Sandhurst Trustees Managed Funds 2017

What is the Sandhurst Trustees Managed Funds

The Sandhurst Trustees Managed Funds are investment products designed to provide individuals and institutions with a diversified portfolio managed by experienced professionals. These funds typically invest in a range of asset classes, including equities, fixed income, and alternative investments, aiming to achieve specific financial goals for their investors. The managed funds are structured to cater to various risk appetites and investment horizons, making them suitable for a wide array of investors.

How to use the Sandhurst Trustees Managed Funds

Utilizing the Sandhurst Trustees Managed Funds involves several steps to ensure that investors align their financial objectives with the appropriate fund. First, individuals should assess their investment goals, risk tolerance, and time frame. Next, they can review the available managed funds, considering factors such as historical performance, fees, and asset allocation strategies. Once a suitable fund is selected, investors can proceed to invest either through a direct purchase or by consulting with a financial advisor for tailored guidance.

Key elements of the Sandhurst Trustees Managed Funds

Several key elements define the Sandhurst Trustees Managed Funds. These include:

- Diversification: The funds typically invest across multiple asset classes to spread risk.

- Professional Management: Experienced fund managers oversee the investment strategy and execution.

- Performance Metrics: Investors can assess funds based on returns, volatility, and other financial indicators.

- Fee Structure: Understanding management fees and other costs associated with the funds is crucial for investors.

Eligibility Criteria

Eligibility for investing in Sandhurst Trustees Managed Funds may vary based on the specific fund and its investment strategy. Generally, individual and institutional investors are welcome, but certain funds may have minimum investment amounts or specific requirements based on the investor's profile. It is advisable for potential investors to review the fund's prospectus for detailed eligibility criteria and any restrictions that may apply.

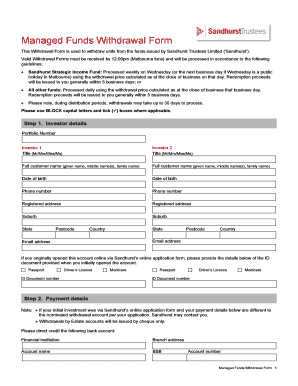

Steps to complete the Sandhurst Trustees Managed Funds

Completing the investment process in Sandhurst Trustees Managed Funds involves several important steps:

- Research: Gather information about the different managed funds available.

- Consultation: Consider speaking with a financial advisor to receive personalized advice.

- Application: Fill out the necessary application forms to initiate the investment.

- Funding: Transfer the required investment amount into the selected fund.

- Monitoring: Regularly review fund performance and adjust your investment strategy as needed.

Legal use of the Sandhurst Trustees Managed Funds

Investors must adhere to legal guidelines when utilizing Sandhurst Trustees Managed Funds. This includes complying with securities regulations and understanding the tax implications of their investments. Investors should ensure that they are eligible to invest in these funds and that they follow all necessary procedures to maintain compliance with federal and state laws. Consulting with a legal or financial expert can help clarify any legal concerns related to fund investments.

Create this form in 5 minutes or less

Find and fill out the correct sandhurst trustees managed funds

Create this form in 5 minutes!

How to create an eSignature for the sandhurst trustees managed funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Sandhurst Trustees managed funds?

Sandhurst Trustees managed funds are investment options that allow individuals to pool their money for professional management. These funds are designed to provide investors with diversified exposure to various asset classes, aiming for optimal returns while managing risk.

-

How do Sandhurst Trustees managed funds work?

Sandhurst Trustees managed funds operate by collecting capital from multiple investors and investing it in a diversified portfolio of assets. Professional fund managers make investment decisions based on market research and analysis, ensuring that the funds align with the investors' financial goals.

-

What are the benefits of investing in Sandhurst Trustees managed funds?

Investing in Sandhurst Trustees managed funds offers several benefits, including professional management, diversification, and access to a range of investment opportunities. These funds can help investors achieve their financial objectives while minimizing risks associated with individual stock picking.

-

What are the fees associated with Sandhurst Trustees managed funds?

The fees for Sandhurst Trustees managed funds typically include management fees and performance fees, which can vary based on the specific fund. It's important for investors to review the fee structure before investing to understand how these costs may impact their overall returns.

-

Can I integrate Sandhurst Trustees managed funds with my existing investment portfolio?

Yes, Sandhurst Trustees managed funds can be integrated with your existing investment portfolio. This allows you to diversify your investments further and potentially enhance your overall returns while maintaining a balanced risk profile.

-

What types of assets are included in Sandhurst Trustees managed funds?

Sandhurst Trustees managed funds typically include a mix of equities, fixed income, and alternative investments. This diversified approach helps to spread risk and can lead to more stable returns over time, catering to various investor preferences.

-

How can I get started with Sandhurst Trustees managed funds?

To get started with Sandhurst Trustees managed funds, you can contact a financial advisor or visit the Sandhurst Trustees website for more information. They provide resources and guidance to help you choose the right fund that aligns with your investment goals.

Get more for Sandhurst Trustees Managed Funds

Find out other Sandhurst Trustees Managed Funds

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now