CT W4P Withholding Certificate Form

What is the CT W4P Withholding Certificate Form

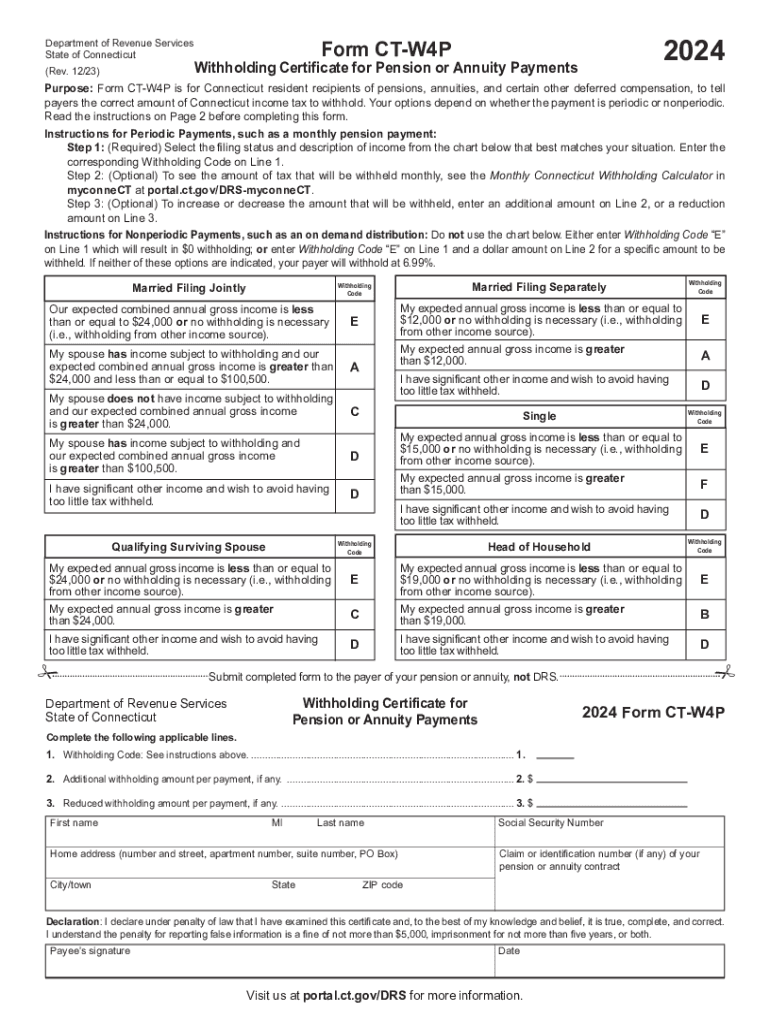

The CT W4P Withholding Certificate Form is a document used by Connecticut residents to inform their employers about the amount of state income tax to withhold from their pension or annuity payments. This form is essential for ensuring that the correct tax amount is deducted, helping individuals manage their tax liabilities effectively. The form is specifically designed for recipients of pension or annuity payments, making it a crucial tool for retirees and beneficiaries.

How to use the CT W4P Withholding Certificate Form

To use the CT W4P Withholding Certificate Form, individuals must complete the form by providing their personal information, including name, address, and Social Security number. They will also indicate the amount they wish to have withheld from their pension or annuity payments. Once completed, the form should be submitted to the payer of the pension or annuity. It is important to ensure that the form is filled out accurately to avoid issues with tax withholding.

Steps to complete the CT W4P Withholding Certificate Form

Completing the CT W4P Withholding Certificate Form involves several straightforward steps:

- Download the latest version of the CT W4P form from an official source.

- Fill in your personal details, including your name, address, and Social Security number.

- Specify the amount you want withheld from your payments.

- Sign and date the form to validate it.

- Submit the completed form to your pension or annuity payer.

Key elements of the CT W4P Withholding Certificate Form

The CT W4P Withholding Certificate Form includes several key elements that are crucial for accurate tax withholding:

- Personal Information: This section requires your name, address, and Social Security number.

- Withholding Amount: You can specify the exact amount of state tax to be withheld from your payments.

- Signature: A signature is required to confirm that the information provided is accurate.

- Date: The date of signing is also necessary for record-keeping purposes.

Legal use of the CT W4P Withholding Certificate Form

The CT W4P Withholding Certificate Form is legally recognized in Connecticut for the purpose of tax withholding on pension and annuity payments. It is important to use this form correctly to comply with state tax laws. Failure to submit the form or providing incorrect information may result in improper withholding, leading to potential tax liabilities or penalties.

Filing Deadlines / Important Dates

When using the CT W4P Withholding Certificate Form, it is essential to be aware of filing deadlines. Generally, the form should be submitted to the pension or annuity payer before the first payment is made. This ensures that the appropriate amount of tax is withheld from the outset. It is advisable to check for any specific deadlines related to your pension plan or annuity provider to avoid any issues with tax withholding.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w4p withholding certificate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ct w4p pdf and why is it important?

The 2024 ct w4p pdf is a tax form used by employees in Connecticut to determine their withholding allowances. It is essential for ensuring that the correct amount of state income tax is withheld from your paycheck. Completing this form accurately can help you avoid underpayment or overpayment of taxes.

-

How can I fill out the 2024 ct w4p pdf using airSlate SignNow?

You can easily fill out the 2024 ct w4p pdf using airSlate SignNow's intuitive interface. Simply upload the PDF, fill in the required fields, and save your changes. Our platform allows for seamless editing and signing, making the process quick and efficient.

-

Is there a cost associated with using airSlate SignNow for the 2024 ct w4p pdf?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing robust features for managing documents, including the 2024 ct w4p pdf. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2024 ct w4p pdf?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage for the 2024 ct w4p pdf. These tools streamline the document management process, ensuring that you can send, sign, and store your forms efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2024 ct w4p pdf?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the 2024 ct w4p pdf alongside your existing tools. This flexibility enhances your workflow and ensures that you can access all necessary documents in one place.

-

What are the benefits of using airSlate SignNow for the 2024 ct w4p pdf?

Using airSlate SignNow for the 2024 ct w4p pdf offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing process, reduces paperwork, and ensures that your sensitive information is protected.

-

How secure is my information when using airSlate SignNow for the 2024 ct w4p pdf?

Security is a top priority at airSlate SignNow. When you use our platform for the 2024 ct w4p pdf, your data is encrypted and stored securely. We adhere to industry standards to ensure that your information remains confidential and protected from unauthorized access.

Get more for CT W4P Withholding Certificate Form

- Md 433 a form

- Delaware 613381459 form

- Suggested affidavit form nonresident purchaser

- Az joint tax application form

- File adjust or review quarterly tax ampamp wage reportdes ncfile adjust or review quarterly tax ampamp wage reportdes ncfile form

- Florida dept of revenue reemployment tax return and payment information

- Reporting agent authorization form

- Form 165 instructions azdorgov

Find out other CT W4P Withholding Certificate Form

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History