Ct600 Form Writable Version 2008

What is the Ct600 Form Writable Version

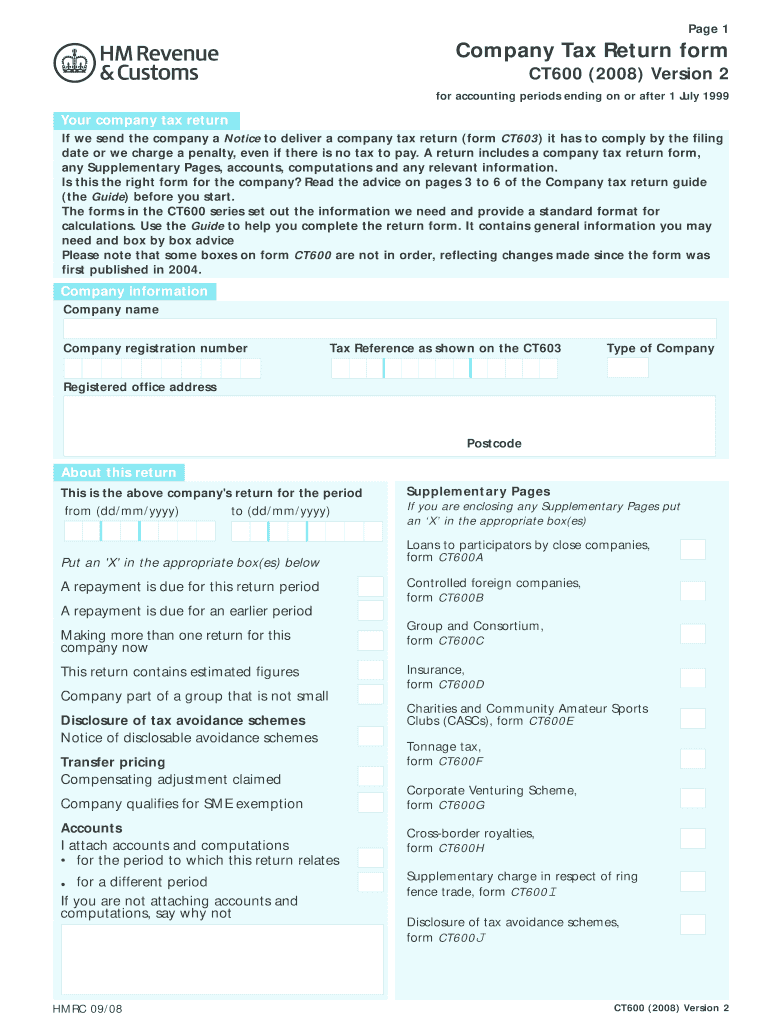

The Ct600 Form Writable Version is a digital version of the corporation tax return form used by companies in the United Kingdom. This form is essential for reporting a company's income, gains, and losses to HM Revenue and Customs (HMRC). The writable version allows users to fill out the form electronically, making it easier to complete and submit. It is designed to streamline the filing process, ensuring that all necessary information is accurately captured and easily accessible.

How to use the Ct600 Form Writable Version

Using the Ct600 Form Writable Version involves several straightforward steps. First, download the form from a reliable source. Once downloaded, open the form using a compatible PDF reader that supports writable fields. Begin by entering your company details, including name, registration number, and accounting period. Proceed to fill in the financial information, such as income, expenses, and tax calculations. After completing the form, review all entries for accuracy before saving the document. Finally, the form can be submitted electronically or printed for mailing, depending on your preference.

Steps to complete the Ct600 Form Writable Version

Completing the Ct600 Form Writable Version requires careful attention to detail. Follow these steps to ensure proper completion:

- Download the writable version of the Ct600 Form.

- Open the form in a PDF reader that supports editing.

- Fill in your company’s name and registration number at the top of the form.

- Enter the accounting period for which you are filing.

- Provide financial details, including total income, allowable expenses, and taxable profits.

- Calculate the corporation tax due based on the profits reported.

- Review the form for any errors or omissions.

- Save your completed form and prepare for submission.

Legal use of the Ct600 Form Writable Version

The legal use of the Ct600 Form Writable Version is governed by UK tax laws. It is crucial for businesses to ensure that the information provided is accurate and complete, as any discrepancies could lead to penalties or audits by HMRC. The writable version is legally recognized as long as it is filled out correctly and submitted within the designated deadlines. Companies must retain a copy of the submitted form for their records, as it may be required for future reference or in the event of an inquiry.

Form Submission Methods

The Ct600 Form Writable Version can be submitted through various methods. Companies have the option to file the form electronically via HMRC's online services, which is the preferred method for many businesses due to its efficiency and speed. Alternatively, the completed form can be printed and mailed to HMRC. If mailing, ensure that it is sent to the correct address and allow sufficient time for delivery to meet filing deadlines. In-person submissions are generally not common for this form, as electronic filing is encouraged.

Filing Deadlines / Important Dates

Filing deadlines for the Ct600 Form Writable Version are critical for compliance. Generally, companies must submit their corporation tax return within twelve months of the end of their accounting period. For example, if a company's accounting period ends on December 31, the form must be filed by December 31 of the following year. It is essential to stay informed about any changes in deadlines or requirements, as failing to meet these deadlines can result in penalties and interest on unpaid taxes.

Quick guide on how to complete ct600 form writable version 2008

Complete Ct600 Form Writable Version effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage Ct600 Form Writable Version on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

The easiest way to modify and eSign Ct600 Form Writable Version seamlessly

- Find Ct600 Form Writable Version and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Modify and eSign Ct600 Form Writable Version and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct600 form writable version 2008

Create this form in 5 minutes!

How to create an eSignature for the ct600 form writable version 2008

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Ct600 Form Writable Version?

The Ct600 Form Writable Version is a digital version of the Corporation Tax return that allows businesses to fill out and submit their tax information electronically. This writable format simplifies the tax filing process, ensuring that you can complete and sign the form conveniently without the need for printouts.

-

How can I use the Ct600 Form Writable Version with airSlate SignNow?

With airSlate SignNow, you can easily upload the Ct600 Form Writable Version and send it for electronic signature. Our platform allows for seamless integrations, enabling you to manage your documents efficiently, saving time and ensuring compliance throughout the process.

-

Is there a cost associated with accessing the Ct600 Form Writable Version?

Yes, while airSlate SignNow offers a variety of plans tailored to different business sizes, accessing the Ct600 Form Writable Version as part of our service typically requires a subscription. Our pricing is competitive, ensuring you receive great value for your document management needs.

-

What are the key features of the Ct600 Form Writable Version?

The Ct600 Form Writable Version includes features such as customizable fields, electronic signature capability, and secure cloud storage. These functionalities not only enhance the user experience but also ensure that all submissions are accurate and compliant with HMRC requirements.

-

Can I save my progress while filling out the Ct600 Form Writable Version?

Absolutely! The airSlate SignNow platform allows you to save your progress when working on the Ct600 Form Writable Version. This means you can return to the document at your convenience, making it easier to complete and submit without feeling rushed.

-

What benefits does the Ct600 Form Writable Version offer for businesses?

The Ct600 Form Writable Version streamlines the tax submission process, reduces paperwork, and minimizes errors, all of which save time and reduce frustration. Additionally, electronic signatures provide added security, ensuring that your documents are handled professionally and legibly.

-

Which integrations are available for the Ct600 Form Writable Version?

airSlate SignNow seamlessly integrates with various business tools, including accounting software and CRM systems, to enhance your workflow with the Ct600 Form Writable Version. These integrations facilitate automatic data population, further optimizing your document management process.

Get more for Ct600 Form Writable Version

- Apple health medicaid form

- Gsa form 3690 ampquotemployees service agreement for receipt of

- Application for universal disability pass application for universal disability pass form

- Fillable online application to correct or change a michigan form

- Request for a state fair hearing to appeal a fill and sign form

- Fin519 form fill out and sign printable pdf templatesignnow

- Attention applicants all fields with an asterisk next to the field header are required fields that must be completed form

- Phone 888 634 5227 form

Find out other Ct600 Form Writable Version

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple