Form 14234 B Rev 12 Material Intercompany Transactions Template MITT 2023-2026

What is the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

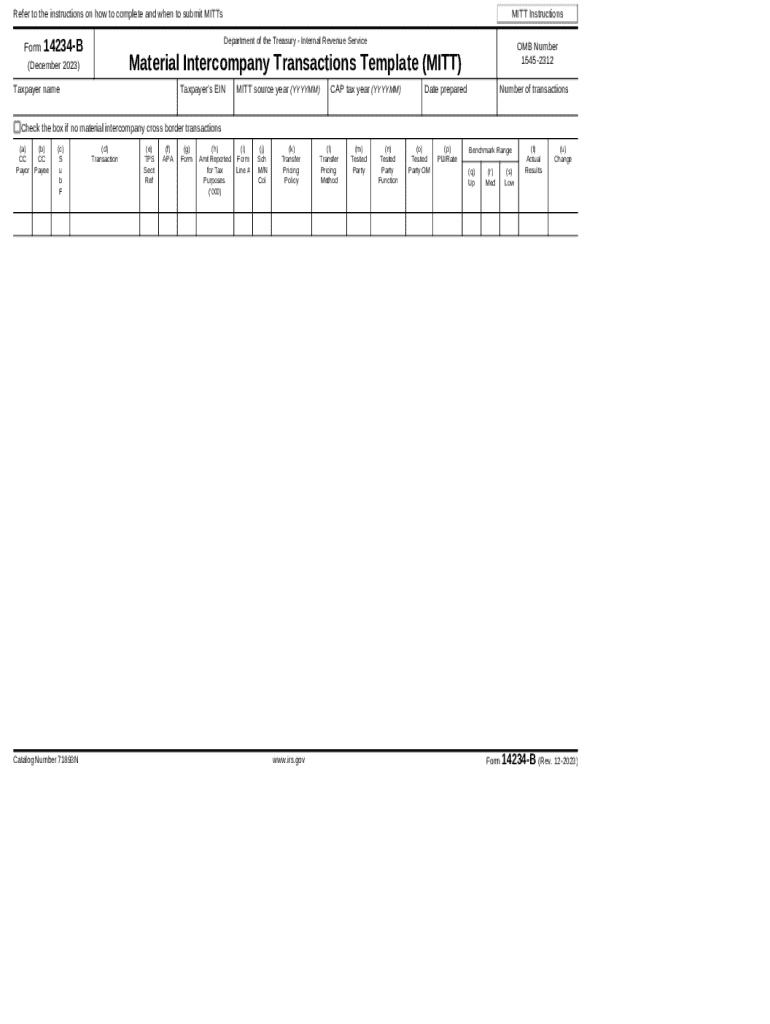

The Form 14234 B Rev 12 Material Intercompany Transactions Template MITT is a specialized document used by businesses to report and manage intercompany transactions. This form is essential for ensuring compliance with regulatory requirements related to financial reporting between affiliated entities. It provides a structured format for detailing transactions that occur between different divisions or subsidiaries of a corporation, which is crucial for accurate tax reporting and financial transparency.

How to use the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

Using the Form 14234 B Rev 12 MITT involves several key steps. First, gather all relevant financial data regarding the intercompany transactions that need to be reported. This includes details such as transaction amounts, dates, and the parties involved. Next, ensure that the form is filled out completely and accurately, adhering to the guidelines provided by the IRS. Once completed, the form can be submitted electronically or via mail, depending on the specific filing requirements for your business.

Steps to complete the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

Completing the Form 14234 B Rev 12 MITT requires careful attention to detail. Start by downloading the latest version of the form from the appropriate source. Fill in the required fields, including information about the entities involved and the nature of the transactions. Double-check all entries for accuracy, as errors can lead to compliance issues. After completing the form, review it for completeness before submission. Ensure that you keep a copy for your records.

Legal use of the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

The legal use of the Form 14234 B Rev 12 MITT is crucial for businesses operating in multiple jurisdictions. This form helps ensure that intercompany transactions are reported in accordance with U.S. tax laws and regulations. Proper use of the form can protect businesses from potential audits and penalties. It is advisable to consult with a tax professional to ensure compliance with all applicable laws when preparing and submitting this form.

Key elements of the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

Key elements of the Form 14234 B Rev 12 MITT include detailed sections for transaction descriptions, amounts, and the parties involved. The form also requires information about the nature of the relationship between the entities, which helps establish the context of the transactions. Additionally, it may include fields for disclosing any relevant financial agreements or contracts that govern the transactions, ensuring transparency and accountability.

Filing Deadlines / Important Dates

Filing deadlines for the Form 14234 B Rev 12 MITT are typically aligned with the overall tax filing deadlines set by the IRS. It is essential for businesses to be aware of these dates to avoid late penalties. Generally, forms related to intercompany transactions should be filed by the annual tax return due date. Keeping a calendar of important dates can help ensure timely submission and compliance.

Create this form in 5 minutes or less

Find and fill out the correct form 14234 b rev 12 material intercompany transactions template mitt

Create this form in 5 minutes!

How to create an eSignature for the form 14234 b rev 12 material intercompany transactions template mitt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

The Form 14234 B Rev 12 Material Intercompany Transactions Template MITT is a standardized document designed to streamline the reporting of intercompany transactions. It helps businesses ensure compliance with regulatory requirements while simplifying the documentation process. By using this template, companies can enhance accuracy and efficiency in their financial reporting.

-

How can airSlate SignNow help with the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

airSlate SignNow provides an intuitive platform for businesses to easily send, sign, and manage the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT. Our solution allows for seamless collaboration and tracking, ensuring that all parties can access and complete the document efficiently. This enhances the overall workflow and reduces the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow with the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our pricing is designed to be cost-effective, allowing you to choose a plan that fits your needs while utilizing the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT. You can explore our subscription options on our website to find the best fit for your organization.

-

What features does airSlate SignNow offer for the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

With airSlate SignNow, you gain access to features such as customizable templates, real-time tracking, and secure eSignature capabilities for the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT. These features enhance the user experience and ensure that your documents are processed quickly and securely. Additionally, our platform supports integrations with various applications to streamline your workflow.

-

What are the benefits of using the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

Using the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT can signNowly improve your financial reporting accuracy and compliance. It simplifies the documentation process, reduces the risk of errors, and saves time for your team. By leveraging airSlate SignNow, you can enhance collaboration and ensure that all necessary parties are involved in the process.

-

Can I integrate airSlate SignNow with other software for the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

Yes, airSlate SignNow offers integrations with a variety of software applications, making it easy to incorporate the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT into your existing workflows. This allows for seamless data transfer and improved efficiency across your business processes. Check our integration options to see how we can connect with your favorite tools.

-

Is airSlate SignNow secure for handling the Form 14234 B Rev 12 Material Intercompany Transactions Template MITT?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Form 14234 B Rev 12 Material Intercompany Transactions Template MITT is handled with the utmost care. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust us to keep your documents safe throughout the signing process.

Get more for Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

- Blank bill of sale form

- Pacific fitness home gym manual form

- Formato de proveedores en word

- Interim report snap va form

- The productivity game pdf package form

- Sex offender registration form

- Business 648 communications in a managerial context course bb wlu form

- Application for bonded certificate of title for a form

Find out other Form 14234 B Rev 12 Material Intercompany Transactions Template MITT

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document