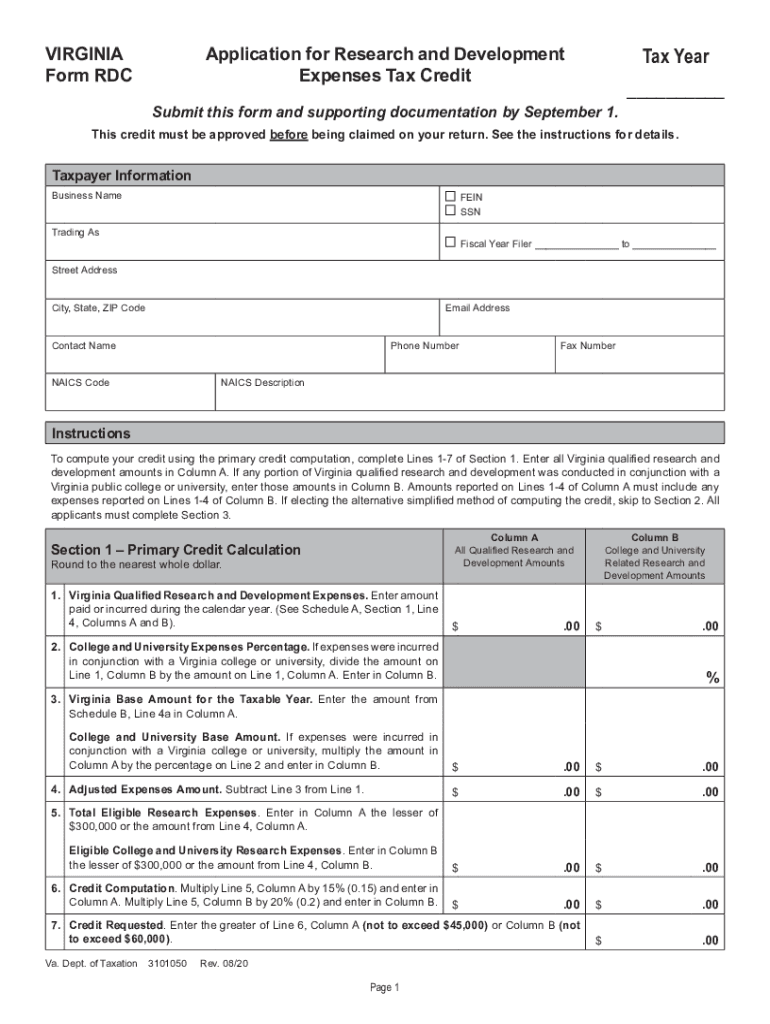

Form RDC Application for Research and Development Expenses Tax Credit Virginia Form RDC Application for Research and Development 2020

What is the RDC Research Development Expenses Credit?

The RDC Research Development Expenses Credit is a tax incentive offered by the state of Virginia to encourage businesses to invest in research and development activities. This credit allows eligible companies to reduce their state tax liability based on qualified research expenses incurred during the tax year. It is designed to stimulate innovation and economic growth within the state by supporting businesses that engage in activities aimed at developing new or improved products, processes, or software.

Eligibility Criteria for the RDC Research Development Expenses Credit

To qualify for the RDC Research Development Expenses Credit, businesses must meet specific criteria outlined by the Virginia Department of Taxation. Key eligibility requirements include:

- The business must be registered and operating in Virginia.

- Research activities must be conducted within the state.

- Expenses must be directly related to qualified research activities as defined by state guidelines.

- Businesses must maintain adequate documentation to support their claims for the credit.

Steps to Complete the Form RDC Application

Filling out the Form RDC Application for the Research Development Expenses Credit involves several steps to ensure compliance and accuracy. Here is a streamlined process:

- Gather all necessary documentation related to research expenses, including payroll records, invoices, and project descriptions.

- Download the Form RDC from the Virginia Department of Taxation website or obtain a physical copy.

- Complete the form by providing detailed information about the business, research activities, and qualifying expenses.

- Review the form for accuracy and completeness before submission.

- Submit the completed form along with any required attachments to the appropriate state tax authority.

Required Documents for the RDC Application

When applying for the RDC Research Development Expenses Credit, businesses must provide specific documents to support their application. Required documents typically include:

- Detailed records of qualifying research expenses.

- Project descriptions that outline the nature of the research conducted.

- Financial statements or tax returns for the applicable tax year.

- Any additional documentation requested by the Virginia Department of Taxation.

Form Submission Methods

The Form RDC can be submitted through various methods to accommodate different preferences. Businesses may choose to:

- Submit the form electronically via the Virginia Department of Taxation's online portal.

- Mail a physical copy of the completed form to the designated tax office.

- Deliver the form in person to a local tax office, if preferred.

IRS Guidelines for Research Credits

While the RDC is a state-specific credit, it is important for businesses to be aware of related IRS guidelines that govern federal research tax credits. Understanding these guidelines can help ensure that businesses maximize their benefits while remaining compliant with both state and federal regulations. Key points to consider include:

- Eligibility for the federal Research and Development Tax Credit may impact state credit claims.

- Documentation requirements for federal credits often align with state requirements.

- Consulting a tax professional can provide clarity on how to navigate both state and federal guidelines effectively.

Quick guide on how to complete 2020 form rdc application for research and development expenses tax credit virginia form rdc 2020 application for research and

Effortlessly Prepare Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed files, as you can acquire the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without any hold-ups. Handle Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development on any device using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Way to Modify and eSign Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development Seamlessly

- Locate Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to store your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form rdc application for research and development expenses tax credit virginia form rdc 2020 application for research and

Create this form in 5 minutes!

How to create an eSignature for the 2020 form rdc application for research and development expenses tax credit virginia form rdc 2020 application for research and

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the rdc research development expenses credit?

The rdc research development expenses credit is a tax incentive designed to encourage businesses to invest in research and development activities. This credit allows eligible businesses to reduce their tax liability based on qualifying R&D expenditures, fostering innovation and growth.

-

How can airSlate SignNow help me track rdc research development expenses credit?

With airSlate SignNow, you can easily manage and document your R&D expenditures required for claiming the rdc research development expenses credit. Our platform allows you to securely store and organize documents, making it easier to present the necessary evidence during tax filing.

-

What features of airSlate SignNow can assist with rdc research development expenses credit documentation?

AirSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document tracking. These tools streamline the documentation process for the rdc research development expenses credit, ensuring you maintain proper records and comply with regulations.

-

Is there a cost associated with using airSlate SignNow for rdc research development expenses credit?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Investing in our platform can help you efficiently manage documentation related to the rdc research development expenses credit, ultimately saving you time and money.

-

Can I integrate airSlate SignNow with other tools for managing rdc research development expenses credit?

Absolutely! airSlate SignNow supports numerous integrations with popular accounting and project management tools. This allows you to seamlessly track and manage your R&D expenditures related to the rdc research development expenses credit across multiple platforms.

-

What benefits does airSlate SignNow provide for claiming rdc research development expenses credit?

Using airSlate SignNow to manage your R&D documentation offers signNow benefits, including increased efficiency, reduced paperwork, and higher accuracy. By utilizing our platform, you can streamline the claims process for the rdc research development expenses credit, making it easier to focus on your innovative projects.

-

How secure is my data when using airSlate SignNow for rdc research development expenses credit?

AirSlate SignNow prioritizes data security, employing industry-leading encryption and compliance measures to protect your sensitive information. When managing your documents for the rdc research development expenses credit, you can trust that your data is safe and secure.

Get more for Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development

- Security contractor package vermont form

- Insulation contractor package vermont form

- Paving contractor package vermont form

- Site work contractor package vermont form

- Siding contractor package vermont form

- Refrigeration contractor package vermont form

- Drainage contractor package vermont form

- Tax free exchange package vermont form

Find out other Form RDC Application For Research And Development Expenses Tax Credit Virginia Form RDC Application For Research And Development

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer