Form CT DRS CT 941X Fill Online, Printable

Understanding Form CT DRS CT 941X

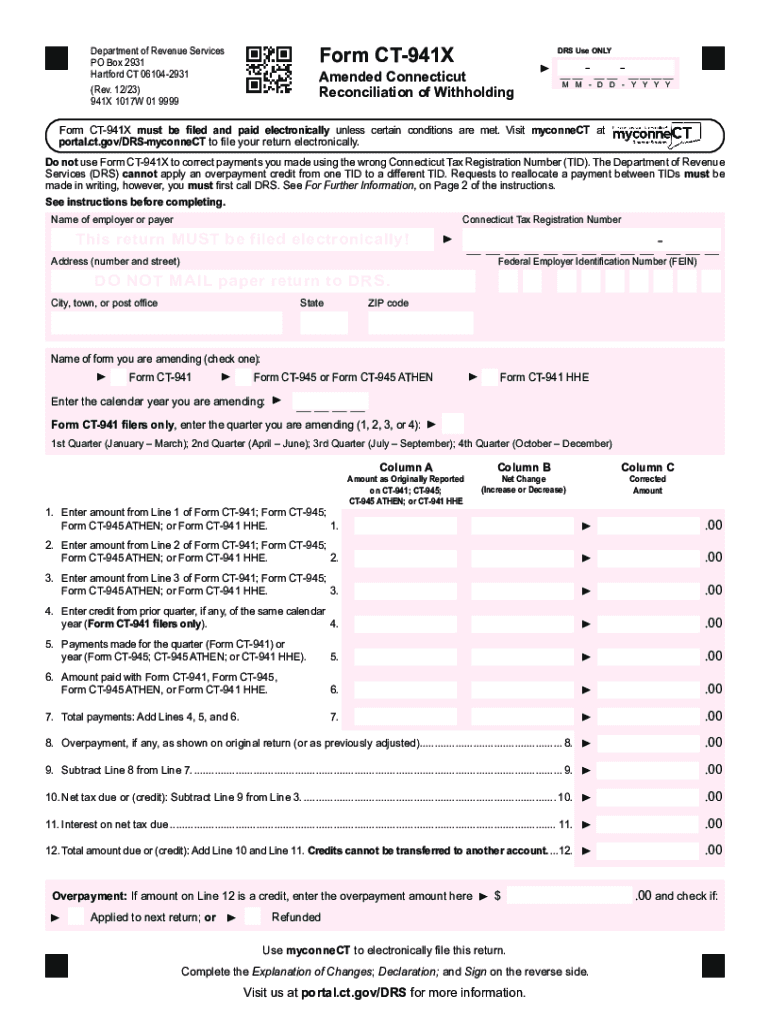

The Form CT DRS CT 941X is an important document used for amending previously filed Connecticut withholding tax returns. This form allows businesses to correct errors or make adjustments to their previously submitted Form CT-941. It is essential for ensuring accurate tax reporting and compliance with state regulations.

Steps to Complete Form CT DRS CT 941X

Completing the Form CT DRS CT 941X involves several key steps:

- Gather all relevant information from the original Form CT-941 that needs correction.

- Clearly indicate the tax period for which you are amending the return.

- Fill out the form with accurate figures, ensuring to highlight the changes made.

- Review the completed form for any errors before submission.

Legal Use of Form CT DRS CT 941X

The Form CT DRS CT 941X is legally recognized for amending withholding tax returns in Connecticut. It is crucial for businesses to use this form to rectify any discrepancies in their tax filings. Proper use of this form helps avoid penalties and ensures compliance with state tax laws.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with Form CT DRS CT 941X. Amendments should be filed as soon as discrepancies are identified, ideally before the state’s deadline for the original return. Late filings may result in penalties or interest on unpaid taxes.

Form Submission Methods

The Form CT DRS CT 941X can be submitted through various methods, including:

- Electronically via the Connecticut Department of Revenue Services (DRS) online portal.

- By mail, sending the completed form to the appropriate DRS address.

- In-person at designated DRS offices, if necessary.

Key Elements of Form CT DRS CT 941X

When filling out the Form CT DRS CT 941X, it is important to include key elements such as:

- The taxpayer identification number.

- The original amounts reported on the Form CT-941.

- The corrected amounts and explanations for changes.

- Signature and date of the individual completing the form.

Examples of Using Form CT DRS CT 941X

Common scenarios for using Form CT DRS CT 941X include:

- Correcting an error in reported employee wages.

- Adjusting the amount of withholding tax reported.

- Updating information due to changes in business structure or ownership.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct drs ct 941x fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct 941x and why is it important?

The form ct 941x is a tax form used by businesses in Connecticut to amend their quarterly payroll tax returns. It is important because it allows businesses to correct any errors made in previously filed forms, ensuring compliance with state tax regulations and avoiding potential penalties.

-

How can airSlate SignNow help with the form ct 941x?

airSlate SignNow simplifies the process of completing and submitting the form ct 941x by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, sign it electronically, and send it directly to the appropriate tax authorities, streamlining the amendment process.

-

Is there a cost associated with using airSlate SignNow for the form ct 941x?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that facilitate the completion and submission of the form ct 941x, making it a cost-effective solution for managing your document workflows.

-

What features does airSlate SignNow offer for managing the form ct 941x?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the form ct 941x. These features enhance efficiency and ensure that your amendments are processed smoothly and securely.

-

Can I integrate airSlate SignNow with other software for the form ct 941x?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the form ct 941x alongside your existing tools. This integration helps streamline your workflow and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the form ct 941x?

Using airSlate SignNow for the form ct 941x offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick amendments and ensures that your documents are signed and submitted in compliance with state regulations.

-

Is airSlate SignNow user-friendly for completing the form ct 941x?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the form ct 941x. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively.

Get more for Form CT DRS CT 941X Fill Online, Printable

- Limited liability company 497336552 form

- Assumption agreement between unilab corporation and unilab finance corporation form

- Credit agreement company form

- Capital call template form

- Consulting corporation form

- Limited liability company make 497336557 form

- Bylaws of mitchell hutchins securities trust form

- Insurance trust form

Find out other Form CT DRS CT 941X Fill Online, Printable

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement