How Do I Claim a District of Columbia DC Refund for Taxes Form

Understanding the DC Tax Form D-40B

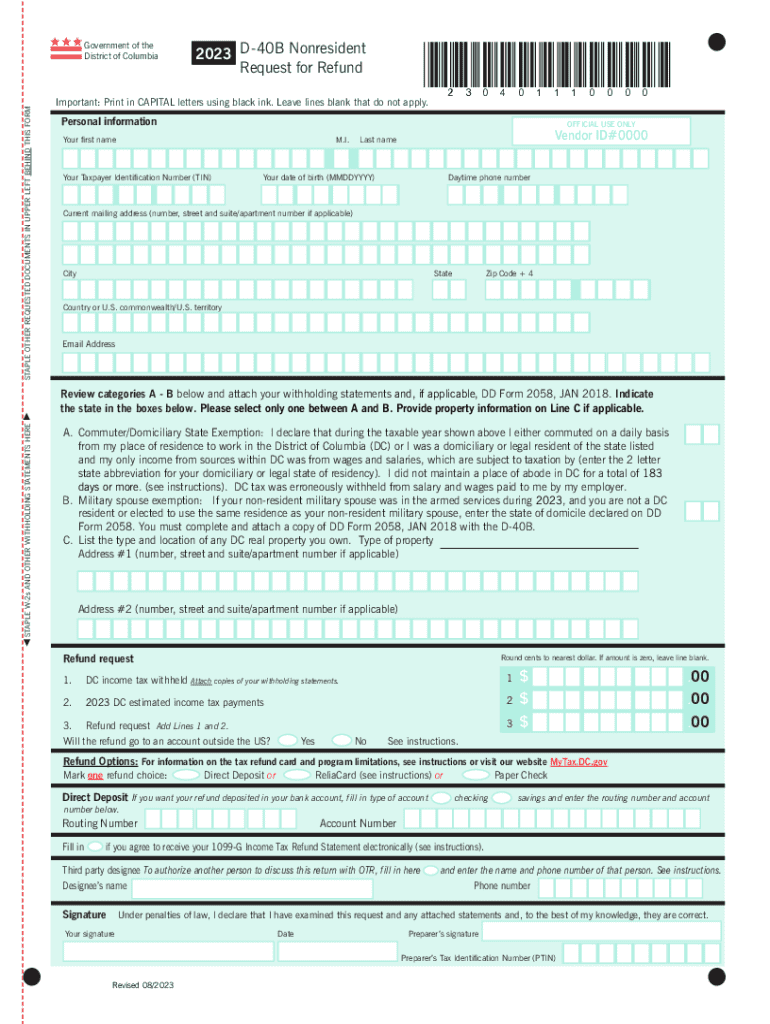

The DC Tax Form D-40B is specifically designed for non-residents seeking a refund of overpaid taxes in the District of Columbia. This form is essential for individuals who earned income in Washington, DC, but do not reside there. It allows taxpayers to claim a refund based on the amount of tax withheld from their income while working in the district.

Steps to Complete the DC Tax Form D-40B

To successfully complete the DC Tax Form D-40B, follow these steps:

- Gather all necessary documentation, including W-2 forms and any other income statements.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Report your total income earned in Washington, DC, along with the total tax withheld.

- Calculate your refund amount by subtracting any applicable deductions and credits from your total tax withheld.

- Sign and date the form before submission.

Required Documents for the DC Tax Form D-40B

When filing the DC Tax Form D-40B, it is crucial to include the following documents:

- Copies of W-2 forms showing income earned in DC.

- Any 1099 forms if applicable.

- Proof of residency in another state, if necessary.

- Any additional supporting documents that substantiate your claim for a refund.

Filing Deadlines for the DC Tax Form D-40B

It is important to be aware of the filing deadlines for the DC Tax Form D-40B to avoid penalties. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individual income tax returns. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Form Submission Methods for the DC Tax Form D-40B

The DC Tax Form D-40B can be submitted through various methods:

- Online submission via the DC Office of Tax and Revenue website.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices in Washington, DC.

Eligibility Criteria for the DC Tax Form D-40B

To be eligible to file the DC Tax Form D-40B, you must meet the following criteria:

- You must be a non-resident who earned income in Washington, DC.

- Taxes must have been withheld from your income while working in the district.

- You must not have a permanent residence in Washington, DC.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how do i claim a district of columbia dc refund for taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc tax form d 40b?

The dc tax form d 40b is a tax form used by residents of Washington D.C. to report their income and calculate their tax liability. It is essential for individuals to accurately complete this form to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with the dc tax form d 40b?

airSlate SignNow provides a seamless platform for electronically signing and sending the dc tax form d 40b. With our user-friendly interface, you can easily manage your tax documents and ensure they are securely signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the dc tax form d 40b?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can efficiently manage the dc tax form d 40b without breaking the bank.

-

What features does airSlate SignNow offer for the dc tax form d 40b?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all of which enhance the process of handling the dc tax form d 40b. These features streamline your workflow and improve efficiency.

-

Can I integrate airSlate SignNow with other software for the dc tax form d 40b?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the dc tax form d 40b alongside your existing tools. This integration helps maintain a smooth workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the dc tax form d 40b?

Using airSlate SignNow for the dc tax form d 40b offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

How secure is airSlate SignNow when handling the dc tax form d 40b?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your dc tax form d 40b and other sensitive documents, ensuring that your information remains confidential.

Get more for How Do I Claim A District Of Columbia DC Refund For Taxes

Find out other How Do I Claim A District Of Columbia DC Refund For Taxes

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF