Form 760 Adj WebFill Out and Use This PDF

Overview of Virginia Tax Form 760 for 2024

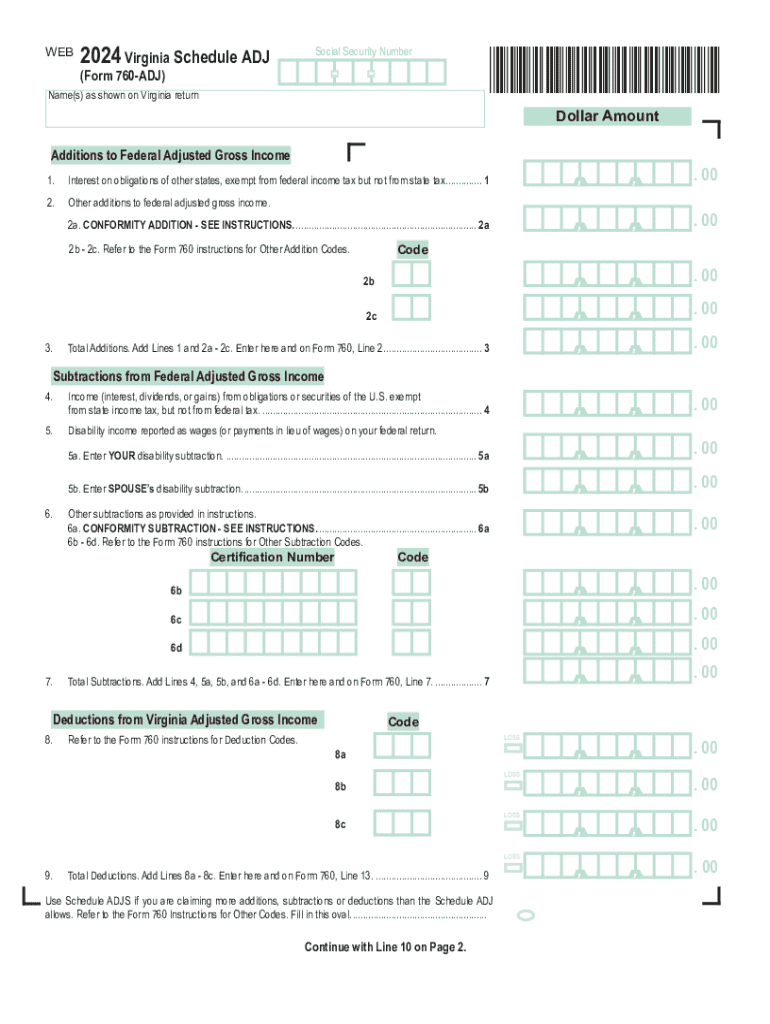

The Virginia Tax Form 760 for 2024 is the primary income tax form used by residents of Virginia to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Virginia, as it allows them to claim deductions, credits, and any applicable adjustments to their taxable income. Understanding the structure and requirements of this form is crucial for accurate filing and compliance with state tax laws.

Key Elements of Virginia Tax Form 760

Virginia Tax Form 760 includes several key components that taxpayers should be aware of:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Income Reporting: All sources of income, including wages, interest, and dividends, must be reported.

- Deductions and Credits: Taxpayers can claim various deductions and credits to reduce their taxable income.

- Signature: The form must be signed and dated by the taxpayer or authorized representative.

Steps to Complete Virginia Tax Form 760 for 2024

Completing the Virginia Tax Form 760 involves several steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section accurately.

- Report all sources of income in the designated sections.

- Calculate deductions and credits based on eligibility.

- Review the completed form for accuracy before signing.

Filing Deadlines for Virginia Tax Form 760

It is important to be aware of the filing deadlines for the Virginia Tax Form 760. Typically, the deadline for submitting this form is May first of the year following the tax year. For 2024, taxpayers should ensure that their forms are filed by May one, 2025, to avoid penalties and interest.

Form Submission Methods for Virginia Tax Form 760

Taxpayers have several options for submitting their completed Virginia Tax Form 760:

- Online Submission: Many taxpayers choose to file electronically through the Virginia Department of Taxation's website.

- Mail: Completed forms can be mailed to the appropriate address provided in the form instructions.

- In-Person: Taxpayers may also submit their forms in person at local tax offices.

Legal Use of Virginia Tax Form 760

The Virginia Tax Form 760 is a legal document that must be completed accurately to comply with state tax laws. Filing this form is a legal requirement for residents earning income in Virginia. Failure to file or providing false information may result in penalties, including fines and interest on unpaid taxes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 760 adj webfill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia tax form 760 for 2024?

The Virginia tax form 760 for 2024 is the state's individual income tax return form. It is used by residents to report their income and calculate their tax liability for the year. Completing this form accurately is essential for ensuring compliance with Virginia tax laws.

-

How can airSlate SignNow help with the Virginia tax form 760 for 2024?

airSlate SignNow provides a streamlined solution for electronically signing and sending the Virginia tax form 760 for 2024. With its user-friendly interface, you can easily manage your tax documents, ensuring they are completed and submitted on time. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Virginia tax form 760 for 2024?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of the features provided, such as secure eSigning and document management for the Virginia tax form 760 for 2024.

-

What features does airSlate SignNow offer for managing the Virginia tax form 760 for 2024?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking, which are essential for managing the Virginia tax form 760 for 2024. These tools help ensure that your documents are completed accurately and efficiently, enhancing your overall tax filing experience.

-

Can I integrate airSlate SignNow with other software for the Virginia tax form 760 for 2024?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage your Virginia tax form 760 for 2024 alongside your other business tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Virginia tax form 760 for 2024?

Using airSlate SignNow for the Virginia tax form 760 for 2024 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows you to complete and sign your tax documents quickly, ensuring you meet deadlines without hassle.

-

Is airSlate SignNow secure for submitting the Virginia tax form 760 for 2024?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure storage. This ensures that your Virginia tax form 760 for 2024 is submitted safely and confidentially.

Get more for Form 760 Adj WebFill Out And Use This PDF

- Brick mason contractor package west virginia form

- Roofing contractor package west virginia form

- Electrical contractor package west virginia form

- Sheetrock drywall contractor package west virginia form

- Flooring contractor package west virginia form

- Trim carpentry contractor package west virginia form

- Fencing contractor package west virginia form

- Hvac contractor package west virginia form

Find out other Form 760 Adj WebFill Out And Use This PDF

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form