Wisconsin Income Tax Form 1 Instructions 2024-2026

What is the Wisconsin Income Tax Form 1 Instructions

The Wisconsin Income Tax Form 1 Instructions provide essential guidance for residents and part-year residents filing their state income tax returns. This form is designed for individuals who need to report their income, calculate their tax liability, and claim any applicable credits and deductions. Understanding these instructions is crucial for ensuring compliance with state tax laws and for accurately completing the form.

Steps to Complete the Wisconsin Income Tax Form 1 Instructions

Completing the Wisconsin Income Tax Form 1 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions carefully to understand the sections of the form and what information is required.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income, including wages, interest, dividends, and any other sources of income.

- Calculate your deductions and credits, which can reduce your taxable income.

- Determine your tax liability based on the tax tables provided in the instructions.

- Review your completed form for accuracy before submission.

Key Elements of the Wisconsin Income Tax Form 1 Instructions

Several key elements are critical to successfully completing the Wisconsin Income Tax Form 1:

- Filing Status: Determine whether you are filing as single, married filing jointly, married filing separately, or head of household.

- Income Reporting: Accurately report all sources of income, including wages, self-employment income, and investment earnings.

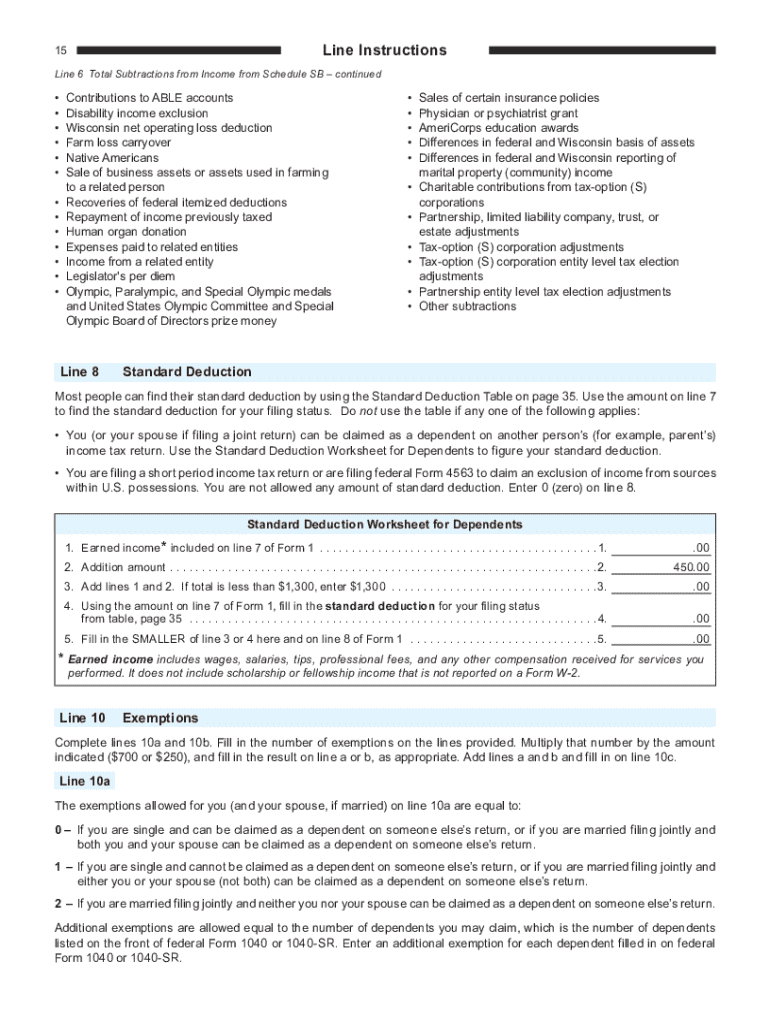

- Deductions and Credits: Familiarize yourself with available deductions and credits that can lower your tax bill, such as the standard deduction or itemized deductions.

- Tax Calculation: Use the tax tables provided to calculate your tax liability based on your taxable income.

How to Obtain the Wisconsin Income Tax Form 1 Instructions

The Wisconsin Income Tax Form 1 Instructions can be obtained through several means:

- Visit the Wisconsin Department of Revenue website to download the instructions directly in PDF format.

- Request a physical copy by contacting the Wisconsin Department of Revenue via phone or mail.

- Check local libraries or community centers, as they may have printed copies available for public use.

Filing Deadlines / Important Dates

Awareness of filing deadlines is essential for compliance. For the Wisconsin Income Tax Form 1, the typical deadline for submission is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to these deadlines annually.

Form Submission Methods

There are several methods available for submitting the Wisconsin Income Tax Form 1:

- Online Filing: Many taxpayers choose to file electronically through approved e-filing software, which can simplify the process and reduce errors.

- Mail: If filing by paper, ensure that you send your completed form to the correct address provided in the instructions, based on your location.

- In-Person: Some taxpayers may opt to file in person at designated state tax offices, where assistance may be available.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin income tax form 1 instructions

Create this form in 5 minutes!

How to create an eSignature for the wisconsin income tax form 1 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the wi instructions for setting up airSlate SignNow?

To set up airSlate SignNow, follow the wi instructions provided in our user guide. Start by creating an account, then navigate to the dashboard to upload your documents. The intuitive interface will guide you through the eSigning process, ensuring you can send and sign documents effortlessly.

-

How much does airSlate SignNow cost according to the wi instructions?

The pricing for airSlate SignNow is outlined in the wi instructions available on our website. We offer various plans to suit different business needs, including monthly and annual subscriptions. Each plan provides access to essential features, ensuring you get the best value for your investment.

-

What features are highlighted in the wi instructions for airSlate SignNow?

The wi instructions detail several key features of airSlate SignNow, including document templates, real-time tracking, and secure cloud storage. These features are designed to streamline your document management process and enhance collaboration within your team. Explore the full range of functionalities to maximize your efficiency.

-

How can I benefit from using airSlate SignNow as per the wi instructions?

Using airSlate SignNow, as outlined in the wi instructions, can signNowly improve your workflow by reducing the time spent on document signing. The platform allows for quick eSigning and document sharing, which can enhance productivity. Additionally, it ensures compliance and security, giving you peace of mind.

-

Are there any integrations available with airSlate SignNow according to the wi instructions?

Yes, the wi instructions specify that airSlate SignNow integrates seamlessly with various applications, including Google Drive, Salesforce, and Microsoft Office. These integrations allow you to streamline your processes and enhance your existing workflows. Check the integrations section in the instructions for a complete list.

-

What support options are available as mentioned in the wi instructions?

The wi instructions provide information on the support options available for airSlate SignNow users. You can access a comprehensive knowledge base, submit support tickets, or signNow out to our customer service team via chat or email. We are committed to ensuring you have the assistance you need.

-

Can I customize my documents using airSlate SignNow as per the wi instructions?

Absolutely! The wi instructions explain how you can customize your documents using airSlate SignNow. You can add fields for signatures, dates, and other necessary information, making it easy to tailor documents to your specific needs. This feature enhances the user experience and ensures accuracy.

Get more for Wisconsin Income Tax Form 1 Instructions

- 13 printable preschool newsletter templates word pdf form

- Credit card authorization form sr lv 034

- Michiganorgrenewalsolicitationregistrationform

- Lic jeevan tarun proposal form no

- Borrowers form

- Auditory verbal ongoing assessment form

- Village of la grange request for waiver of building form

- Renewable energy guidance ampamp application form pdf

Find out other Wisconsin Income Tax Form 1 Instructions

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe