Llc Formation Questionnaire

What is the LLC Formation Questionnaire

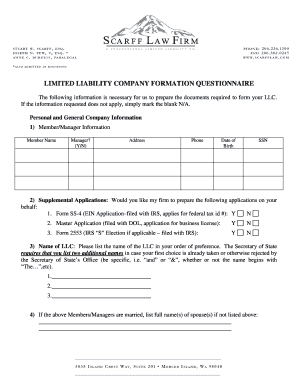

The LLC formation questionnaire is a vital document designed to gather essential information for establishing a Limited Liability Company (LLC). This form typically includes inquiries about the business name, address, ownership structure, and the nature of the business activities. Completing this questionnaire accurately is crucial, as it lays the groundwork for the legal formation of the LLC and ensures compliance with state regulations.

Key Elements of the LLC Formation Questionnaire

Several key elements are typically included in the LLC formation questionnaire. These elements often encompass:

- Business Name: The desired name for the LLC, which must comply with state naming rules.

- Principal Address: The primary location where the business will operate.

- Members' Information: Names and addresses of the LLC members or owners.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the LLC.

- Business Purpose: A brief description of the business activities the LLC will engage in.

Steps to Complete the LLC Formation Questionnaire

Completing the LLC formation questionnaire involves several systematic steps:

- Gather necessary information, including personal details and business specifics.

- Fill out the questionnaire, ensuring all sections are completed accurately.

- Review the information for any errors or omissions.

- Consult with a legal professional if needed, to ensure compliance with state laws.

- Submit the completed questionnaire as part of the LLC formation process.

Legal Use of the LLC Formation Questionnaire

The LLC formation questionnaire serves a legal purpose in the formation of an LLC. It is often a required document for filing with the state’s Secretary of State or equivalent agency. By providing accurate information, the questionnaire helps establish the legal identity of the LLC, protecting its members from personal liability. Failure to complete this document correctly can lead to delays in formation or potential legal issues.

State-Specific Rules for the LLC Formation Questionnaire

Each state in the U.S. has its own specific rules and requirements regarding the LLC formation questionnaire. It is essential to be aware of these variations, as they can affect the information required and the filing process. For instance, some states may have additional questions related to business licenses or specific regulations that must be adhered to. Checking the state’s official website or consulting with a legal expert can provide clarity on these requirements.

Required Documents

When completing the LLC formation questionnaire, several supporting documents may be required. Commonly needed documents include:

- Identification: Personal identification for all members, such as a driver's license or passport.

- Operating Agreement: A document outlining the management structure and operating procedures of the LLC.

- Proof of Address: Documentation verifying the principal business address.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the llc formation questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an LLC formation questionnaire?

An LLC formation questionnaire is a structured document designed to gather essential information needed to establish a Limited Liability Company. It typically includes questions about the business name, address, ownership structure, and other relevant details. Completing this questionnaire is a crucial step in the LLC formation process.

-

How does airSlate SignNow's LLC formation questionnaire work?

airSlate SignNow's LLC formation questionnaire simplifies the process by guiding users through each necessary step. Users can fill out the questionnaire online, ensuring all required information is collected efficiently. This streamlined approach helps prevent errors and speeds up the LLC formation process.

-

What are the benefits of using an LLC formation questionnaire?

Using an LLC formation questionnaire helps ensure that all necessary information is accurately captured, reducing the risk of delays in the formation process. It also provides clarity on the requirements for forming an LLC, making it easier for users to understand their obligations. Overall, it enhances the efficiency of setting up a business.

-

Is there a cost associated with the LLC formation questionnaire?

Yes, there may be a cost associated with using airSlate SignNow's LLC formation questionnaire, depending on the specific services selected. However, the pricing is designed to be cost-effective, providing excellent value for the comprehensive support offered. Users can review pricing details on the airSlate SignNow website.

-

Can I save my progress on the LLC formation questionnaire?

Absolutely! airSlate SignNow allows users to save their progress while completing the LLC formation questionnaire. This feature enables users to return to their questionnaire at any time, ensuring they can complete it at their convenience without losing any information.

-

What features does the LLC formation questionnaire include?

The LLC formation questionnaire includes user-friendly prompts, validation checks, and guidance on required information. Additionally, it offers integration with eSignature capabilities, allowing users to sign documents electronically once the questionnaire is completed. These features enhance the overall user experience.

-

How does the LLC formation questionnaire integrate with other tools?

airSlate SignNow's LLC formation questionnaire seamlessly integrates with various business tools and applications. This integration allows users to manage their documents and workflows more efficiently. By connecting with other platforms, users can streamline their business processes and enhance productivity.

Get more for Llc Formation Questionnaire

- Letter recognition assessmentindividual record form

- Application jimmy johns print form

- Blank missouri marriage license form

- Mtn insurance claim form pdf

- Native reflections catalogue form

- Pwd 143 144 application form

- Chp1 child pension application form

- Small scale embedded generation sseg application form

Find out other Llc Formation Questionnaire

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online