Application for Propery Tax Relief Form

What is the Application for Property Tax Relief

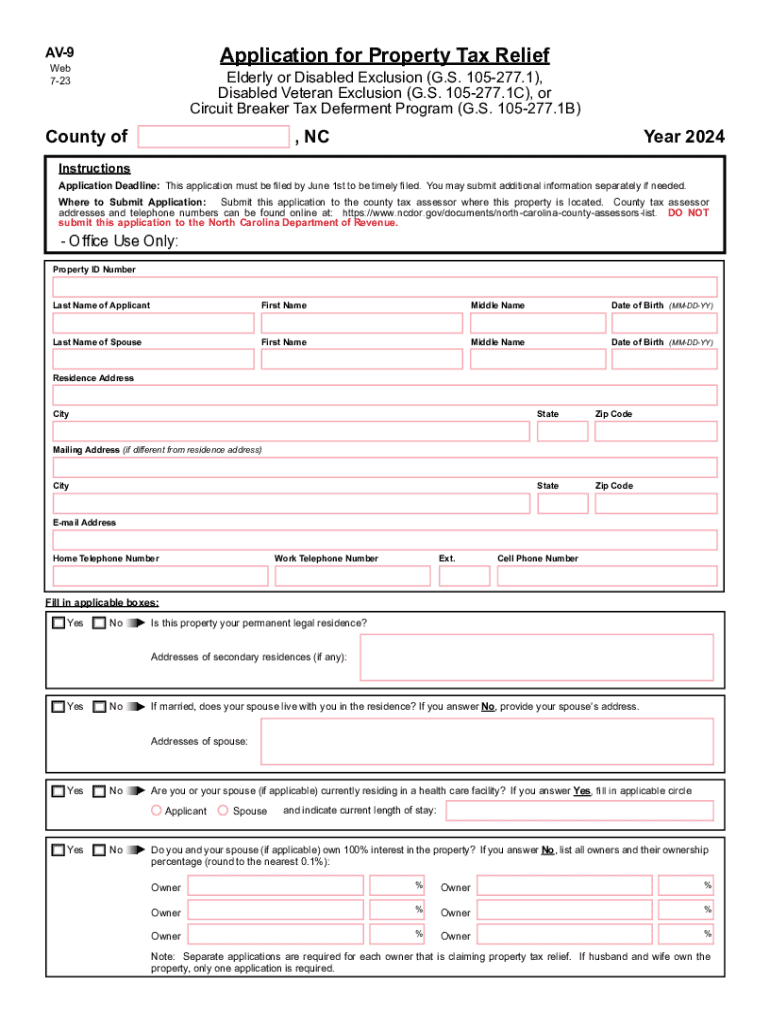

The Application for Property Tax Relief, commonly referred to as the NC Form AV-9, is a document used in North Carolina to provide financial relief to eligible property owners. This application allows individuals to claim exemptions or reductions in property taxes based on specific criteria, such as age, disability, or income level. Understanding the purpose of this form is crucial for those seeking to alleviate their tax burden and ensure they are taking advantage of available benefits.

Eligibility Criteria

To qualify for property tax relief through the NC Form AV-9, applicants must meet certain eligibility requirements. Generally, these criteria include:

- Being a resident of North Carolina.

- Owning the property for which relief is being sought.

- Meeting income limits set by the state.

- Being at least sixty-five years old or permanently disabled.

It is essential for applicants to review these criteria carefully to determine their eligibility before submitting the form.

Steps to Complete the Application for Property Tax Relief

Completing the NC Form AV-9 involves several straightforward steps. Applicants should:

- Obtain the form from the local tax office or download it from the state’s official website.

- Fill out the required information, including personal details and property information.

- Provide documentation that supports the claim, such as proof of age or disability.

- Review the application for accuracy before submission.

Following these steps can help ensure a smooth application process and increase the likelihood of approval.

Required Documents

When submitting the NC Form AV-9, applicants must include specific documentation to support their claims. Required documents typically include:

- Proof of age, such as a birth certificate or driver's license.

- Documentation of disability, if applicable.

- Income verification, which may include tax returns or pay stubs.

Gathering these documents in advance can help streamline the application process and prevent delays.

Form Submission Methods

Applicants can submit the NC Form AV-9 through various methods, ensuring flexibility and convenience. The available submission options include:

- Online submission through the local tax office’s portal.

- Mailing the completed form to the appropriate tax office.

- In-person submission at the local tax office.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Filing Deadlines / Important Dates

It is important for applicants to be aware of the filing deadlines associated with the NC Form AV-9. Generally, the application must be submitted by June 1st of the tax year for which relief is being requested. Missing this deadline may result in the loss of eligibility for that tax year, making timely submission crucial for those seeking property tax relief.

Legal Use of the Application for Property Tax Relief

The NC Form AV-9 is legally recognized as a valid means for property owners to apply for tax relief. It is essential for applicants to complete the form accurately and honestly, as providing false information can lead to penalties or denial of the application. Understanding the legal implications of the form helps ensure compliance with state regulations and protects the rights of the applicant.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for propery tax relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form av 9 and how can airSlate SignNow help?

The form av 9 is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing this form by providing an intuitive platform that allows users to easily create, send, and eSign the form av 9, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for the form av 9?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose from various subscription options, ensuring that they can efficiently manage the form av 9 without breaking the bank. A free trial is also available to explore the features before committing.

-

What features does airSlate SignNow offer for managing the form av 9?

airSlate SignNow provides a range of features for managing the form av 9, including customizable templates, automated workflows, and secure eSigning capabilities. These features streamline the document management process, making it easier for users to handle the form av 9 efficiently.

-

Can I integrate airSlate SignNow with other applications for the form av 9?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the functionality for managing the form av 9. Users can connect with popular tools like Google Drive, Salesforce, and more, allowing for a more cohesive workflow.

-

What are the benefits of using airSlate SignNow for the form av 9?

Using airSlate SignNow for the form av 9 provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform ensures that your documents are handled securely while allowing for quick access and easy collaboration.

-

Is airSlate SignNow user-friendly for completing the form av 9?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the form av 9. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effortlessly.

-

How does airSlate SignNow ensure the security of the form av 9?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for the form av 9. This ensures that all documents are protected during transmission and storage, giving users peace of mind when handling sensitive information.

Get more for Application For Propery Tax Relief

Find out other Application For Propery Tax Relief

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple