Desktop Form 8862 Information to Claim Certain Credits

What is IRS Form 8862?

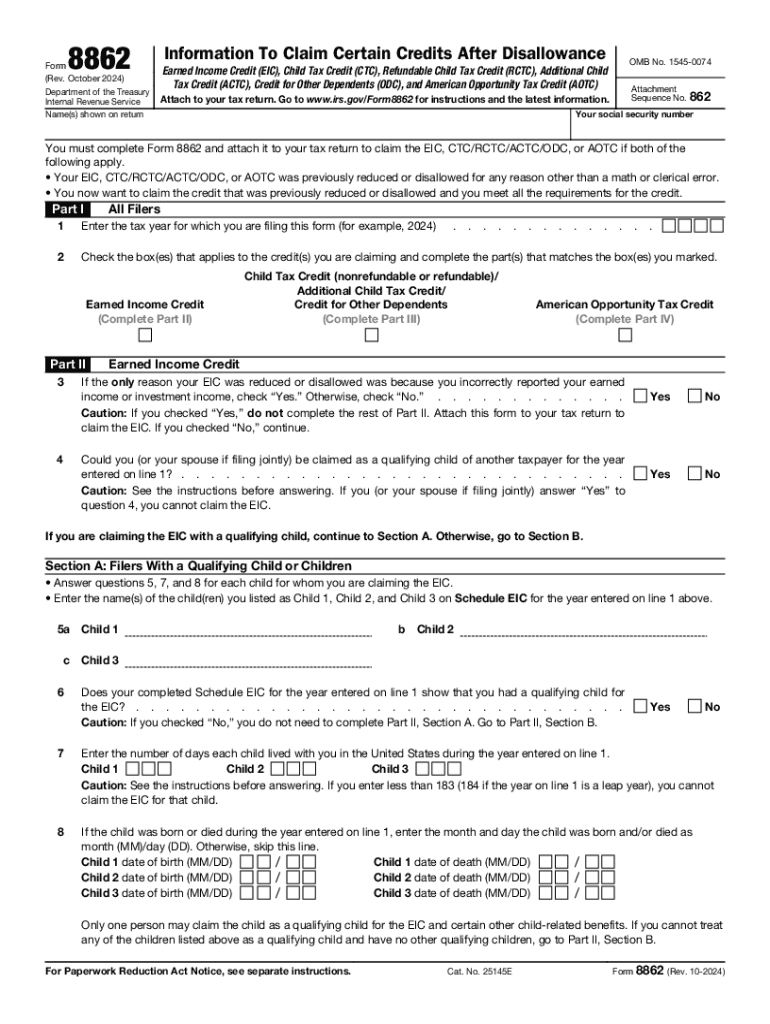

IRS Form 8862, titled "Information To Claim Certain Credits After Disallowance," is a tax form used by individuals who have previously had certain tax credits disallowed. This form is essential for taxpayers who want to reclaim eligibility for credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) after a prior disallowance. By completing this form, taxpayers provide the IRS with necessary information to determine their eligibility for these credits in the current tax year.

How to Use IRS Form 8862

Using IRS Form 8862 involves a straightforward process. Taxpayers must first ensure they meet the eligibility criteria for the credits they are claiming. After verifying eligibility, the form must be completed accurately, providing all required information. Once completed, Form 8862 should be attached to the taxpayer's federal income tax return. It is important to note that this form must be submitted for each tax year in which the taxpayer wishes to claim the credits after a disallowance.

Steps to Complete IRS Form 8862

Completing IRS Form 8862 requires several steps:

- Gather relevant personal information, including Social Security numbers and tax identification numbers for all dependents.

- Review the eligibility criteria for the credits you wish to claim.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check the form for any errors or omissions.

- Attach the completed form to your federal income tax return.

Eligibility Criteria for IRS Form 8862

To qualify for IRS Form 8862, taxpayers must have previously claimed a credit that was disallowed and must now demonstrate that they meet all eligibility requirements for that credit. This includes meeting income thresholds, filing status, and dependent qualifications. Taxpayers should review the specific requirements for each credit they are claiming to ensure compliance.

IRS Guidelines for Filing Form 8862

The IRS provides specific guidelines for filing Form 8862. Taxpayers must submit the form with their tax return for the year they are claiming the credits. It is also crucial to keep copies of all documentation supporting the information provided on the form. Failure to comply with IRS guidelines may result in further disallowance of credits or potential penalties.

Required Documents for IRS Form 8862

When completing IRS Form 8862, taxpayers should have several documents on hand, including:

- Previous tax returns that show the disallowed credits.

- Documentation proving eligibility for the credits, such as W-2 forms, 1099 forms, and records of any dependents.

- Any correspondence from the IRS regarding the disallowance.

Handy tips for filling out Desktop Form 8862 Information To Claim Certain Credits online

Quick steps to complete and e-sign Desktop Form 8862 Information To Claim Certain Credits online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to e-sign and send Desktop Form 8862 Information To Claim Certain Credits for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the desktop form 8862 information to claim certain credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8862 and why is it important?

Form 8862 is a tax form used to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a previous year. It is important because it allows taxpayers to re-establish their eligibility for the credit, potentially resulting in signNow tax savings.

-

How can airSlate SignNow help with form 8862?

airSlate SignNow provides a seamless way to eSign and send form 8862 securely. With our user-friendly interface, you can easily fill out and submit the form, ensuring that your tax documents are handled efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for form 8862?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage your form 8862 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing form 8862?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features streamline the process of managing form 8862, making it easier for users to complete and submit their tax documents.

-

Can I integrate airSlate SignNow with other software for form 8862?

Absolutely! airSlate SignNow integrates with various applications, allowing you to manage form 8862 alongside your existing tools. This integration enhances your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for form 8862?

Using airSlate SignNow for form 8862 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive tax information is protected while simplifying the signing process.

-

How secure is airSlate SignNow when handling form 8862?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you use our platform for form 8862, you can trust that your data is safe and secure throughout the signing process.

Get more for Desktop Form 8862 Information To Claim Certain Credits

Find out other Desktop Form 8862 Information To Claim Certain Credits

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy