Schedule a Form 1040 Itemized Deductions

What is the Schedule A Form 1040 Itemized Deductions

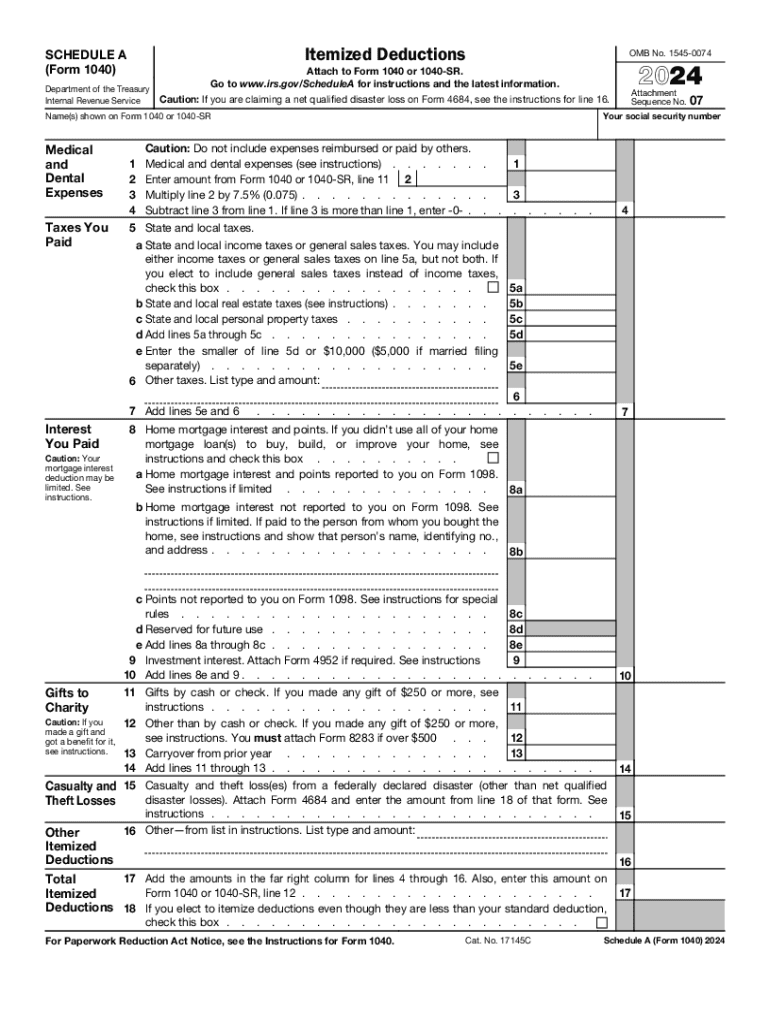

The Schedule A Form 1040 is a crucial document used by taxpayers in the United States to report itemized deductions. These deductions allow individuals to subtract certain expenses from their taxable income, potentially lowering their overall tax liability. Common categories of itemized deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By using this form, taxpayers can detail their eligible expenses and determine whether itemizing deductions is more beneficial than taking the standard deduction.

How to use the Schedule A Form 1040 Itemized Deductions

To effectively use the Schedule A Form 1040, taxpayers should first gather all relevant documentation that supports their itemized deductions. This includes receipts, bank statements, and any other records of eligible expenses. Once the documentation is collected, taxpayers can fill out the form by entering their total deductions in the appropriate sections. It is important to ensure that all figures are accurate and that the form is completed in accordance with IRS guidelines to avoid potential issues during the filing process.

Steps to complete the Schedule A Form 1040 Itemized Deductions

Completing the Schedule A Form 1040 involves several key steps:

- Gather all necessary documentation for itemized deductions.

- Fill out the identification section at the top of the form, including your name and Social Security number.

- Complete each section of the form, entering your total deductions for medical expenses, taxes paid, mortgage interest, and charitable contributions.

- Calculate the total itemized deductions and ensure that they are accurately reflected on your Form 1040.

- Review the completed form for accuracy before submitting it with your tax return.

Key elements of the Schedule A Form 1040 Itemized Deductions

The Schedule A Form 1040 includes several key elements that taxpayers must understand:

- Medical and Dental Expenses: This section allows taxpayers to report qualifying medical expenses that exceed a certain percentage of their adjusted gross income.

- Taxes You Paid: Taxpayers can deduct state and local taxes, including property taxes and sales taxes, within specified limits.

- Interest You Paid: This includes mortgage interest and points paid on a mortgage for a primary residence.

- Gifts to Charity: Taxpayers can deduct contributions made to qualified charitable organizations, subject to certain limitations.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Schedule A Form 1040. Taxpayers should refer to the IRS instructions for the form to ensure compliance with current tax laws. These guidelines outline what qualifies as an itemized deduction, the necessary documentation required, and any limitations or phase-outs that may apply. Staying informed about these guidelines helps taxpayers maximize their deductions while avoiding errors that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A Form 1040 align with the general tax return deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who need additional time can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

Handy tips for filling out Schedule A Form 1040 Itemized Deductions online

Quick steps to complete and e-sign Schedule A Form 1040 Itemized Deductions online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Use signNow to e-sign and send Schedule A Form 1040 Itemized Deductions for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 itemized deductions 770347631

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are itemized deductions and how can they benefit me?

Itemized deductions are specific expenses that taxpayers can deduct from their taxable income to reduce their overall tax liability. By utilizing itemized deductions, you can potentially lower your tax bill signNowly. Understanding which expenses qualify can help you maximize your savings during tax season.

-

How does airSlate SignNow help with managing itemized deductions?

airSlate SignNow streamlines the process of collecting and signing documents related to itemized deductions. With our easy-to-use platform, you can quickly send and eSign necessary forms, ensuring that all your deduction-related paperwork is organized and accessible. This efficiency can save you time and reduce stress during tax preparation.

-

What features does airSlate SignNow offer for tracking itemized deductions?

Our platform includes features that allow you to track and manage documents related to itemized deductions effectively. You can create templates for common deduction forms, set reminders for important deadlines, and securely store all your documents in one place. This helps ensure that you never miss a deduction opportunity.

-

Is airSlate SignNow cost-effective for managing itemized deductions?

Yes, airSlate SignNow offers a cost-effective solution for managing itemized deductions. Our pricing plans are designed to fit various budgets, making it accessible for individuals and businesses alike. By using our service, you can save money on tax preparation costs while ensuring that you maximize your deductions.

-

Can I integrate airSlate SignNow with other accounting software for itemized deductions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your itemized deductions more efficiently. This integration ensures that all your financial data is synchronized, making it easier to track expenses and deductions in one unified platform.

-

What types of documents can I eSign related to itemized deductions?

You can eSign a variety of documents related to itemized deductions using airSlate SignNow. This includes tax forms, receipts, and any other documentation that supports your deductions. Our platform ensures that all signed documents are legally binding and securely stored for your records.

-

How secure is my information when using airSlate SignNow for itemized deductions?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your information related to itemized deductions. You can trust that your sensitive data is safe while you manage your tax documents with our platform.

Get more for Schedule A Form 1040 Itemized Deductions

- Waiver and release from liability for minor child for duck hunting form

- Waiver liability house 497427241 form

- Waiver and release from liability for adult for scout function form

- Waiver and release from liability for adult for lodge membership form

- Waiver liability land 497427244 form

- Waiver and release from liability for adult for intramural sports form

- Release minor child 497427246 form

- Waiver and release from liability for adult for aerobic sports form

Find out other Schedule A Form 1040 Itemized Deductions

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online