Form 945 a Rev December Annual Record of Federal Tax Liability 2020

What is the Form 945 A Rev December Annual Record Of Federal Tax Liability

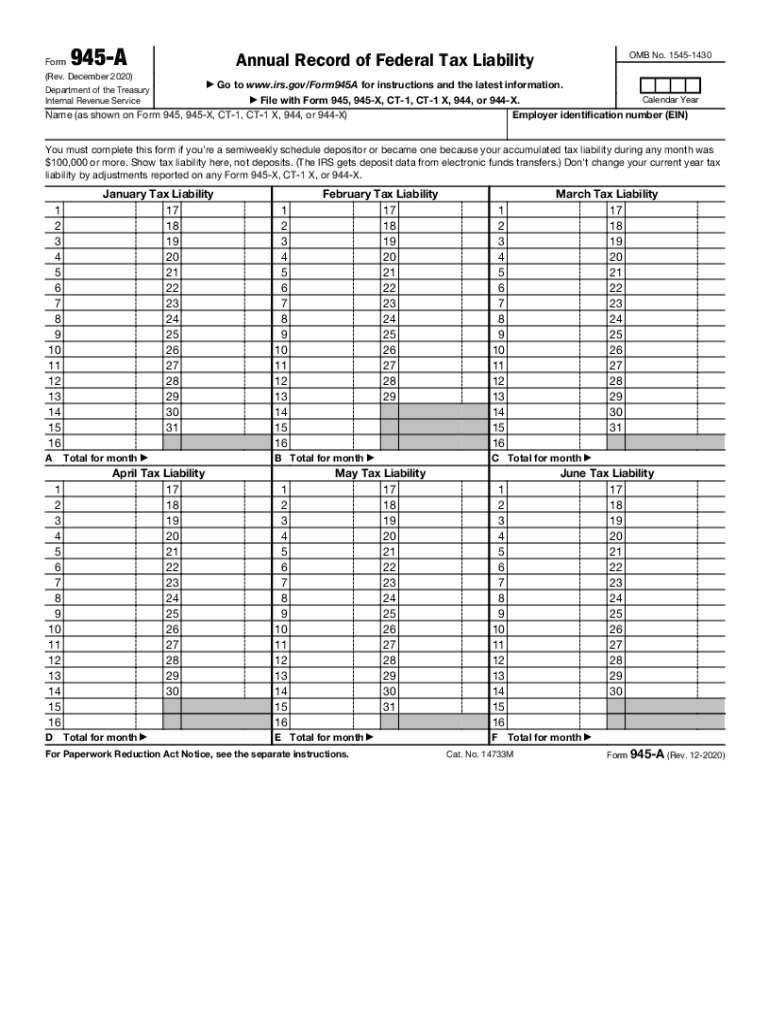

The Form 945 A, also known as the Annual Record of Federal Tax Liability, is a crucial document for employers who withhold federal income tax from nonpayroll payments. This form is used to report the total federal tax liability for the year, specifically for payments such as pensions, annuities, and other similar types of compensation. Understanding this form is essential for ensuring compliance with federal tax regulations and accurately reporting your tax obligations.

How to use the Form 945 A Rev December Annual Record Of Federal Tax Liability

Using the Form 945 A involves several steps to ensure accurate reporting of your federal tax liabilities. First, gather all relevant financial records that detail your nonpayroll payments for the year. Next, fill out the form by entering the total amounts withheld for federal taxes. It is important to ensure that all figures are accurate to avoid penalties. Once completed, the form should be submitted to the IRS along with your other tax documents for the year.

Steps to complete the Form 945 A Rev December Annual Record Of Federal Tax Liability

Completing the Form 945 A requires careful attention to detail. Here are the key steps:

- Gather all necessary documentation, including records of nonpayroll payments and tax withholdings.

- Enter your business information, including the employer identification number (EIN).

- List the total federal tax liability for the year, ensuring accuracy in your calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 945 A are critical to avoid penalties. Typically, the form must be submitted by January 31 of the following year for the previous tax year. It is essential to stay updated on any changes to these deadlines, as they can vary based on IRS regulations. Marking these dates on your calendar can help ensure timely compliance.

Penalties for Non-Compliance

Failing to file the Form 945 A or submitting it with inaccuracies can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay in filing. Understanding these penalties emphasizes the importance of accurate and timely submission of the form to avoid unnecessary financial burdens.

Legal use of the Form 945 A Rev December Annual Record Of Federal Tax Liability

The legal use of the Form 945 A is essential for employers to maintain compliance with federal tax laws. This form serves as an official record of federal tax liabilities associated with nonpayroll payments. Proper completion and submission of the form ensure that employers fulfill their tax obligations, protecting them from potential legal issues and penalties associated with non-compliance.

Quick guide on how to complete form 945 a rev december 2020 annual record of federal tax liability

Easily Prepare Form 945 A Rev December Annual Record Of Federal Tax Liability on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent green alternative to traditional printed and signed papers, allowing you to locate the necessary forms and keep them secure online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 945 A Rev December Annual Record Of Federal Tax Liability on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-driven task today.

How to Edit and eSign Form 945 A Rev December Annual Record Of Federal Tax Liability with Ease

- Obtain Form 945 A Rev December Annual Record Of Federal Tax Liability and hit Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about mislaid documents, tedious form searching, or corrections that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 945 A Rev December Annual Record Of Federal Tax Liability and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 945 a rev december 2020 annual record of federal tax liability

Create this form in 5 minutes!

How to create an eSignature for the form 945 a rev december 2020 annual record of federal tax liability

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What are the form 945 instructions for employers?

The form 945 instructions provide guidance for employers on how to report federal income tax withheld from nonpayroll payments. Following these instructions is crucial for accurate tax reporting and compliance. By utilizing airSlate SignNow, you can easily capture signatures on these forms to streamline your administrative tasks.

-

How does airSlate SignNow simplify the form 945 instructions process?

airSlate SignNow simplifies the form 945 instructions process by allowing users to digitally sign and send documents securely. This means you can easily manage the paperwork required for submitting federal income tax without the hassle of printing and mailing forms. Our platform ensures quick access to your documents anytime, anywhere.

-

Are there any costs associated with using airSlate SignNow for form 945 instructions?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs. Our plans are cost-effective, allowing you to choose the best option based on your volume of document transactions. With affordable features included, managing your form 945 instructions becomes more efficient and budget-friendly.

-

Can I integrate airSlate SignNow with my existing tools for form 945 instructions?

Absolutely! airSlate SignNow seamlessly integrates with a wide range of popular business tools and software. This capability enhances your workflow, allowing you to automate and manage the form 945 instructions process alongside your other operations.

-

What are the benefits of using airSlate SignNow for form 945 instructions?

Using airSlate SignNow for form 945 instructions offers numerous benefits, including enhanced security, reduced turnaround time, and improved document management. Our platform ensures that your sensitive tax information is securely stored and easily retrievable. Additionally, eSigning minimizes delays, allowing your business to operate more efficiently.

-

How do I get started with airSlate SignNow for form 945 instructions?

Getting started with airSlate SignNow for your form 945 instructions is simple. Sign up for an account, explore our user-friendly interface, and begin uploading your documents for eSigning. Our platform also offers helpful tutorials and customer support to assist you throughout the process.

-

Can airSlate SignNow help with compliance regarding form 945 instructions?

Yes, airSlate SignNow is designed to help ensure compliance with federal regulations regarding form 945 instructions. By using digital signatures and secure document storage, you can maintain accurate records of your tax submissions and avoid potential penalties for non-compliance.

Get more for Form 945 A Rev December Annual Record Of Federal Tax Liability

- Divorce with children form

- Vital statistics form state of wyoming department of health absolute divorce or annulment for plaintiff without children wyoming

- Complaint for divorce for plaintiff without children wyoming form

- Summons wyoming form

- Initial disclosures form

- Initial disclosures divorce form

- Acceptance service form

- Affidavit service mail 497432442 form

Find out other Form 945 A Rev December Annual Record Of Federal Tax Liability

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed