5076 Form 2024-2026

What is the 5076 Form?

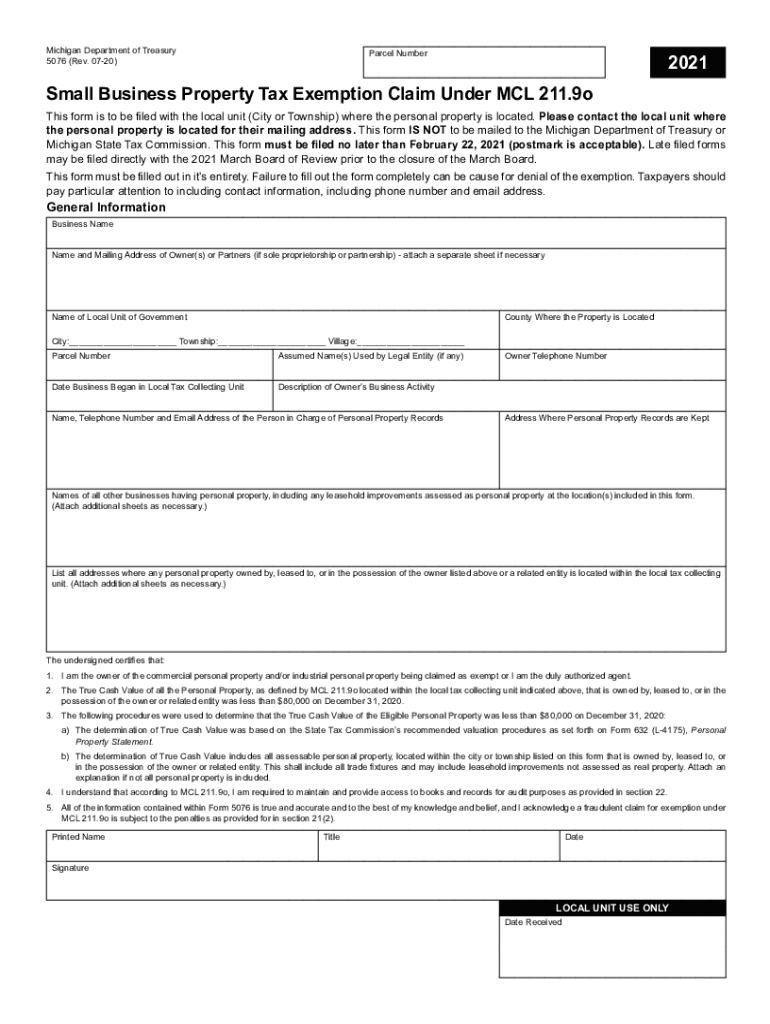

The 5076 form, also referred to as the form 5076 for 2021, is a document used primarily for tax purposes in the United States. It serves as a means for taxpayers to report specific financial information to the Internal Revenue Service (IRS). This form is crucial for ensuring compliance with federal tax regulations and is often used by individuals and businesses alike to document income, deductions, and other relevant financial data.

How to Use the 5076 Form

Using the 5076 form involves several steps that ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer's preference and the specific requirements set forth by the IRS.

Steps to Complete the 5076 Form

Completing the 5076 form requires careful attention to detail. Begin by entering your personal information at the top of the form, including your name, address, and Social Security number. Follow this by filling in the income sections, where you will report all sources of income. Next, provide information about any deductions you wish to claim. After reviewing the form for accuracy, sign and date it before submission. It is advisable to keep a copy of the completed form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the 5076 form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. For the 2021 tax year, this means the form is due on April 15, 2022. Taxpayers should be aware of any extensions that may apply and ensure that they file on time to avoid interest and penalties.

Legal Use of the 5076 Form

The legal use of the 5076 form is governed by IRS regulations. It is essential to use this form to report accurate financial information, as failure to do so can lead to legal repercussions, including audits and penalties. The form is designed to facilitate transparency in financial reporting, which is a fundamental aspect of tax compliance in the United States.

Who Issues the Form

The 5076 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain and fill out the form, ensuring that taxpayers have access to the necessary resources for compliance. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to filing requirements.

Quick guide on how to complete 5076 form

Complete 5076 Form easily on any device

Online document handling has gained traction with businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 5076 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign 5076 Form effortlessly

- Locate 5076 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the exact same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign 5076 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5076 form

Create this form in 5 minutes!

How to create an eSignature for the 5076 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5076 form 2021 and why is it important?

The 5076 form 2021 is a crucial document used for various administrative purposes. It helps streamline processes by ensuring that all necessary information is collected efficiently. Understanding its significance can help businesses maintain compliance and improve operational efficiency.

-

How can airSlate SignNow assist with the 5076 form 2021?

airSlate SignNow provides a user-friendly platform to easily send and eSign the 5076 form 2021. Our solution simplifies the document management process, allowing users to complete and store forms securely. This ensures that your business can handle important paperwork without hassle.

-

What are the pricing options for using airSlate SignNow for the 5076 form 2021?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small startup or a large enterprise, you can find a plan that fits your budget while efficiently managing the 5076 form 2021. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the 5076 form 2021?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage, specifically designed to enhance the management of the 5076 form 2021. These tools help ensure that your documents are processed quickly and securely, improving overall productivity.

-

Can I integrate airSlate SignNow with other software for the 5076 form 2021?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the 5076 form 2021 alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the 5076 form 2021?

Using airSlate SignNow for the 5076 form 2021 provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform allows for quick eSigning and document sharing, which can signNowly improve your business operations.

-

Is airSlate SignNow secure for handling the 5076 form 2021?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your 5076 form 2021 and other documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your sensitive information.

Get more for 5076 Form

- Pd verificationreflection form f 6 eschoolview

- Huntsville police department form

- Box talk form

- Unsafe acts warning form download

- Laurel county kentucky net profits license fee return form

- Duct leakage test report tra green form

- Parent permission form sheldon isd

- Form ssa 4 bk social security socialsecurity

Find out other 5076 Form

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free