New Solar Market Development Tax Credit Claim Form

What is the New Solar Market Development Tax Credit Claim Form

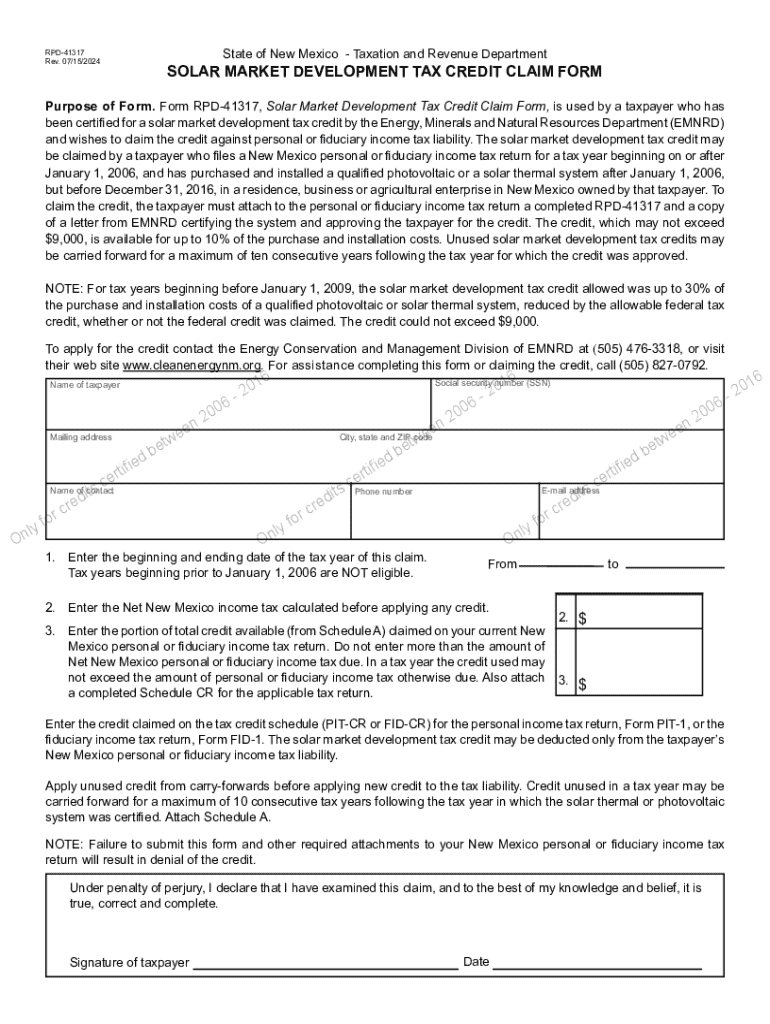

The New Solar Market Development Tax Credit Claim Form, commonly referred to as the RPD 41317 form, is a crucial document for individuals and businesses in New Mexico seeking to claim tax credits related to solar energy investments. This form is specifically designed to facilitate the application process for tax credits aimed at promoting solar energy development within the state. By completing the RPD 41317 form, taxpayers can potentially reduce their state income tax liability, making solar energy solutions more accessible and financially viable.

How to use the New Solar Market Development Tax Credit Claim Form

Using the RPD 41317 form involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation that supports your claim, including proof of solar system installation and any related expenses. Next, fill out the form with your personal information, including your name, address, and taxpayer identification number. Be sure to include details about the solar system, such as the installation date and the total cost incurred. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the New Solar Market Development Tax Credit Claim Form

Completing the RPD 41317 form requires careful attention to detail. Follow these steps for successful submission:

- Collect supporting documents, including receipts and installation contracts.

- Fill in your personal details, ensuring correct spelling and numbers.

- Provide comprehensive information about your solar system, including capacity and installation date.

- Calculate the eligible tax credit based on the guidelines provided in the form.

- Double-check all entries for accuracy and completeness.

- Submit the completed form to the New Mexico Taxation and Revenue Department.

Eligibility Criteria

To qualify for the tax credits claimed through the RPD 41317 form, applicants must meet specific eligibility criteria set forth by the state. These criteria generally include:

- The solar energy system must be installed on property within New Mexico.

- The system must meet certain performance and efficiency standards.

- Applicants must be the owner of the solar system and have incurred eligible expenses.

- Claims must be filed within the designated timeframe as outlined by state regulations.

Required Documents

When filing the RPD 41317 form, several documents are necessary to support your claim. These typically include:

- Proof of installation, such as an installation contract or invoice.

- Receipts for any materials or services related to the solar system.

- Documentation demonstrating the performance of the solar system, if applicable.

- Any previous correspondence with tax authorities related to solar credits.

Form Submission Methods

The RPD 41317 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the New Mexico Taxation and Revenue Department's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new solar market development tax credit claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rpd 41317 form?

The rpd 41317 form is a document used for specific tax purposes, often required by businesses to report certain financial information. Understanding how to properly fill out the rpd 41317 form is crucial for compliance. airSlate SignNow simplifies this process by allowing users to eSign and send the form securely.

-

How can airSlate SignNow help with the rpd 41317 form?

airSlate SignNow provides an easy-to-use platform for businesses to manage the rpd 41317 form efficiently. With features like eSigning and document tracking, users can ensure that their forms are completed accurately and submitted on time. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the rpd 41317 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans provide access to features that facilitate the completion and eSigning of the rpd 41317 form. Investing in this solution can save time and enhance productivity.

-

What features does airSlate SignNow offer for the rpd 41317 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document storage, all of which are beneficial for managing the rpd 41317 form. These tools help ensure that your documents are organized and easily accessible. Additionally, the platform supports collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the rpd 41317 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage the rpd 41317 form alongside your existing tools. This flexibility allows for a seamless workflow, enhancing efficiency in document management and eSigning.

-

What are the benefits of using airSlate SignNow for the rpd 41317 form?

Using airSlate SignNow for the rpd 41317 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy tracking of document status, ensuring that your forms are processed without delays. This can lead to signNow time savings for your business.

-

Is airSlate SignNow secure for handling the rpd 41317 form?

Yes, airSlate SignNow prioritizes security, ensuring that your rpd 41317 form and other documents are protected. The platform uses encryption and secure storage to safeguard sensitive information. This commitment to security helps businesses comply with regulations while managing their documents.

Get more for New Solar Market Development Tax Credit Claim Form

Find out other New Solar Market Development Tax Credit Claim Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe