M1CWFC, Minnesota Child and Working Family Credits 2023-2026

What is the M1CWFC, Minnesota Child And Working Family Credits

The Minnesota Child and Working Family Credits (M1CWFC) is a tax benefit designed to assist families with children and working individuals in Minnesota. This credit aims to reduce the financial burden on low- to moderate-income families by providing them with a refundable tax credit. The M1CWFC is particularly beneficial for those who may not owe taxes but can still receive a refund, thereby enhancing their financial stability and supporting their overall well-being.

Eligibility Criteria

To qualify for the M1CWFC, applicants must meet specific eligibility requirements. Generally, the following criteria apply:

- Must be a resident of Minnesota for at least half of the tax year.

- Must have earned income from employment or self-employment.

- Must have qualifying children under the age of 19 or students under the age of 24.

- Income must fall within the limits set by the state, which can vary based on family size.

It is essential to review the latest guidelines from the Minnesota Department of Revenue to ensure compliance with all eligibility requirements.

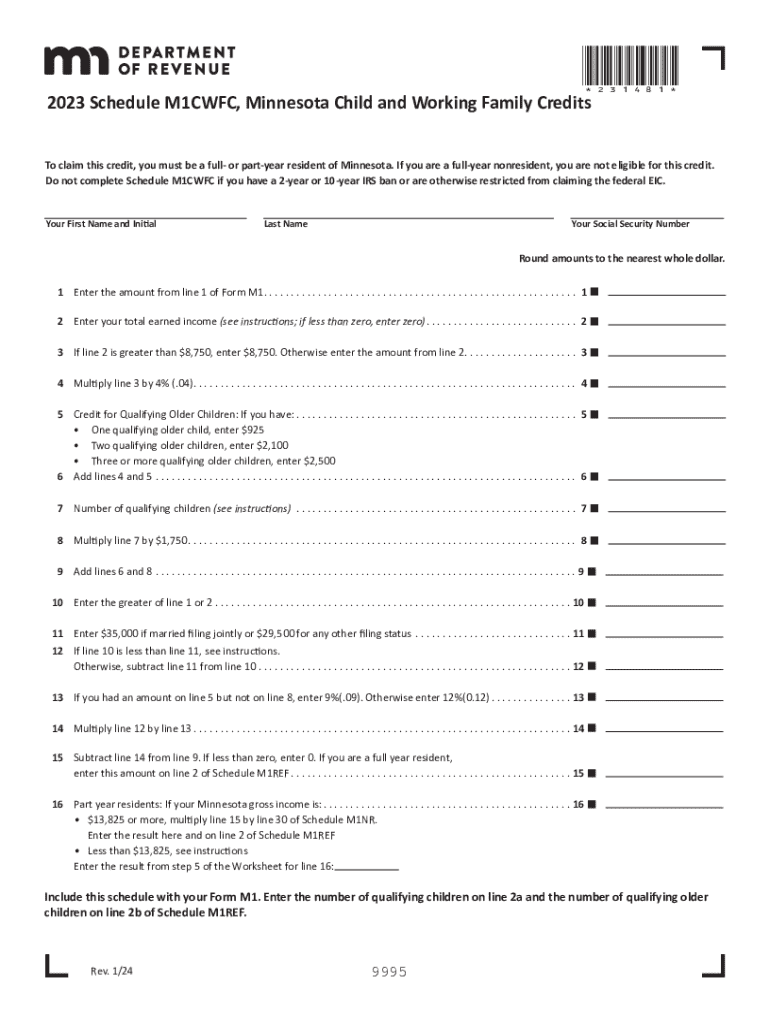

Steps to Complete the M1CWFC

Filing for the M1CWFC involves several straightforward steps. Here’s a guide to help you through the process:

- Gather necessary documents, including proof of income and information about your qualifying children.

- Complete the M1CWFC form, ensuring all sections are filled accurately.

- Calculate your credit amount based on your income and family size using the provided tables.

- Submit your completed form along with your tax return to the Minnesota Department of Revenue.

Ensure that you keep copies of all submitted documents for your records.

How to Use the M1CWFC

The M1CWFC can be utilized to reduce your overall tax liability or increase your refund. When filing your taxes, you will include the M1CWFC on your Minnesota income tax return. If you qualify, the amount of the credit will be deducted from your total tax owed or added to your refund. This process helps to alleviate some of the financial pressures faced by working families in Minnesota.

Required Documents

When applying for the M1CWFC, certain documents are necessary to support your application. These may include:

- W-2 forms or 1099 forms to verify income.

- Social Security numbers for all qualifying children.

- Proof of residency in Minnesota, such as utility bills or lease agreements.

Having these documents ready can streamline the application process and ensure that you meet all requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the M1CWFC to ensure you do not miss out on this valuable credit. Typically, the deadline for submitting your Minnesota income tax return, including the M1CWFC, aligns with the federal tax filing deadline, which is usually April 15th. However, it is advisable to check for any updates or changes to these dates each tax year.

Create this form in 5 minutes or less

Find and fill out the correct m1cwfc minnesota child and working family credits

Create this form in 5 minutes!

How to create an eSignature for the m1cwfc minnesota child and working family credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it support Minnesota working?

airSlate SignNow is a powerful eSignature solution that enables businesses in Minnesota working to send and sign documents electronically. This platform streamlines the document workflow, making it easier for teams to collaborate and finalize agreements quickly. With its user-friendly interface, airSlate SignNow is designed to enhance productivity for Minnesota working professionals.

-

How much does airSlate SignNow cost for Minnesota working businesses?

airSlate SignNow offers flexible pricing plans tailored for Minnesota working businesses of all sizes. The pricing is competitive and designed to provide value, ensuring that companies can access essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your business needs.

-

What features does airSlate SignNow offer for Minnesota working?

airSlate SignNow includes a variety of features that cater to Minnesota working, such as customizable templates, real-time tracking, and secure cloud storage. These features help businesses streamline their document management processes and improve efficiency. Additionally, the platform supports multiple file formats, making it versatile for different industries.

-

How can airSlate SignNow benefit Minnesota working professionals?

For Minnesota working professionals, airSlate SignNow provides a seamless way to manage documents and eSign contracts from anywhere. This flexibility allows for quicker turnaround times and enhances collaboration among team members. By reducing the need for physical paperwork, businesses can also lower their operational costs.

-

Does airSlate SignNow integrate with other tools for Minnesota working?

Yes, airSlate SignNow offers integrations with various tools commonly used by Minnesota working businesses, such as CRM systems, project management software, and cloud storage services. These integrations help streamline workflows and ensure that all your tools work together efficiently. This connectivity enhances productivity and simplifies the document signing process.

-

Is airSlate SignNow secure for Minnesota working businesses?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for Minnesota working businesses. The platform employs advanced encryption and complies with industry standards to protect sensitive information. This commitment to security ensures that your documents remain confidential and secure throughout the signing process.

-

Can airSlate SignNow help with compliance for Minnesota working?

Yes, airSlate SignNow is designed to help Minnesota working businesses maintain compliance with various regulations, including eSignature laws. The platform provides audit trails and secure storage, ensuring that all signed documents are legally binding and easily retrievable. This feature is crucial for businesses that need to adhere to strict compliance standards.

Get more for M1CWFC, Minnesota Child And Working Family Credits

Find out other M1CWFC, Minnesota Child And Working Family Credits

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document