Form 945 a Rev December 2024-2026

What is the Form 945 A Rev December

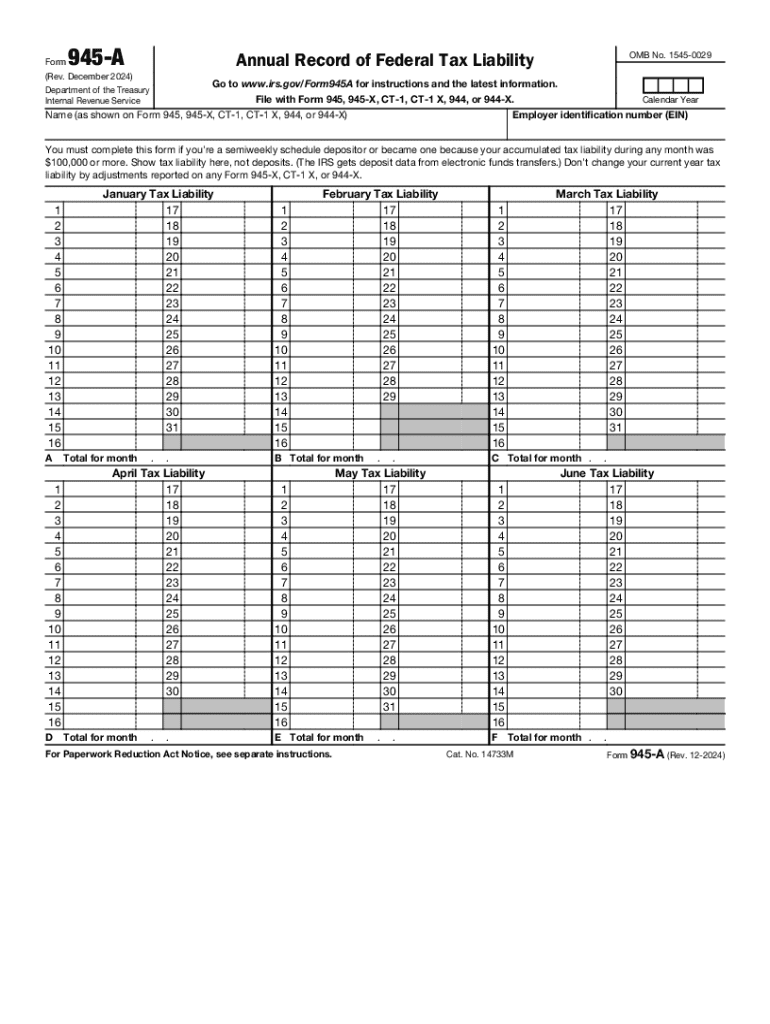

The Form 945 A Rev December is a tax form used by employers to report annual federal tax withheld from nonpayroll payments. This form is specifically designed for reporting backup withholding, which is applicable in various situations, including payments made to independent contractors and certain other non-employees. Understanding this form is crucial for businesses that need to comply with IRS regulations regarding tax withholding.

How to use the Form 945 A Rev December

To effectively use the Form 945 A Rev December, businesses must gather all necessary information related to nonpayroll payments made throughout the year. This includes details about the recipients of these payments and the total amount withheld for federal taxes. The form is typically filed annually, and it is essential to ensure that all figures are accurate to avoid penalties. The completed form can be submitted electronically or via mail, depending on the preferences and capabilities of the business.

Steps to complete the Form 945 A Rev December

Completing the Form 945 A Rev December involves several key steps:

- Gather all relevant financial records, including payment amounts and withholding information.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check the calculations for the total amount withheld.

- Submit the form by the designated deadline, either electronically or by mail.

Following these steps helps ensure compliance with IRS requirements and minimizes the risk of errors.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 945 A Rev December. These guidelines include instructions on the types of payments that require reporting, the method of submission, and deadlines for filing. It is important for businesses to regularly consult the IRS website or official publications for any updates or changes to the filing process or requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 945 A Rev December are crucial for compliance. Typically, the form must be submitted by January 31 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses should mark their calendars to ensure timely submission and avoid potential penalties.

Penalties for Non-Compliance

Failure to file the Form 945 A Rev December on time or inaccuracies in the reported information can result in penalties imposed by the IRS. These penalties may include fines based on the amount of tax owed or the length of time the form is overdue. It is essential for businesses to understand these potential repercussions and take the necessary steps to ensure compliance.

Create this form in 5 minutes or less

Find and fill out the correct form 945 a rev december

Create this form in 5 minutes!

How to create an eSignature for the form 945 a rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 945 a and how can airSlate SignNow help?

Form 945 a is a tax form used for reporting withheld federal income tax. airSlate SignNow simplifies the process of completing and submitting form 945 a by providing an intuitive platform for eSigning and managing documents securely.

-

What features does airSlate SignNow offer for managing form 945 a?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, making it easy to manage form 945 a efficiently. These tools help streamline the process, ensuring compliance and reducing errors.

-

Is there a cost associated with using airSlate SignNow for form 945 a?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing form 945 a, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for form 945 a?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your existing tools for managing form 945 a. This integration enhances productivity and ensures a smooth workflow.

-

How does airSlate SignNow ensure the security of my form 945 a?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. This ensures that your form 945 a and other sensitive documents are protected at all times.

-

Can I track the status of my form 945 a with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your form 945 a in real-time. You will receive notifications when the document is viewed, signed, or completed, keeping you informed throughout the process.

-

What benefits does airSlate SignNow provide for businesses handling form 945 a?

Using airSlate SignNow for form 945 a offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface makes it easy for teams to collaborate and manage documents effectively.

Get more for Form 945 A Rev December

Find out other Form 945 A Rev December

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form