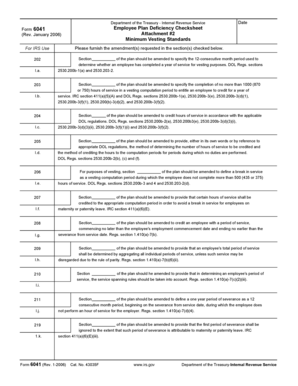

Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

What is the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

The Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards is a critical document used by employers to ensure compliance with minimum vesting requirements for employee benefit plans. This form serves as a checklist to identify any deficiencies in an employee's plan regarding vesting schedules. It is essential for maintaining the integrity of retirement plans and ensuring that employees receive their entitled benefits.

How to use the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

Using the Form 6041 Rev 1 involves a systematic approach to assess your employee benefit plans. Begin by reviewing the vesting schedules outlined in your plan documents. Next, utilize the checksheet to evaluate each component against the minimum standards set forth by the IRS. This process helps identify any areas that may require correction or adjustment to ensure compliance.

Steps to complete the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

Completing the Form 6041 Rev 1 requires a few key steps:

- Gather all relevant plan documents and participant data.

- Review the vesting provisions in your plan to understand the requirements.

- Use the checksheet to systematically evaluate each provision against the minimum standards.

- Document any deficiencies identified during the review process.

- Prepare a corrective action plan if necessary to address any issues.

Legal use of the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

The legal use of the Form 6041 Rev 1 is essential for compliance with federal regulations governing employee benefit plans. Employers must ensure that their plans meet the minimum vesting standards established by the IRS. Failure to comply can result in penalties and loss of tax-qualified status for the plan. Proper completion of this form helps demonstrate adherence to legal requirements.

Key elements of the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

Key elements of the Form 6041 Rev 1 include:

- Identification of the plan sponsor and plan name.

- A detailed checklist of vesting provisions.

- Sections for documenting deficiencies and corrective actions.

- Signatures of responsible parties to affirm the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the minimum vesting standards that must be met by employee benefit plans. These guidelines outline the required vesting schedules and conditions under which employees earn their benefits. Adhering to these guidelines is crucial for ensuring that plans remain compliant and that employees receive their rightful benefits.

Penalties for Non-Compliance

Employers who fail to comply with the minimum vesting standards outlined in the Form 6041 Rev 1 may face significant penalties. These can include fines, loss of tax benefits, and potential legal action from employees. It is vital for employers to regularly review their plans and utilize the checksheet to avoid these consequences and ensure compliance with federal regulations.

Quick guide on how to complete form 6041 rev 1 2006 employee plan deficiency checksheet attachment 2 minimum vesting standards

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specially provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

Create this form in 5 minutes!

How to create an eSignature for the form 6041 rev 1 2006 employee plan deficiency checksheet attachment 2 minimum vesting standards

How to generate an eSignature for your Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards in the online mode

How to create an electronic signature for your Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards in Chrome

How to make an electronic signature for putting it on the Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards in Gmail

How to generate an electronic signature for the Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards from your smartphone

How to make an eSignature for the Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards on iOS devices

How to make an eSignature for the Form 6041 Rev 1 2006 Employee Plan Deficiency Checksheet Attachment 2 Minimum Vesting Standards on Android devices

People also ask

-

What is the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

The Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards is a crucial document used by employers to assess compliance with minimum vesting standards in employee benefit plans. It helps ensure that plans meet federal regulations, protecting both the employer and employees. With airSlate SignNow, you can easily eSign and manage this form digitally, streamlining your compliance processes.

-

How does airSlate SignNow facilitate the use of Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

airSlate SignNow simplifies the process of completing and submitting the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards. Our platform allows for easy document customization, secure eSigning, and real-time tracking of submissions. This ensures a hassle-free experience when managing your compliance documentation.

-

Is airSlate SignNow cost-effective for managing compliance documents like Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

Yes, airSlate SignNow offers a cost-effective solution for managing compliance documents such as the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards. With competitive pricing plans, you can access powerful features without breaking the bank, making it an ideal choice for businesses of any size.

-

What features does airSlate SignNow offer for the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

airSlate SignNow provides a range of features tailored for the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards, including customizable templates, automated workflows, and secure eSigning. These features help you ensure compliance while saving time and reducing errors in your documentation processes.

-

Can I integrate airSlate SignNow with other tools for better management of Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

Absolutely! airSlate SignNow offers seamless integrations with various business tools, allowing you to manage the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards more effectively. By connecting with CRM systems, cloud storage, and document management platforms, you can streamline your workflows and enhance efficiency.

-

How does airSlate SignNow enhance collaboration on Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

AirSlate SignNow enhances collaboration on documents like the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards through features like shared access and comment threads. Multiple team members can collaborate in real-time, ensuring that everyone involved is on the same page and contributing effectively towards compliance.

-

What security measures does airSlate SignNow employ for sensitive documents like Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards?

airSlate SignNow prioritizes security for sensitive documents such as the Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards. We implement advanced encryption, two-factor authentication, and secure access controls to protect your data from unauthorized access, ensuring that your compliance documents remain confidential.

Get more for Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

- Jayhawk camp brochure 13 dec form

- Addition deletion form

- Acrobat creating pdf forms ku university of kansas techdocs ku

- Rapid destruction of the pfr form of phytochrome by a substance

- Peoplesoft financials access form

- Digital humanities seed grants proposal guidelines description www2 ku form

- Expiration date 073106 form

- Course registration form name home phone address work phone e mail city state zip code sponsor outward bound odin falls

Find out other Form 6041 Rev 1 Employee Plan Deficiency Checksheet Attachment #2 Minimum Vesting Standards

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement