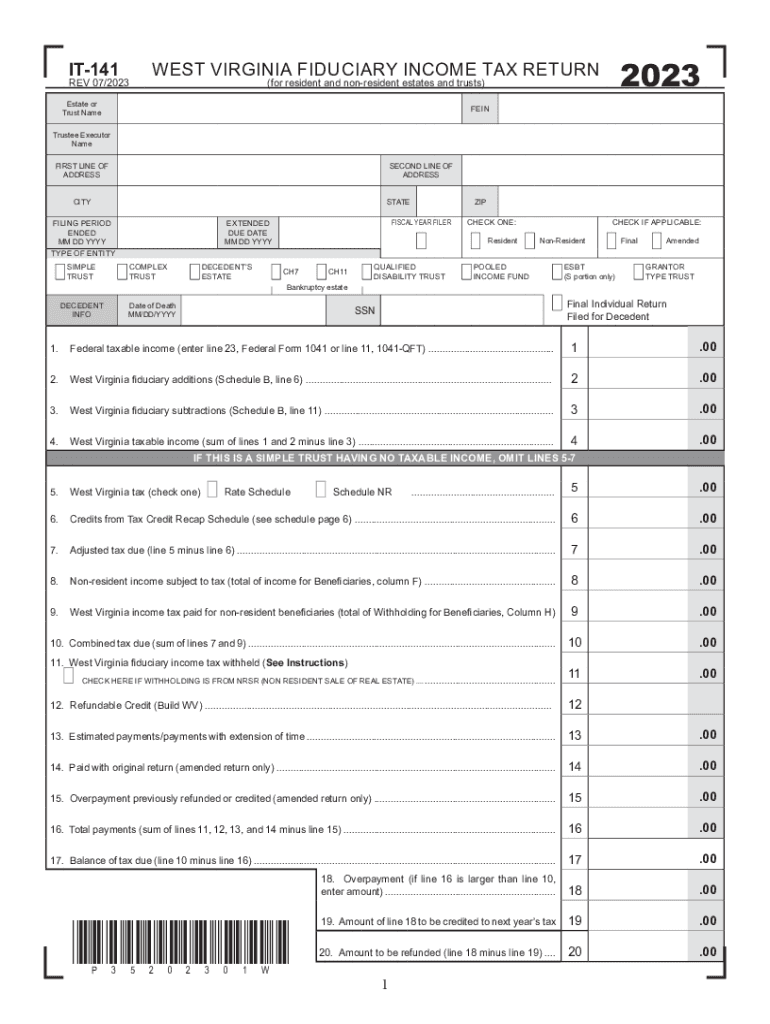

The West Virginia 141 form, also known as the IT-141 Fiduciary Income Tax Return, is used by fiduciaries to report income, deductions, and tax liability on behalf of estates or trusts. This form is essential for ensuring compliance with state tax laws and is required for any fiduciary managing an estate or trust that generates income. The form captures various financial details, including income received, expenses incurred, and distributions made to beneficiaries.

Steps to Complete the West Virginia 141 Form

Completing the West Virginia 141 form involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including income statements and expense receipts related to the estate or trust.

- Fill Out the Form: Enter the required information in the appropriate sections of the form, ensuring accuracy in reporting income and deductions.

- Calculate Tax Liability: Use the provided tax tables or formulas to determine the tax owed based on the reported income.

- Review for Accuracy: Double-check all entries for completeness and correctness before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, ensuring it is sent by the designated deadline.

Legal Use of the West Virginia 141 Form

The West Virginia 141 form is legally required for fiduciaries managing estates or trusts that have taxable income. Failure to file this form can result in penalties and interest on unpaid taxes. It is crucial for fiduciaries to understand their legal obligations and ensure timely and accurate filing to maintain compliance with state tax regulations.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines associated with the West Virginia 141 form. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the form is generally due by April 15. It is essential to mark this date on your calendar to avoid late filing penalties.

Required Documents

When preparing the West Virginia 141 form, several documents are necessary to ensure accurate reporting:

- Income Statements: Documentation of all income generated by the estate or trust.

- Expense Receipts: Proof of any expenses incurred in managing the estate or trust.

- Distribution Records: Information on distributions made to beneficiaries during the tax year.

Form Submission Methods

The West Virginia 141 form can be submitted through various methods:

- Online: Many fiduciaries choose to file electronically through the West Virginia State Tax Department's online portal.

- By Mail: The completed form can be printed and mailed to the appropriate tax office.

- In Person: Fiduciaries may also submit the form directly at designated tax offices if they prefer personal assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 41 fiduciary income tax return rev 7 17

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is west virginia 141 in relation to airSlate SignNow?

West Virginia 141 refers to a specific document signing process that can be efficiently managed using airSlate SignNow. This solution allows users in West Virginia to streamline their eSigning needs, ensuring compliance and security while saving time.

-

How much does airSlate SignNow cost for users in west virginia 141?

The pricing for airSlate SignNow varies based on the plan selected, but it remains a cost-effective solution for businesses in west virginia 141. Users can choose from different tiers that cater to their specific needs, ensuring they only pay for the features they require.

-

What features does airSlate SignNow offer for west virginia 141 users?

AirSlate SignNow offers a range of features for west virginia 141 users, including customizable templates, secure eSigning, and document tracking. These features help businesses manage their documents efficiently while ensuring a smooth signing experience.

-

How can airSlate SignNow benefit businesses in west virginia 141?

Businesses in west virginia 141 can benefit from airSlate SignNow by reducing the time spent on document management and improving workflow efficiency. The platform's user-friendly interface and robust features enable teams to collaborate effectively and close deals faster.

-

Does airSlate SignNow integrate with other tools for west virginia 141 users?

Yes, airSlate SignNow offers integrations with various tools that are popular among west virginia 141 users, such as CRM systems and cloud storage services. This allows businesses to streamline their processes and enhance productivity by connecting their existing workflows.

-

Is airSlate SignNow secure for users in west virginia 141?

Absolutely, airSlate SignNow prioritizes security for all users, including those in west virginia 141. The platform employs advanced encryption and compliance measures to protect sensitive information, ensuring that all eSignatures and documents are secure.

-

Can I use airSlate SignNow on mobile devices for west virginia 141?

Yes, airSlate SignNow is fully optimized for mobile devices, making it convenient for users in west virginia 141 to manage their documents on the go. The mobile app allows users to send, sign, and track documents from anywhere, enhancing flexibility and accessibility.

Get more for K 41 Fiduciary Income Tax Return Rev 7 17

Find out other K 41 Fiduciary Income Tax Return Rev 7 17

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe