Form 945a 2014

What is the Form 945a

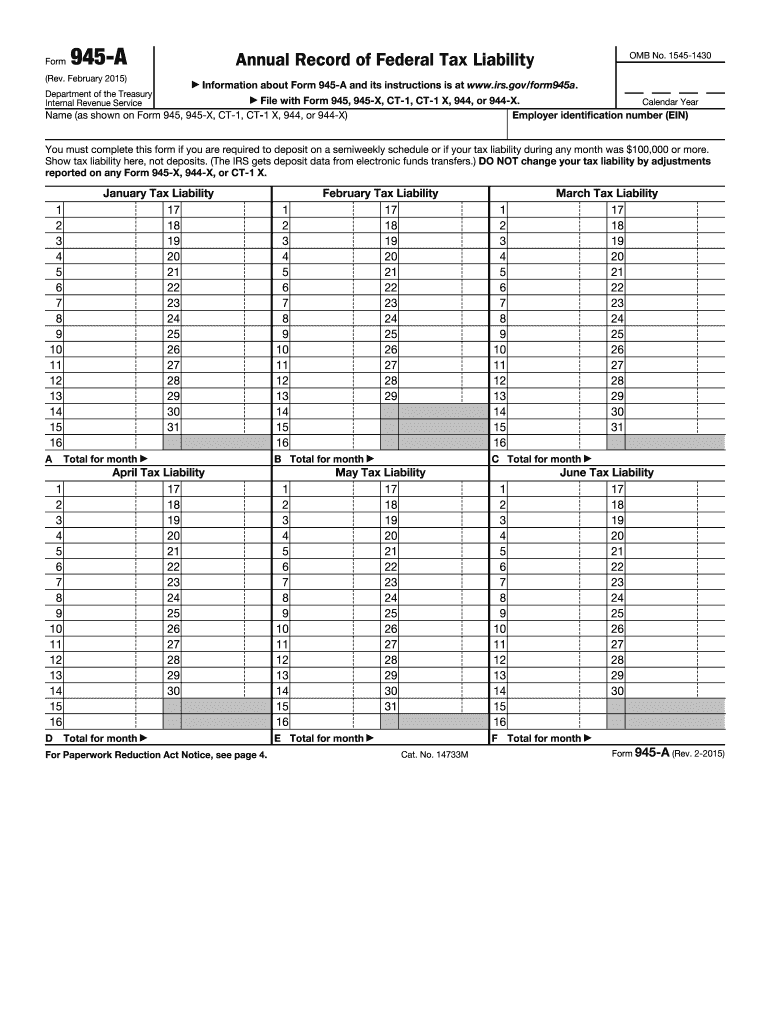

The Form 945a is a tax form used by employers to report nonpayroll withholding. This includes amounts withheld from payments such as pensions, annuities, and certain gambling winnings. The form is essential for ensuring compliance with federal tax regulations and helps the Internal Revenue Service (IRS) track withheld taxes accurately. Understanding its purpose is crucial for businesses and individuals involved in nonpayroll transactions.

How to use the Form 945a

Using the Form 945a involves accurately reporting the total amount withheld from nonpayroll payments throughout the year. Employers must complete the form by entering their identification information, the total amount withheld, and any adjustments needed. It is important to ensure that all figures are accurate to avoid penalties. Once completed, the form must be submitted to the IRS along with any required payments.

Steps to complete the Form 945a

Completing the Form 945a requires several steps:

- Gather necessary information, including your employer identification number (EIN) and details of the payments made.

- Fill in your identifying information at the top of the form.

- Report the total amount of nonpayroll withholding for the year in the appropriate section.

- Make any necessary adjustments for prior periods if applicable.

- Review the form for accuracy before submission.

Legal use of the Form 945a

The legal use of the Form 945a is governed by IRS regulations. Employers must file this form to report withheld taxes accurately. Failure to file or inaccuracies can lead to penalties and interest on unpaid taxes. It is crucial for businesses to understand their obligations regarding this form to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

The filing deadline for the Form 945a is generally January 31 of the year following the reporting year. Employers must ensure that the form is submitted by this date to avoid late penalties. Additionally, if you are making payments, it is essential to adhere to the IRS payment schedule to remain compliant with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form 945a can be submitted to the IRS through various methods. Employers may choose to file electronically using IRS e-file options, which can expedite processing. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submission is generally not available for this form, making electronic filing or mailing the most common methods.

Examples of using the Form 945a

Examples of situations where the Form 945a is used include:

- Employers withholding taxes from pension distributions for retirees.

- Businesses deducting taxes from gambling winnings paid to individuals.

- Financial institutions reporting withheld taxes from annuity payments.

These examples illustrate the form's relevance in various nonpayroll withholding scenarios, highlighting its importance for compliance and accurate tax reporting.

Quick guide on how to complete 2014 form 945a

Complete Form 945a effortlessly on any gadget

Digital document handling has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Form 945a on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Form 945a effortlessly

- Locate Form 945a and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 945a and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 945a

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 945a

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form 945a and how does it relate to eSignature solutions?

Form 945a is a crucial document for businesses that report nonpayroll taxes. Using airSlate SignNow, you can easily eSign and manage Form 945a and other related documents, streamlining your compliance processes. Our platform ensures that your Form 945a is securely handled and can be shared with the necessary parties.

-

How can airSlate SignNow help me with Form 945a submissions?

airSlate SignNow simplifies the submission process for Form 945a by allowing you to eSign and send the form directly through our platform. This eliminates the hassle of printing, signing, and scanning, making your submissions faster and more efficient. Our user-friendly interface guides you through each step, ensuring accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for Form 945a?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs, including those focusing on Form 945a submissions. Our pricing is transparent with no hidden fees, allowing you to choose the plan that fits your budget while providing powerful features for document management. You can also benefit from our free trial to explore all functionalities before committing.

-

What features does airSlate SignNow offer for managing Form 945a?

airSlate SignNow provides a suite of features specifically designed for managing Form 945a, including easy eSigning, document templates, and secure storage. You can track the status of your Form 945a in real-time and receive notifications for any updates or required actions. Additionally, our platform supports audits and compliance checks to ensure your documents meet regulatory standards.

-

Can I integrate airSlate SignNow with other applications for Form 945a?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems, accounting software, and cloud storage services. This means you can automate workflows involving Form 945a and enhance your overall productivity. Our integration capabilities ensure that your data flows smoothly between platforms, saving you time and reducing errors.

-

How secure is airSlate SignNow for handling Form 945a?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like Form 945a. Our platform employs advanced encryption methods and complies with industry standards to protect your data. You can trust that your Form 945a and other documents are handled with the utmost confidentiality and security.

-

What are the benefits of using airSlate SignNow for Form 945a compared to traditional methods?

Using airSlate SignNow for Form 945a offers numerous benefits over traditional methods. It dramatically reduces processing time, eliminates paperwork, and ensures a more efficient workflow. With features like eSigning and automated notifications, you can focus on your core business activities instead of getting bogged down by administrative tasks.

Get more for Form 945a

- Patient name dob mrn unm srmc form

- Ups hrsc form

- Provider dispute resolution request form blank

- Family care authorization disclosure form

- Brief pain inventory short form modified

- Loss runs request form

- Physical exam form for foster children rev july 20101doc umchildrenshome

- Error analysis order of operations form

Find out other Form 945a

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe