Form 14950 Rev 6 2024-2026

What is the Form 14950 Rev 6

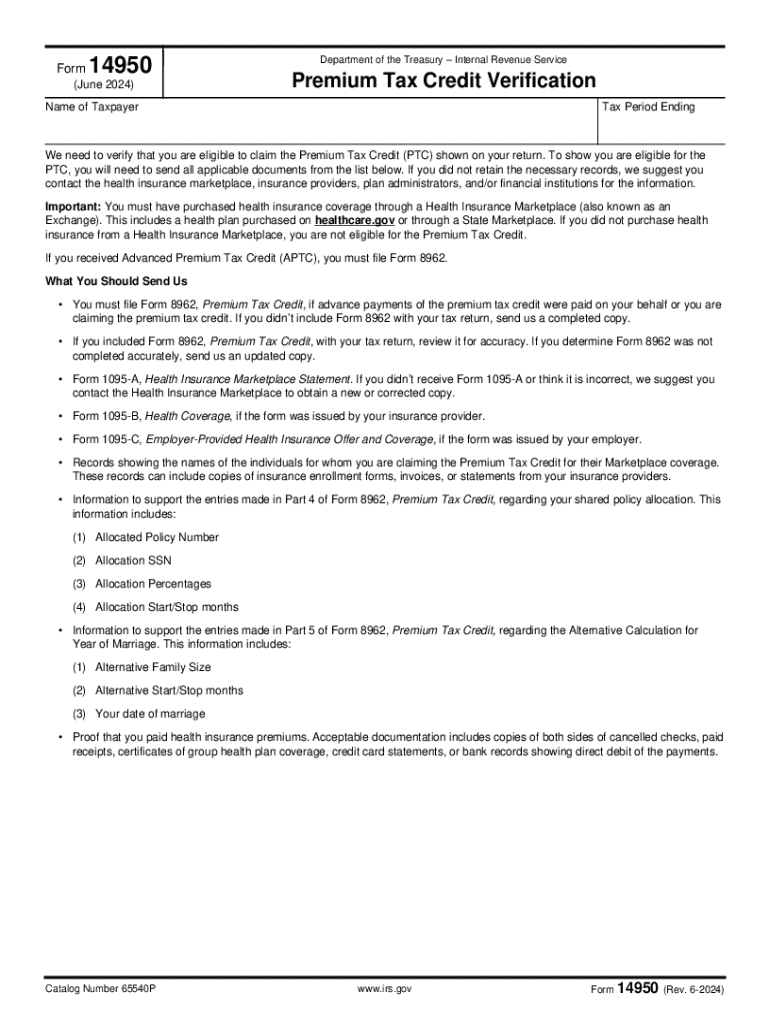

The Form 14950 Rev 6, also known as the Premium Tax Credit Verification Form, is a crucial document used to verify eligibility for premium tax credits under the Affordable Care Act. This form is specifically designed for individuals and families who have received premium tax credits to help lower their health insurance costs. It collects essential information regarding the taxpayer’s income, household size, and the health coverage they have obtained through the Health Insurance Marketplace.

How to use the Form 14950 Rev 6

To effectively utilize the Form 14950 Rev 6, taxpayers must complete it accurately and submit it to the appropriate tax authority. The form requires detailed information about the taxpayer’s income and household composition to determine eligibility for tax credits. It is essential to follow the instructions provided with the form carefully, ensuring that all required sections are filled out completely to avoid delays in processing.

Steps to complete the Form 14950 Rev 6

Completing the Form 14950 Rev 6 involves several steps:

- Gather necessary documentation, including proof of income and household size.

- Fill out personal information, including names, Social Security numbers, and addresses.

- Provide details about the health coverage obtained, including policy numbers and coverage dates.

- Review the completed form for accuracy and completeness.

- Submit the form according to the provided instructions, either online or via mail.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 14950 Rev 6. Typically, the form must be submitted along with your tax return by the annual tax filing deadline, which is usually April 15th. However, if you are applying for an extension, ensure that the form is submitted by the extended deadline. Staying informed about these dates helps avoid penalties and ensures timely processing of your premium tax credits.

Eligibility Criteria

Eligibility for the premium tax credits verified by the Form 14950 Rev 6 is based on several factors:

- Income level, which must fall within the specified range set by the IRS.

- Household size, as this affects the amount of credit for which you qualify.

- Enrollment in a qualified health plan through the Health Insurance Marketplace.

Meeting these criteria is essential for successfully claiming the premium tax credit, making the accurate completion of this form vital for eligible taxpayers.

Required Documents

When completing the Form 14950 Rev 6, certain documents are required to substantiate your claims:

- Proof of income, such as W-2 forms, pay stubs, or tax returns.

- Documentation of health coverage, including insurance cards or policy statements.

- Any relevant tax documents that may support your eligibility for the premium tax credit.

Having these documents ready can streamline the completion process and ensure that your submission is accurate and complete.

Create this form in 5 minutes or less

Find and fill out the correct form 14950 rev 6

Create this form in 5 minutes!

How to create an eSignature for the form 14950 rev 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax credit verify and how does it work with airSlate SignNow?

Tax credit verify is a process that helps businesses confirm their eligibility for various tax credits. With airSlate SignNow, you can easily manage and eSign documents related to tax credit verification, streamlining the process and ensuring compliance.

-

How can airSlate SignNow help me save money on tax credits?

By using airSlate SignNow to tax credit verify your documents, you can reduce the time and resources spent on manual processes. This efficiency can lead to cost savings, allowing you to focus on maximizing your tax credits.

-

What features does airSlate SignNow offer for tax credit verification?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which enhance the tax credit verify process. These tools ensure that your documents are completed accurately and efficiently.

-

Is airSlate SignNow affordable for small businesses looking to tax credit verify?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. This cost-effective solution allows you to tax credit verify without breaking the bank, making it accessible for companies of all sizes.

-

Can I integrate airSlate SignNow with other software for tax credit verification?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to tax credit verify. This integration allows for a more streamlined workflow, connecting your eSigning process with your existing systems.

-

What are the benefits of using airSlate SignNow for tax credit verification?

Using airSlate SignNow for tax credit verify offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages help ensure that your tax credit processes are smooth and compliant.

-

How secure is the tax credit verification process with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and authentication measures to ensure that your tax credit verify documents are protected from unauthorized access.

Get more for Form 14950 Rev 6

Find out other Form 14950 Rev 6

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself