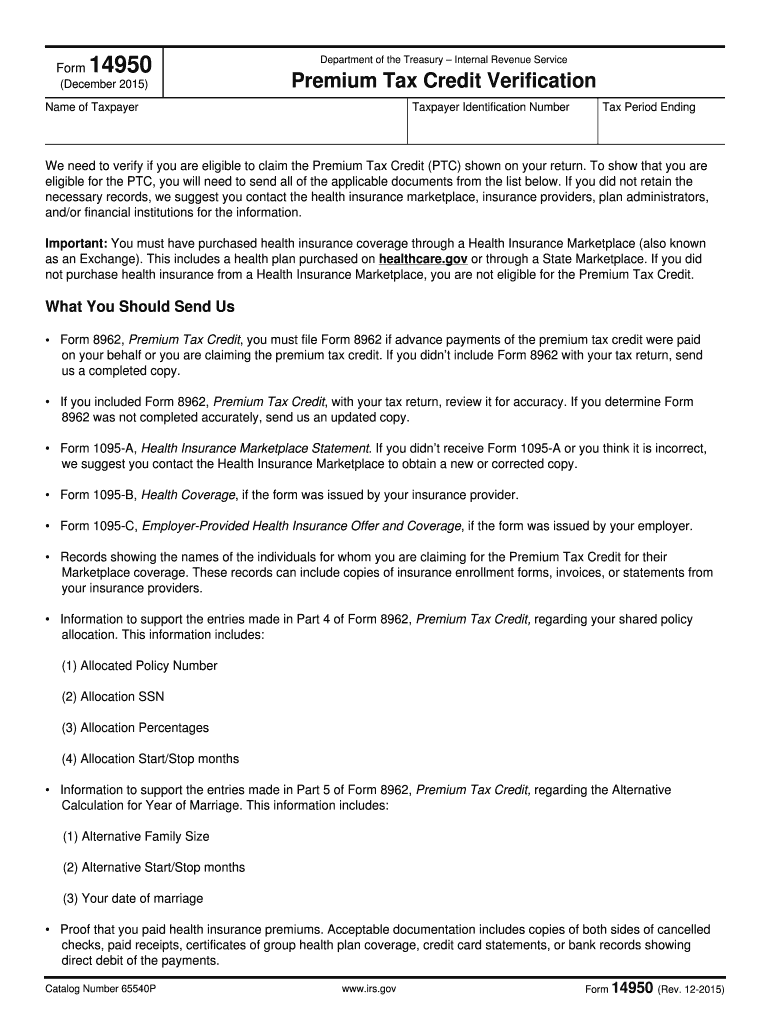

Form 14950 2015

What is the IRS Letter 2645C?

The IRS Letter 2645C is a correspondence sent by the Internal Revenue Service to taxpayers. It typically addresses specific inquiries or issues related to a taxpayer's account. This letter may provide information about adjustments, audits, or other important tax matters. Understanding the content and purpose of the 2645C letter is crucial for taxpayers to ensure compliance and address any concerns raised by the IRS.

Key Elements of the IRS Letter 2645C

The IRS Letter 2645C contains several important components that taxpayers should review carefully:

- Taxpayer Information: This section includes the taxpayer's name, address, and identification number.

- Issue Description: The letter outlines the specific issue or inquiry related to the taxpayer's account.

- Response Instructions: It provides guidance on how to respond to the IRS, including deadlines and required documentation.

- Contact Information: The letter includes contact details for the IRS, allowing taxpayers to seek clarification or assistance.

Steps to Complete the IRS Letter 2645C

Completing the IRS Letter 2645C requires careful attention to detail. Here are the steps to follow:

- Read the Letter Thoroughly: Understand the issue being addressed and the IRS's requests.

- Gather Required Documentation: Collect any necessary documents that support your response or clarify the issue.

- Prepare Your Response: Draft a clear and concise response, addressing each point raised in the letter.

- Submit Your Response: Follow the instructions provided in the letter for submitting your response, whether online or by mail.

- Keep Copies: Retain copies of all correspondence and documentation for your records.

IRS Guidelines for Responding to Letter 2645C

The IRS provides specific guidelines for responding to the Letter 2645C. Taxpayers should ensure that their responses are timely and complete. Here are some key guidelines:

- Respond within the timeframe specified in the letter to avoid penalties.

- Include all requested documentation to support your case.

- Use clear and professional language in your correspondence.

- Contact the IRS if you have questions or need further clarification on the issues raised.

Legal Use of the IRS Letter 2645C

The IRS Letter 2645C serves as an official communication from the IRS, making it a legally binding document. Taxpayers must treat it with the seriousness it deserves. Ignoring or improperly responding to this letter can lead to further complications, including penalties or additional audits. It is advisable to consult a tax professional if you are uncertain about how to proceed.

Filing Deadlines for IRS Letter 2645C

Timeliness is crucial when responding to the IRS Letter 2645C. The letter will specify a deadline by which the taxpayer must respond. Failing to meet this deadline could result in additional penalties or complications with your tax account. It is important to mark this date on your calendar and ensure that all necessary actions are completed well in advance.

Quick guide on how to complete form 14950

Effortlessly Prepare Form 14950 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Form 14950 on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and electronically sign Form 14950 with ease

- Find Form 14950 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow uniquely provides for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 14950 and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14950

Create this form in 5 minutes!

How to create an eSignature for the form 14950

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is an IRS letter 2645C?

The IRS letter 2645C is a communication from the Internal Revenue Service confirming the acceptance of an offer in compromise. This letter serves as an important document for taxpayers dealing with unresolved tax debts. It provides clarity on the tax situation and helps individuals understand their options moving forward.

-

How can airSlate SignNow help with IRS letter 2645C documentation?

airSlate SignNow allows you to securely send and electronically sign documents related to your IRS letter 2645C. With its user-friendly interface, you can streamline the process of gathering necessary signatures. This feature is essential for ensuring that all parties involved can easily manage documentation related to tax negotiations.

-

Is there a cost associated with using airSlate SignNow for IRS letter 2645C?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including the management of IRS letter 2645C. The plans are cost-effective and designed to provide value for businesses looking to simplify document transactions. You can choose a plan based on your specific requirements and frequency of use.

-

What features does airSlate SignNow offer for managing IRS letter 2645C?

airSlate SignNow provides features such as document templates, real-time tracking, and secure cloud storage, all of which are beneficial for managing IRS letter 2645C. With eSignature capabilities, you can ensure that your documents are signed and returned promptly. These features streamline the entire process, making it easier to deal with tax matters.

-

Are there integrations available with airSlate SignNow for handling IRS letter 2645C?

Yes, airSlate SignNow offers integrations with various popular applications, which can enhance the management of IRS letter 2645C. Whether you use CRM systems, document storage solutions, or email platforms, these integrations facilitate seamless workflows. This connectivity allows you to handle all related tasks efficiently.

-

Can I track the status of my IRS letter 2645C documents using airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their IRS letter 2645C documents in real-time. This feature provides peace of mind as you can see when the document is sent, viewed, and signed. Being able to monitor the entire process eliminates uncertainties and helps you stay organized.

-

What are the benefits of using airSlate SignNow for IRS letter 2645C?

Using airSlate SignNow for IRS letter 2645C offers numerous benefits, such as improved efficiency and reduced paperwork. The electronic signing feature saves time and minimizes the risk of errors compared to traditional methods. Additionally, it enhances security through encrypted document handling.

Get more for Form 14950

- Homelessness verification form

- Commercial animal facility permit application form

- In the matter of application 24729 of northern california form

- Use agreement application for churches and schoolspdf form

- Connected thermostat verification elmhurst mutual power form

- Oklahoma form c

- Neuter contract form

- Trials of life living together worksheet answers form

Find out other Form 14950

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter