Form 13614rev August

What is the Form 13614rev August

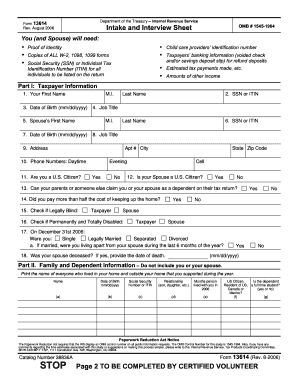

The Form 13614rev August 2006, also known as the Intake/Interview Sheet, is a crucial document used primarily by tax preparers to gather essential information from taxpayers. This form helps ensure that all relevant details are collected to accurately prepare tax returns. It serves as a guide for interviewers during the tax preparation process, facilitating a thorough understanding of the taxpayer's financial situation, including income sources, deductions, and credits.

How to use the Form 13614rev August

Using the Form 13614rev August 2006 involves a systematic approach to gather and organize taxpayer information. Tax preparers should follow these steps:

- Begin by reviewing the form with the taxpayer to explain its purpose.

- Ask the taxpayer to provide accurate information regarding their personal details, income, and expenses.

- Utilize the form to identify potential deductions and credits that the taxpayer may qualify for.

- Ensure all sections of the form are completed to avoid missing critical information.

Steps to complete the Form 13614rev August

Completing the Form 13614rev August 2006 requires attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Document all sources of income, including wages, self-employment earnings, and investment income.

- List all deductions and credits that apply, ensuring to check eligibility for each.

- Review the completed form with the taxpayer for accuracy before submission.

Legal use of the Form 13614rev August

The Form 13614rev August 2006 is legally recognized as part of the tax preparation process in the United States. Its use ensures compliance with IRS guidelines, as it helps tax preparers collect accurate information necessary for filing tax returns. Properly completed forms can support claims made on tax returns and serve as documentation in case of audits.

IRS Guidelines

The IRS provides specific guidelines for using the Form 13614rev August 2006. These guidelines emphasize the importance of accurately collecting taxpayer information to prevent errors in tax filings. Tax preparers should familiarize themselves with the IRS instructions related to this form to ensure compliance and avoid penalties. Following these guidelines also helps in identifying any potential issues that may arise during the tax preparation process.

Required Documents

To accurately complete the Form 13614rev August 2006, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Documentation for any other income sources, such as rental income or dividends

- Receipts for deductible expenses, including medical bills and charitable contributions

Form Submission Methods

The Form 13614rev August 2006 can be submitted electronically or via mail, depending on the preferences of the taxpayer and the capabilities of the tax preparer. Electronic submission is often preferred for its speed and efficiency, while paper submissions may be necessary in certain situations. It is essential to ensure that the form is submitted by the appropriate deadlines to avoid penalties.

Quick guide on how to complete form 13614rev august 2006

Prepare form 13614rev august 2006 effortlessly on any device

Digital document management has become increasingly preferred by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage form 13614rev august 2006 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign form 13614rev august 2006 without hassle

- Locate form 13614rev august 2006 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign form 13614rev august 2006 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 13614rev august 2006

Create this form in 5 minutes!

How to create an eSignature for the form 13614rev august 2006

How to create an electronic signature for the Form 13614 Rev August 2006 Fill In Capable online

How to generate an eSignature for your Form 13614 Rev August 2006 Fill In Capable in Chrome

How to generate an electronic signature for putting it on the Form 13614 Rev August 2006 Fill In Capable in Gmail

How to create an electronic signature for the Form 13614 Rev August 2006 Fill In Capable from your smartphone

How to create an electronic signature for the Form 13614 Rev August 2006 Fill In Capable on iOS

How to make an eSignature for the Form 13614 Rev August 2006 Fill In Capable on Android OS

People also ask form 13614rev august 2006

-

What is the 'form 13614rev august 2006' used for?

The 'form 13614rev august 2006' is utilized primarily for IRS tax return preparation. It helps in collecting taxpayer information to ensure accurate completion of tax returns. Using this form can simplify the tax filing process, making it more efficient for both taxpayers and tax preparers.

-

How can airSlate SignNow streamline the completion of 'form 13614rev august 2006'?

airSlate SignNow enables users to easily send and eSign 'form 13614rev august 2006' online. By utilizing our platform, you can automate the approval process, ensuring that the form is completed faster. Our intuitive interface makes it easy for taxpayers to fill out, review, and sign the necessary documents without any hassle.

-

What are the key features of airSlate SignNow for handling 'form 13614rev august 2006'?

Key features include document templates, secure eSigning, and unlimited document storage. These tools allow users to efficiently manage 'form 13614rev august 2006' and other important documents. Additionally, our platform provides real-time tracking and notifications, ensuring you’re always informed about the status of your forms.

-

Is airSlate SignNow cost-effective for processing 'form 13614rev august 2006'?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage 'form 13614rev august 2006.' With flexible pricing plans, you can choose the package that fits your budget while still getting comprehensive features. The potential for time savings and enhanced efficiency creates signNow value for users.

-

Can airSlate SignNow integrate with other software to enhance 'form 13614rev august 2006' processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for a more streamlined experience when handling 'form 13614rev august 2006.' Whether you use CRM systems, cloud storage, or other business tools, our integrations ensure that your documents are easily accessible and manageable.

-

How secure is the information on 'form 13614rev august 2006' when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure servers to protect all documents, including 'form 13614rev august 2006.' Users can sign with confidence, knowing that their sensitive information is safeguarded through our robust security measures.

-

What benefits do businesses gain from using airSlate SignNow for 'form 13614rev august 2006'?

By using airSlate SignNow for 'form 13614rev august 2006,' businesses experience increased efficiency, reduced turnaround times, and improved document management. Our solution eliminates the need for paper documents, thus saving time and resources. Additionally, businesses can enhance collaboration among teams working on tax-related documents.

Get more for form 13614rev august 2006

- Form 1120 reit internal revenue service

- Chapter vii practice relative to recommendations to the form

- Community board 7manhattan nyc gov nyc form

- April minutes full board april 7 st lukes nyc gov nyc form

- Oracle quoting forms oracle documentation

- Technical support request form

- Multiple forms ofplant phosphoenolpyruvate carboxylase

- Form dtf 664 tax shelter disclosure for material advisors tax year 772083208

Find out other form 13614rev august 2006

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT