Schedule Sb Form

What is the Schedule Sb

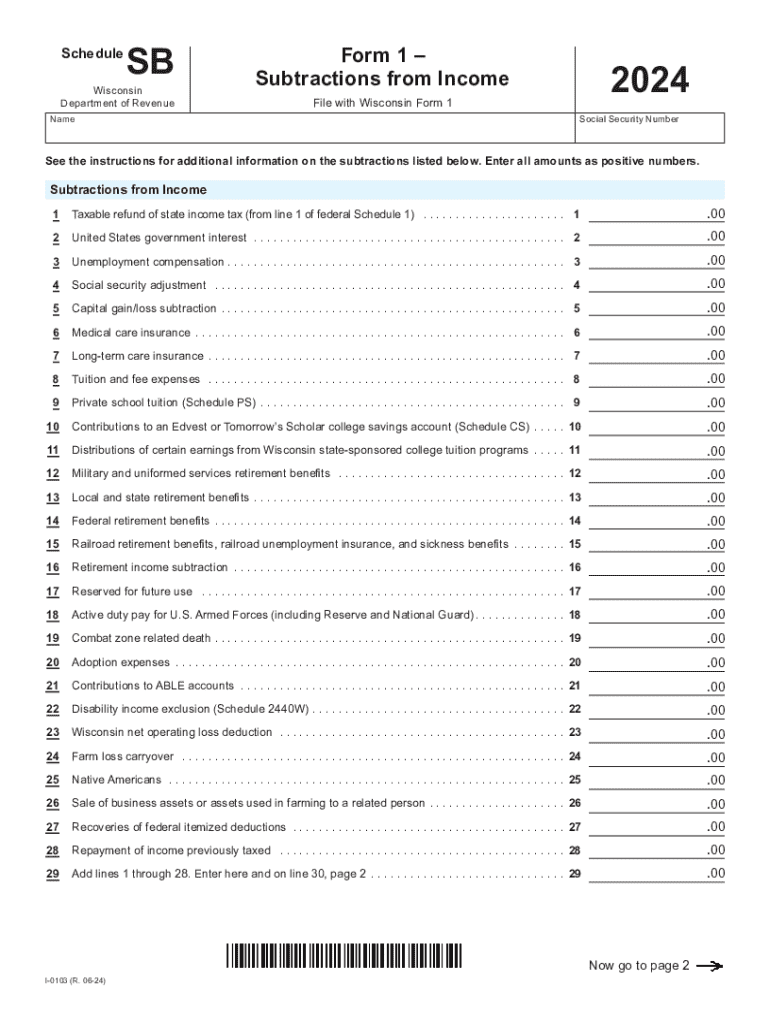

The Schedule Sb is a tax form used by certain taxpayers in the United States to report information regarding their income and tax obligations. It is primarily associated with the reporting of income from self-employment and other specific sources. This form helps the Internal Revenue Service (IRS) track income that may not be reported on standard tax forms. Understanding the Schedule Sb is essential for individuals who need to accurately report their earnings and comply with tax regulations.

How to use the Schedule Sb

To use the Schedule Sb effectively, taxpayers must first determine if they are required to file it based on their income sources. Once confirmed, they should gather all relevant financial documents, including income statements and any other supporting paperwork. The form typically includes sections for reporting income, deductions, and credits. It is important to fill out each section carefully to ensure accurate reporting. After completing the form, taxpayers can submit it along with their main tax return.

Steps to complete the Schedule Sb

Completing the Schedule Sb involves several key steps:

- Gather necessary documents, such as income statements and expense records.

- Review the instructions provided by the IRS for the Schedule Sb to understand the requirements.

- Fill out the form, ensuring that all income and deductions are accurately reported.

- Double-check the information for any errors or omissions.

- Submit the completed Schedule Sb with your tax return by the designated deadline.

Legal use of the Schedule Sb

The legal use of the Schedule Sb is essential for compliance with U.S. tax laws. Taxpayers must file this form if they meet specific criteria set by the IRS. Failing to file the Schedule Sb when required can result in penalties and interest on unpaid taxes. It is crucial for individuals to understand their obligations and ensure that they use the form correctly to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule Sb align with the general tax return deadlines. Typically, individual taxpayers must file their returns, including the Schedule Sb, by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their forms.

Required Documents

To complete the Schedule Sb, taxpayers need to gather several key documents, including:

- Income statements, such as 1099 forms or other records of self-employment income.

- Records of business expenses that can be deducted.

- Any applicable tax credits or deductions that may affect the filing.

Having these documents on hand will facilitate the accurate completion of the form and help ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Schedule Sb. Taxpayers should refer to the IRS website or the instructions accompanying the form for detailed information on eligibility, required information, and filing procedures. Adhering to these guidelines is crucial for ensuring that the form is filled out correctly and submitted on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule sb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to Schedule Sb with airSlate SignNow?

To Schedule Sb with airSlate SignNow, simply log in to your account and navigate to the scheduling feature. You can set specific dates and times for document signing, ensuring that all parties are aligned. This feature streamlines the signing process and enhances overall efficiency.

-

How much does it cost to Schedule Sb using airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost to Schedule Sb depends on the plan you choose, with options for individuals and teams. Each plan provides access to essential features, including scheduling capabilities, at a competitive price.

-

What features does airSlate SignNow offer for scheduling documents?

airSlate SignNow includes robust features for scheduling documents, such as automated reminders and customizable signing workflows. You can easily Schedule Sb and track the status of your documents in real-time. These features help ensure that your signing process is smooth and efficient.

-

Can I integrate airSlate SignNow with other applications to Schedule Sb?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to Schedule Sb directly from your preferred tools. Whether you use CRM systems, project management software, or cloud storage, you can enhance your workflow by integrating SignNow. This flexibility makes it easier to manage your documents.

-

What are the benefits of using airSlate SignNow to Schedule Sb?

Using airSlate SignNow to Schedule Sb provides numerous benefits, including increased efficiency and reduced turnaround times for document signing. The platform's user-friendly interface makes it easy for all parties to engage in the signing process. Additionally, you can ensure compliance and security with advanced features.

-

Is there a mobile app for Scheduling Sb with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to Schedule Sb on the go. This app provides full access to all features, enabling you to manage your documents and signing processes from anywhere. The mobile functionality ensures that you never miss an important signing opportunity.

-

How secure is the process to Schedule Sb with airSlate SignNow?

The process to Schedule Sb with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. Your documents are protected throughout the signing process, ensuring confidentiality and integrity. airSlate SignNow complies with industry standards to provide a safe environment for all users.

Get more for Schedule Sb

Find out other Schedule Sb

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors