Check the Applicable Box on Form RDC to Indicate W 2024-2026

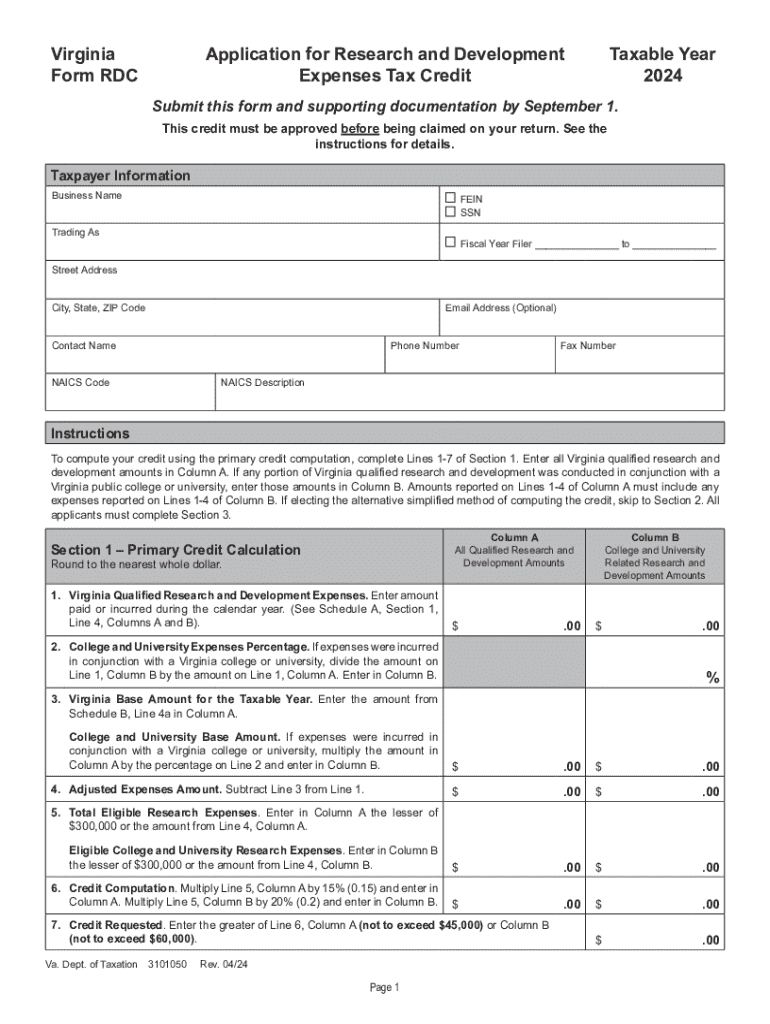

What is the form RDC research tax credit?

The form RDC research tax credit is a tax incentive designed to encourage businesses in the United States to invest in research and development activities. This credit allows eligible companies to reduce their tax liability based on qualified research expenses incurred during the tax year. The form is particularly relevant for businesses engaged in innovation, product development, and technological advancements.

Eligibility criteria for the form RDC research tax credit

To qualify for the RDC research tax credit, businesses must meet specific eligibility criteria. Generally, the company must be a for-profit entity that conducts qualified research activities within the United States. Eligible expenses may include wages for employees directly involved in research, costs associated with materials used in research, and contract research expenses. Additionally, the research must aim to develop or improve products, processes, or software.

Steps to complete the form RDC research tax credit

Completing the form RDC research tax credit involves several key steps:

- Gather necessary documentation, including financial records and details of research activities.

- Identify eligible expenses that qualify for the tax credit.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the form along with your tax return by the designated filing deadline.

Attention to detail is crucial, as inaccuracies can lead to delays or penalties.

Filing deadlines for the form RDC research tax credit

Filing deadlines for the form RDC research tax credit typically align with the annual tax return deadlines. For most businesses, this means submitting the form by April fifteenth of the following year. However, businesses may be eligible for extensions, which can provide additional time to gather necessary documentation and complete the form. It is essential to stay informed about any changes to deadlines that may occur due to legislative updates or IRS guidance.

Form submission methods for the RDC research tax credit

The form RDC research tax credit can be submitted through various methods. Businesses may choose to file electronically, which is often faster and provides immediate confirmation of receipt. Alternatively, forms can be mailed to the appropriate IRS address. In-person submission is also an option, though it is less common. Regardless of the method chosen, it is important to retain copies of all submitted documents for record-keeping purposes.

Required documents for the form RDC research tax credit

When completing the form RDC research tax credit, businesses must prepare and submit several key documents:

- Financial statements detailing research expenditures.

- Payroll records for employees involved in research activities.

- Documentation of research projects and their objectives.

- Any additional records that support the claimed expenses.

Having these documents readily available can streamline the filing process and help ensure compliance with IRS requirements.

Create this form in 5 minutes or less

Find and fill out the correct check the applicable box on form rdc to indicate w

Create this form in 5 minutes!

How to create an eSignature for the check the applicable box on form rdc to indicate w

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form rdc research tax credit?

The form rdc research tax credit is a tax incentive designed to encourage businesses to invest in research and development activities. By utilizing this form, companies can potentially reduce their tax liabilities while fostering innovation. Understanding how to properly complete this form is crucial for maximizing your benefits.

-

How can airSlate SignNow help with the form rdc research tax credit?

airSlate SignNow streamlines the process of completing and submitting the form rdc research tax credit by providing an easy-to-use eSignature solution. This allows businesses to quickly gather necessary signatures and documentation, ensuring compliance and efficiency. With our platform, you can manage all your tax credit forms seamlessly.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a variety of features tailored for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features simplify the process of preparing and submitting the form rdc research tax credit. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow cost-effective for small businesses applying for the form rdc research tax credit?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses applying for the form rdc research tax credit. Our pricing plans are flexible and cater to various needs, ensuring that you can manage your tax documentation without breaking the bank. Investing in our platform can save you time and resources.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various tax management software, making it easier to handle the form rdc research tax credit alongside your existing tools. This seamless integration allows for better data management and enhances your overall workflow, ensuring that all your tax-related documents are in one place.

-

What are the benefits of using airSlate SignNow for the form rdc research tax credit?

Using airSlate SignNow for the form rdc research tax credit provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents electronically, which speeds up the submission process. Additionally, you can track the status of your forms in real-time.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive tax documents, including the form rdc research tax credit. Our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

Get more for Check The Applicable Box On Form RDC To Indicate W

- Ey2 form 15307808

- Community service report sample pdf form

- Cladogram worksheet answers form

- Affidavit for caste certificate pdf form

- Monitoring slip form

- Punjab national bank claim form fill up

- Impost sobre transmissions patrimonials i actes jurdics documentats form

- Espacio reservado para la administracin form

Find out other Check The Applicable Box On Form RDC To Indicate W

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter