Regional Income Tax Agency City of Bellefontaine, Ohio Form

Understanding the Regional Income Tax Agency in Bellefontaine, Ohio

The Regional Income Tax Agency (RITA) is responsible for administering municipal income taxes for various cities in Ohio, including Bellefontaine. This agency ensures compliance with local tax laws and provides resources for residents and businesses to fulfill their tax obligations. RITA plays a crucial role in collecting taxes that fund local services and infrastructure, contributing to the community's overall well-being.

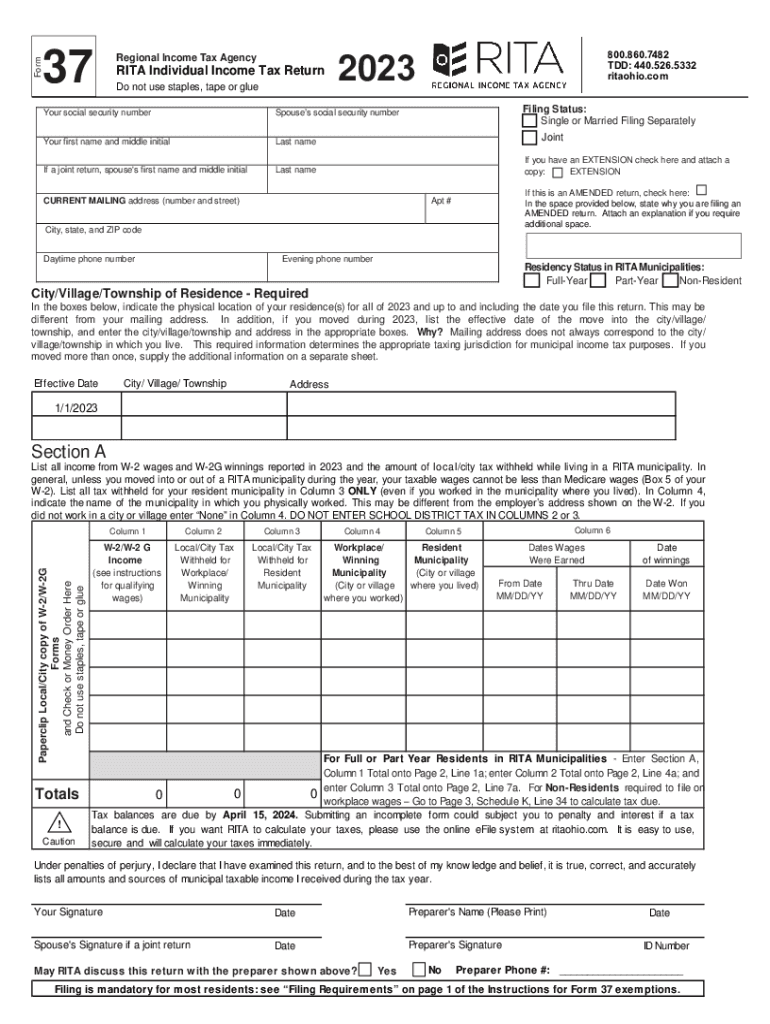

Steps to Complete the RITA Tax Forms

Filling out the RITA tax forms, particularly the RITA Form 37, involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, download the RITA Form 37 from the official RITA website. Carefully follow the instructions provided on the form, ensuring that you report all income accurately. After completing the form, review it for any errors before submitting it. You can submit the form online, by mail, or in person, depending on your preference.

Required Documents for RITA Tax Forms

To successfully complete the RITA tax forms, you will need specific documentation. This includes:

- W-2 forms from all employers

- 1099 forms for any freelance or contract work

- Records of any additional income sources

- Receipts for deductible expenses, if applicable

Having these documents ready will streamline the process and help ensure that you accurately report your income and deductions.

Filing Deadlines for RITA Tax Forms

It is essential to be aware of the filing deadlines for RITA tax forms to avoid penalties. Generally, the deadline for filing the RITA Form 37 is April 15 of each year. If you are unable to meet this deadline, you may request an extension, but it is important to understand the implications of late filing and any potential penalties that may apply.

Form Submission Methods

RITA provides multiple options for submitting your tax forms. You can choose to file online through the RITA website, which offers a user-friendly interface for completing and submitting your forms electronically. Alternatively, you can print the completed RITA Form 37 and mail it to the appropriate RITA office. In-person submissions are also accepted at designated locations. Each method has its advantages, so select the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with RITA tax obligations can result in penalties and interest on unpaid taxes. It is crucial to file your RITA tax forms accurately and on time to avoid these consequences. Penalties may include fines and additional charges that accumulate over time, making it essential to stay informed about your tax responsibilities and deadlines.

Eligibility Criteria for RITA Tax Forms

Eligibility for filing RITA tax forms typically includes individuals who reside or work in municipalities that impose a local income tax. This includes both full-time and part-time residents, as well as non-residents who earn income within the jurisdiction. Understanding the eligibility criteria is vital to ensure that you are meeting your tax obligations correctly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the regional income tax agency city of bellefontaine ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are rita tax forms and how can airSlate SignNow help?

Rita tax forms are specific tax documents required for filing in certain jurisdictions. airSlate SignNow simplifies the process of completing and signing these forms electronically, ensuring that you can manage your tax documentation efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for rita tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and signing of rita tax forms, making it a cost-effective solution for managing your tax documentation.

-

What features does airSlate SignNow offer for managing rita tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored to enhance the management of rita tax forms. These tools help ensure that your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for rita tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software, to streamline the process of handling rita tax forms. This integration allows for a more efficient workflow and better data management.

-

How does airSlate SignNow ensure the security of my rita tax forms?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect your rita tax forms, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Is it easy to use airSlate SignNow for rita tax forms?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete and eSign rita tax forms. The intuitive interface guides users through the process, reducing the learning curve and allowing for quick adoption.

-

What benefits can I expect from using airSlate SignNow for rita tax forms?

Using airSlate SignNow for rita tax forms offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform helps streamline your tax filing process, allowing you to focus on your core business activities.

Get more for Regional Income Tax Agency City Of Bellefontaine, Ohio

Find out other Regional Income Tax Agency City Of Bellefontaine, Ohio

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy