Form 1040 Cannot Be Processed with Incorrect Social

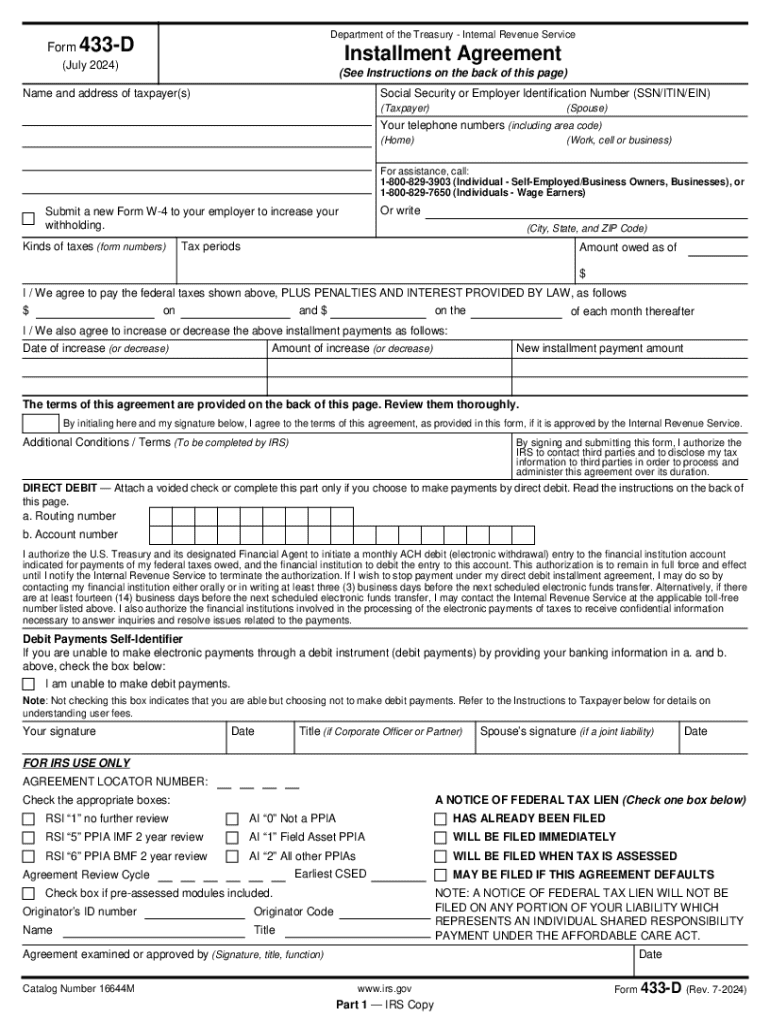

Understanding Form 433

Form 433, also known as the Collection Information Statement, is used by the IRS to gather financial information about taxpayers. This form is essential for individuals seeking to establish an installment agreement or offer in compromise. It provides the IRS with a detailed overview of a taxpayer's income, expenses, assets, and liabilities, helping them assess the taxpayer's ability to pay their tax obligations.

How to Complete Form 433

Filling out Form 433 requires careful attention to detail. Taxpayers should start by gathering all necessary financial documents, including pay stubs, bank statements, and any other relevant financial information. The form consists of several sections, including personal information, income details, and a breakdown of monthly expenses. Each section must be filled out accurately to ensure the IRS has a complete picture of your financial situation.

Submitting Form 433

Once Form 433 is completed, it can be submitted to the IRS either online or via mail. For online submissions, taxpayers can use the IRS website to upload their forms securely. If mailing the form, it is important to send it to the correct address, which can be found on the IRS website. Ensure that all required documents accompany the form to avoid delays in processing.

Legal Implications of Form 433

Using Form 433 correctly is crucial for compliance with IRS regulations. Failing to provide accurate information can lead to penalties or denial of payment plans. It is important for taxpayers to understand that submitting this form does not guarantee approval for an installment agreement or offer in compromise. The IRS will review the information provided and make a determination based on their guidelines.

Common Scenarios for Using Form 433

Form 433 is often utilized by individuals facing financial difficulties who wish to negotiate their tax obligations with the IRS. Common scenarios include taxpayers who have lost their job, experienced a significant decrease in income, or incurred unexpected expenses. By providing a clear picture of their financial situation, taxpayers can work with the IRS to find a manageable solution for their tax debts.

Required Documentation for Form 433

To support the information provided on Form 433, taxpayers must include various documents that verify their financial status. These may include:

- Recent pay stubs or proof of income

- Bank statements for the last few months

- Documentation of monthly expenses, such as bills and receipts

- Information on any assets, including property and vehicles

Providing thorough documentation helps ensure that the IRS can accurately assess the taxpayer's financial situation.

Handy tips for filling out Form 1040 Cannot Be Processed With Incorrect Social online

Quick steps to complete and e-sign Form 1040 Cannot Be Processed With Incorrect Social online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to e-sign and share Form 1040 Cannot Be Processed With Incorrect Social for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 cannot be processed with incorrect social

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 433 form?

A fillable 433 form is a digital document that allows users to input information directly into designated fields. With airSlate SignNow, you can easily create and manage fillable 433 forms, streamlining the process of collecting data and signatures.

-

How can I create a fillable 433 form using airSlate SignNow?

Creating a fillable 433 form with airSlate SignNow is simple. You can upload your existing document, use our intuitive editor to add fillable fields, and customize it to meet your needs. This ensures that your form is user-friendly and efficient.

-

What are the pricing options for using fillable 433 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that includes features for creating and managing fillable 433 forms, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for fillable 433 forms?

airSlate SignNow provides a range of features for fillable 433 forms, including customizable templates, electronic signatures, and secure cloud storage. These features enhance the efficiency of document management and ensure compliance with legal standards.

-

What are the benefits of using fillable 433 forms?

Using fillable 433 forms can signNowly reduce paperwork and streamline your workflow. With airSlate SignNow, you can automate the signing process, save time, and improve accuracy, making it easier to manage important documents.

-

Can I integrate fillable 433 forms with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing the functionality of your fillable 433 forms. You can connect with CRM systems, cloud storage services, and more to create a cohesive workflow.

-

Is it secure to use fillable 433 forms with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that your fillable 433 forms are protected with advanced encryption and compliance with industry standards. You can confidently manage sensitive information without compromising security.

Get more for Form 1040 Cannot Be Processed With Incorrect Social

Find out other Form 1040 Cannot Be Processed With Incorrect Social

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online