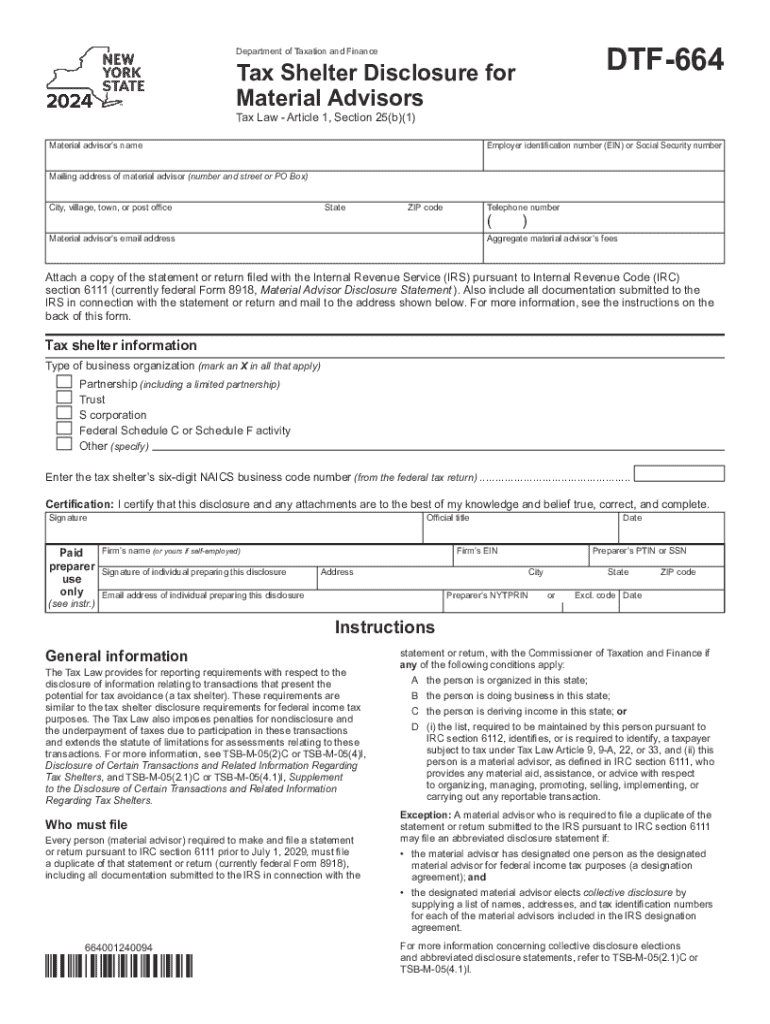

Form DTF 664 Tax Shelter Disclosure for Material Advisors Tax Year 2024-2026

What is the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

The Form DTF 664 is a crucial document required by the New York State Department of Taxation and Finance. It serves as a Tax Shelter Disclosure for Material Advisors for a specific tax year. This form is designed to ensure that material advisors disclose their involvement in tax shelters, which are strategies used to reduce taxable income. By completing this form, advisors provide transparency regarding their roles and the potential tax implications for their clients.

Steps to complete the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

Completing the Form DTF 664 involves several key steps:

- Gather necessary information about the tax shelter and the clients involved.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form as per the guidelines provided by the New York State Department of Taxation and Finance.

How to obtain the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

The Form DTF 664 can be obtained directly from the New York State Department of Taxation and Finance website. Users can download the form in PDF format for easy access and printing. It is important to ensure that you are using the correct version for the applicable tax year to avoid any compliance issues.

Legal use of the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

The legal use of Form DTF 664 is essential for compliance with New York tax laws. Material advisors must file this form to avoid potential penalties associated with non-disclosure of tax shelters. The form provides a legal framework for advisors to report their involvement and ensures that all parties are aware of the tax implications involved in the shelters being utilized.

Filing Deadlines / Important Dates

Filing deadlines for the Form DTF 664 are typically aligned with the tax filing deadlines for the relevant tax year. It is crucial for material advisors to be aware of these dates to ensure timely submission. Missing the deadline may result in penalties or additional scrutiny from tax authorities.

Disclosure Requirements

Disclosure requirements for the Form DTF 664 include providing comprehensive information about the tax shelter, the material advisor's role, and any relevant financial data. Advisors must ensure that all disclosures are accurate and complete to meet the legal standards set by the New York State Department of Taxation and Finance.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 664 tax shelter disclosure for material advisors tax year 772083208

Create this form in 5 minutes!

How to create an eSignature for the form dtf 664 tax shelter disclosure for material advisors tax year 772083208

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

The Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year is a tax form required by the New York State Department of Taxation and Finance. It is used by material advisors to disclose information about tax shelters to the state. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

airSlate SignNow provides an efficient platform for preparing, sending, and eSigning the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year. Our user-friendly interface simplifies the process, ensuring that you can complete and submit your forms accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that streamline the completion of forms like the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year. Check our website for the latest pricing details.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow. This allows you to easily manage the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year alongside your other tax documents, ensuring a smooth and efficient process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including document templates, eSignature capabilities, and secure cloud storage. These features are particularly beneficial for managing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year, allowing you to keep all your tax documents organized and accessible.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication measures. This ensures that your Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year and other sensitive documents are protected throughout the signing process.

-

Can I track the status of my Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year submissions?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your submissions. You can easily see when your Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year has been viewed and signed, giving you peace of mind and ensuring timely compliance.

Get more for Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

- 01fast final interventioncentralmysdhcorg form

- Monthly report ministry of social development form

- Naugatuck dog license form

- This agreement is entered into between tenant and form

- Formstequesta fl official website

- Charlotte sun herald all collection groups form

- Athletic information sheet miramar high school

- Sawgrass springs middle school form

Find out other Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself