NJ Form PTR 1 Fill Out Tax Template Online

Understanding the NJ Form PTR 1

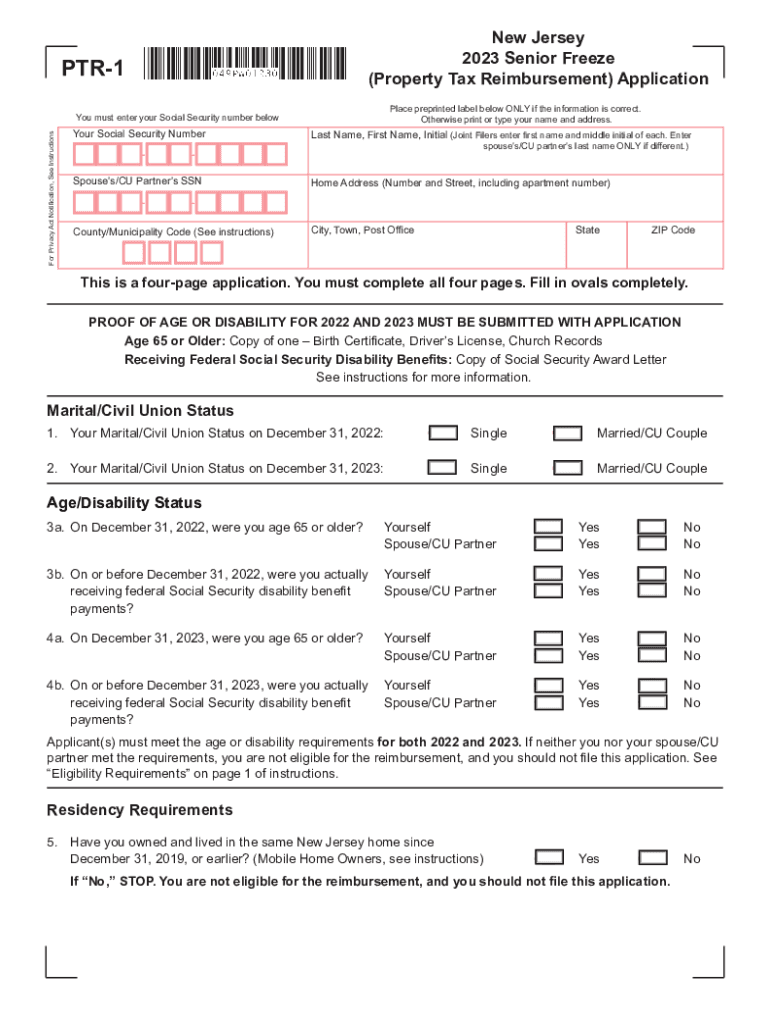

The NJ Form PTR 1 is a property tax reimbursement application used by eligible New Jersey residents to claim a reimbursement for property taxes paid on their principal residence. This form is essential for those who meet specific criteria, such as age or disability status, allowing them to receive financial relief on their property taxes. Understanding the details of this form can help applicants navigate the process more effectively.

Steps to Complete the NJ Form PTR 1

Filling out the NJ Form PTR 1 involves several key steps:

- Gather necessary documents, including proof of residency and property tax statements.

- Complete the personal information section, ensuring all details are accurate.

- Provide information about your property, including the address and tax identification number.

- Calculate the total property taxes paid and enter this information in the designated section.

- Sign and date the form to certify that the information provided is true and complete.

Taking these steps carefully can help ensure that your application is processed smoothly.

Eligibility Criteria for the NJ Form PTR 1

To qualify for the NJ Form PTR 1, applicants must meet specific eligibility criteria, including:

- Being a resident of New Jersey for at least one year.

- Being at least sixty-five years old or disabled.

- Having a total income that does not exceed the state’s established limits.

- Owning and occupying the property as your principal residence.

Meeting these criteria is crucial for successful reimbursement claims.

Required Documents for the NJ Form PTR 1

When submitting the NJ Form PTR 1, applicants must include several documents to support their application:

- Proof of age or disability, such as a birth certificate or disability documentation.

- Property tax statements for the year of the claim.

- Income verification documents, including tax returns or W-2 forms.

- Any additional documentation required by the state for verification purposes.

Providing complete and accurate documentation helps streamline the review process.

Form Submission Methods for the NJ Form PTR 1

Applicants can submit the NJ Form PTR 1 through various methods, ensuring flexibility in how they choose to file:

- Online submission through the New Jersey Division of Taxation website.

- Mailing the completed form and supporting documents to the appropriate tax office.

- In-person submission at designated state offices for direct assistance.

Choosing the right submission method can enhance the efficiency of the application process.

Common Mistakes to Avoid with the NJ Form PTR 1

To ensure a successful application, applicants should be aware of common mistakes that can lead to delays or denials:

- Failing to include all required documentation, which can result in processing delays.

- Providing inaccurate personal or property information that may lead to complications.

- Missing the filing deadline, which is crucial for receiving the reimbursement.

Avoiding these pitfalls can significantly improve the chances of a successful claim.

Handy tips for filling out NJ Form PTR 1 Fill Out Tax Template Online online

Quick steps to complete and e-sign NJ Form PTR 1 Fill Out Tax Template Online online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum simplicity. Use signNow to e-sign and send out NJ Form PTR 1 Fill Out Tax Template Online for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj form ptr 1 fill out tax template online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ptr 1 and how does it work?

The form ptr 1 is a specific document format used for various administrative processes. With airSlate SignNow, you can easily create, send, and eSign form ptr 1 documents, streamlining your workflow and ensuring compliance. Our platform simplifies the process, making it accessible for users of all skill levels.

-

How can I integrate form ptr 1 with other applications?

airSlate SignNow offers seamless integrations with various applications, allowing you to manage your form ptr 1 documents efficiently. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration capability ensures that your workflow remains uninterrupted.

-

What are the pricing options for using form ptr 1 with airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to different business needs when using form ptr 1. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for managing form ptr 1?

With airSlate SignNow, you can take advantage of features like customizable templates, automated workflows, and real-time tracking for your form ptr 1 documents. These features enhance productivity and ensure that your documents are processed efficiently. Additionally, our user-friendly interface makes it easy to navigate through these features.

-

Can I customize my form ptr 1 documents?

Yes, airSlate SignNow allows you to customize your form ptr 1 documents to meet your specific needs. You can add fields, logos, and branding elements to ensure that your documents reflect your business identity. This level of customization helps maintain professionalism in your communications.

-

What are the benefits of using airSlate SignNow for form ptr 1?

Using airSlate SignNow for form ptr 1 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. Our platform ensures that your documents are securely stored and easily accessible, allowing you to focus on your core business activities. Additionally, eSigning capabilities streamline the approval process.

-

Is airSlate SignNow secure for handling form ptr 1 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form ptr 1 documents. We adhere to industry standards to ensure that your sensitive information remains confidential and secure. You can trust our platform for safe document management.

Get more for NJ Form PTR 1 Fill Out Tax Template Online

Find out other NJ Form PTR 1 Fill Out Tax Template Online

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample