RI 1120S Subchapter S Business Corporation Tax Return Form

What is the RI 1120S Subchapter S Business Corporation Tax Return

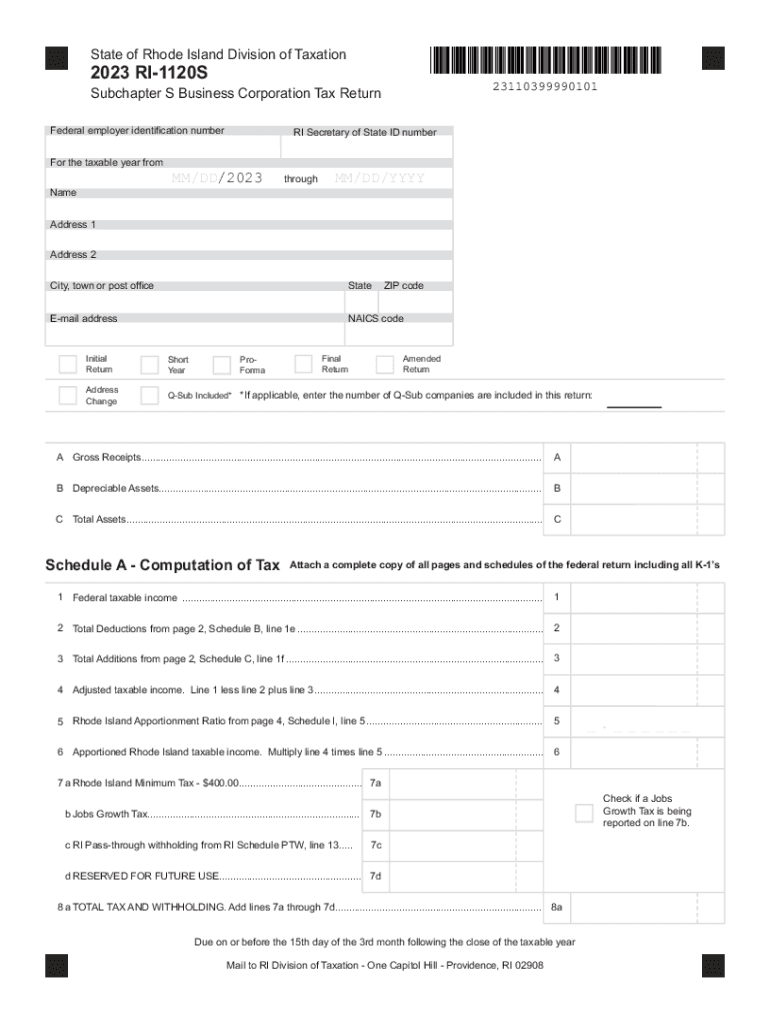

The RI 1120S Subchapter S Business Corporation Tax Return is a tax form specifically designed for corporations that have elected to be treated as S corporations under the Internal Revenue Code. This form is used by businesses operating in Rhode Island to report income, deductions, and credits, ensuring compliance with state tax regulations. S corporations typically pass their income, losses, and deductions through to shareholders, who then report these amounts on their personal tax returns. This tax treatment can provide significant tax benefits for qualifying businesses.

Steps to complete the RI 1120S Subchapter S Business Corporation Tax Return

Completing the RI 1120S form requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Fill out the identification section, providing the corporation's name, address, and federal employer identification number (EIN).

- Report income by listing all sources of revenue, including sales and service income.

- Detail deductions, such as operating expenses, salaries, and other allowable costs.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax computation section, applying the appropriate tax rates.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the RI 1120S form. Generally, the return is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. Extensions may be available, but they must be requested before the original deadline. Failure to file on time can result in penalties and interest on any unpaid tax liabilities.

Required Documents

To successfully complete the RI 1120S form, several documents are necessary:

- Income statements that detail revenue generated during the tax year.

- Balance sheets that provide a snapshot of the corporation's financial position.

- Records of all deductions, including receipts and invoices for business expenses.

- Prior year tax returns for reference and consistency.

- Any supporting documentation for credits or special deductions claimed.

Legal use of the RI 1120S Subchapter S Business Corporation Tax Return

The RI 1120S form serves a legal purpose by ensuring that S corporations comply with state tax laws. By accurately reporting income and deductions, corporations fulfill their obligations to the state of Rhode Island. This form also helps prevent issues related to tax evasion or misreporting, which can lead to legal consequences. It is essential for businesses to understand their legal responsibilities when filing this form to maintain good standing with tax authorities.

Who Issues the Form

The RI 1120S Subchapter S Business Corporation Tax Return is issued by the Rhode Island Division of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Rhode Island. The Division provides guidelines and resources to assist corporations in understanding their tax obligations and completing the necessary forms accurately.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1120s subchapter s business corporation tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 1120S Subchapter S Business Corporation Tax Return?

The RI 1120S Subchapter S Business Corporation Tax Return is a tax form used by S corporations in Rhode Island to report income, deductions, and credits. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately calculate their tax liabilities.

-

How can airSlate SignNow assist with the RI 1120S Subchapter S Business Corporation Tax Return?

airSlate SignNow provides an efficient platform for businesses to prepare and eSign their RI 1120S Subchapter S Business Corporation Tax Return. With our user-friendly interface, you can easily upload documents, gather signatures, and ensure timely submission, streamlining your tax filing process.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and larger corporations. Our cost-effective solutions ensure that you can manage your RI 1120S Subchapter S Business Corporation Tax Return without breaking the bank, providing great value for your investment.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, automated workflows, and secure eSigning capabilities. These tools are designed to simplify the process of managing your RI 1120S Subchapter S Business Corporation Tax Return, making it easier to collaborate with your team and ensure accuracy.

-

Is airSlate SignNow compliant with tax regulations for the RI 1120S Subchapter S Business Corporation Tax Return?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the RI 1120S Subchapter S Business Corporation Tax Return. Our platform ensures that your documents are securely stored and that your eSignatures are legally binding, providing peace of mind during tax season.

-

Can I integrate airSlate SignNow with other accounting software for my tax returns?

Absolutely! airSlate SignNow offers integrations with various accounting software solutions, allowing you to seamlessly manage your RI 1120S Subchapter S Business Corporation Tax Return alongside your financial data. This integration helps streamline your workflow and reduces the risk of errors during the tax filing process.

-

What are the benefits of using airSlate SignNow for my business tax returns?

Using airSlate SignNow for your RI 1120S Subchapter S Business Corporation Tax Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to focus on your business while we handle the complexities of document management and eSigning.

Get more for RI 1120S Subchapter S Business Corporation Tax Return

Find out other RI 1120S Subchapter S Business Corporation Tax Return

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed