Form OS 114 SUT CT Gov 2018-2026

What is the Form OS 114 SUT CT gov

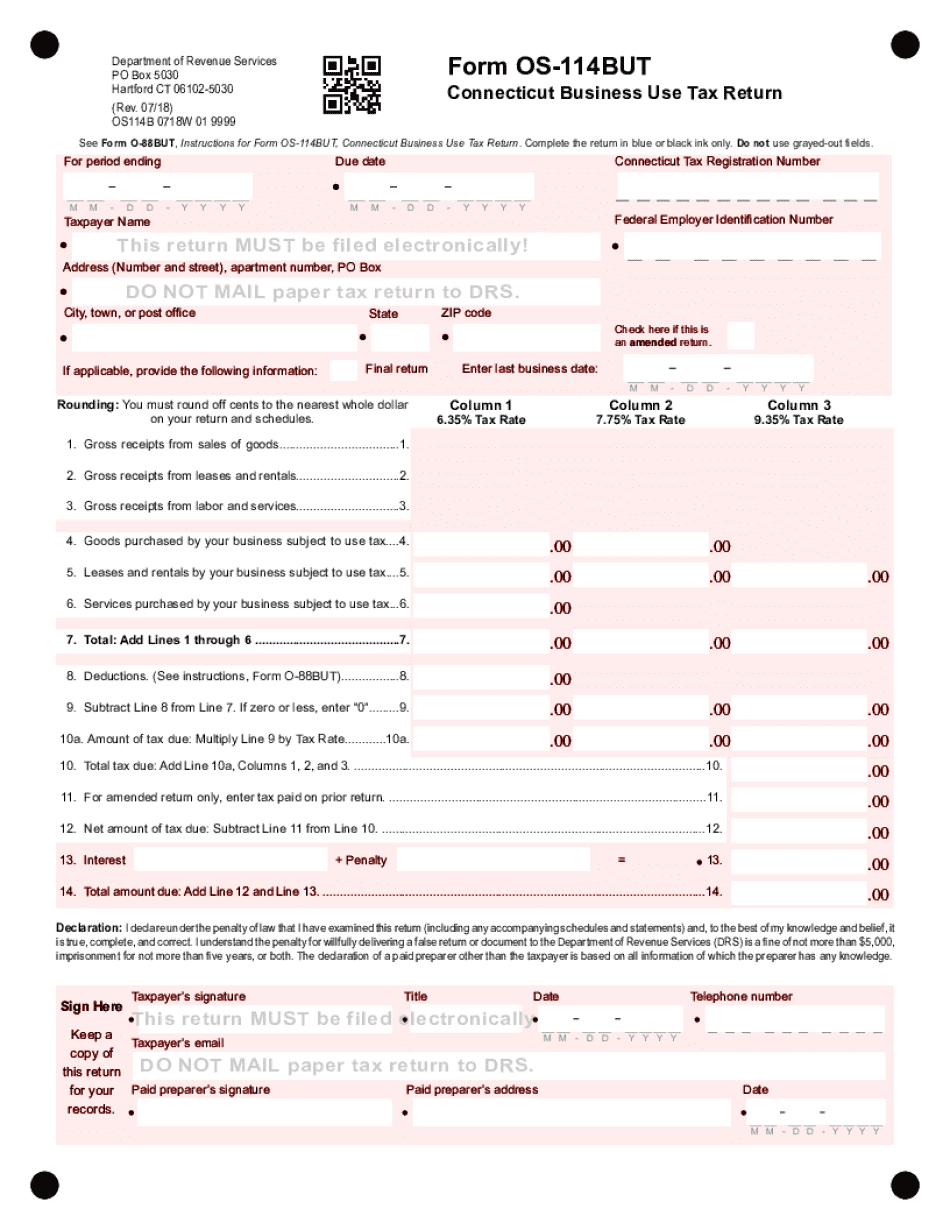

The Form OS 114 SUT CT gov is a state-specific document used in Connecticut for reporting and remitting sales and use tax. This form is essential for businesses that sell taxable goods or services within the state, as it ensures compliance with Connecticut's tax regulations. The form captures various details, including the total sales made, exemptions claimed, and the amount of tax owed to the state. Understanding this form is crucial for businesses to accurately report their tax obligations and avoid potential penalties.

How to use the Form OS 114 SUT CT gov

Using the Form OS 114 SUT CT gov involves several steps to ensure accurate completion and submission. First, gather all necessary sales records for the reporting period, including invoices and receipts. Next, fill out the form by entering your business information, such as the name, address, and tax identification number. Then, report the total sales and calculate the sales tax owed based on the applicable rates. After completing the form, review it for accuracy before submitting it to the Connecticut Department of Revenue Services.

Steps to complete the Form OS 114 SUT CT gov

Completing the Form OS 114 SUT CT gov requires careful attention to detail. Follow these steps:

- Collect all sales records for the reporting period.

- Enter your business name, address, and tax identification number in the designated fields.

- List total sales made during the reporting period, separating taxable and non-taxable sales.

- Calculate the sales tax owed by applying the appropriate tax rates to taxable sales.

- Review the form for accuracy and completeness.

- Submit the form by the due date, either online or via mail.

Required Documents

When completing the Form OS 114 SUT CT gov, it is important to have the following documents ready:

- Invoices and receipts for all sales made during the reporting period.

- Records of any exempt sales, including resale certificates.

- Previous tax returns, if applicable, for reference.

- Any correspondence with the Connecticut Department of Revenue Services regarding tax matters.

Form Submission Methods

The Form OS 114 SUT CT gov can be submitted through various methods to accommodate different preferences. Businesses may choose to file the form online through the Connecticut Department of Revenue Services' website, which offers a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address provided by the state. In-person submissions may also be possible at designated state offices, ensuring that businesses can fulfill their tax obligations conveniently.

Legal use of the Form OS 114 SUT CT gov

The legal use of the Form OS 114 SUT CT gov is crucial for maintaining compliance with state tax laws. Businesses are required to file this form to report sales and use tax accurately. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their legal obligations regarding this form to avoid potential legal issues and ensure proper tax compliance.

Create this form in 5 minutes or less

Find and fill out the correct form os 114 sut ct gov

Create this form in 5 minutes!

How to create an eSignature for the form os 114 sut ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form OS 114 SUT CT gov and how can airSlate SignNow help?

Form OS 114 SUT CT gov is a document used for sales and use tax purposes in Connecticut. airSlate SignNow simplifies the process of completing and eSigning this form, ensuring compliance and accuracy. With our platform, you can easily fill out, sign, and send Form OS 114 SUT CT gov electronically, saving time and reducing errors.

-

How much does it cost to use airSlate SignNow for Form OS 114 SUT CT gov?

airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have access to all the necessary features for managing Form OS 114 SUT CT gov. Our cost-effective solution allows you to streamline your document processes without breaking the bank.

-

What features does airSlate SignNow offer for managing Form OS 114 SUT CT gov?

airSlate SignNow provides a range of features designed to enhance your document management experience. For Form OS 114 SUT CT gov, you can utilize templates, automated workflows, and secure eSigning capabilities. These features help ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for Form OS 114 SUT CT gov?

Yes, airSlate SignNow offers seamless integrations with various software applications. This allows you to connect your existing tools with our platform, making it easier to manage Form OS 114 SUT CT gov alongside your other business processes. Integrations enhance productivity and ensure a smooth workflow.

-

Is airSlate SignNow secure for handling Form OS 114 SUT CT gov?

Absolutely! airSlate SignNow prioritizes security and compliance, especially when handling sensitive documents like Form OS 114 SUT CT gov. Our platform uses advanced encryption and security protocols to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

-

How can airSlate SignNow improve the efficiency of processing Form OS 114 SUT CT gov?

By using airSlate SignNow, you can signNowly improve the efficiency of processing Form OS 114 SUT CT gov. Our platform automates many steps in the document workflow, reducing the time spent on manual tasks. This allows your team to focus on more important activities while ensuring timely submission of your forms.

-

What are the benefits of using airSlate SignNow for Form OS 114 SUT CT gov?

Using airSlate SignNow for Form OS 114 SUT CT gov offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our user-friendly interface makes it easy to complete and eSign documents, while our automated features help minimize errors. This leads to a more efficient and reliable document management process.

Get more for Form OS 114 SUT CT gov

- Wpf ps 120100 petition for rescission of denial of paternity within 60 days washington form

- Wpf ps 120200 summons rescission of denial of paternity within 60 days washington form

- Wpf ps 120300 response to petition for rescission of denial of paternity within 60 days washington form

- Findings fact conclusions form

- Denial paternity form

- Wpf ps 130100 petition for challenge to acknowledgment of paternity washington form

- Wpf ps 130200 summons challenge to acknowledgment of paternity washington form

- Washington order court form

Find out other Form OS 114 SUT CT gov

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template