Kingbet9 Withdrawal FormRetirement Plan and IRA Required 2024-2026

What is the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required?

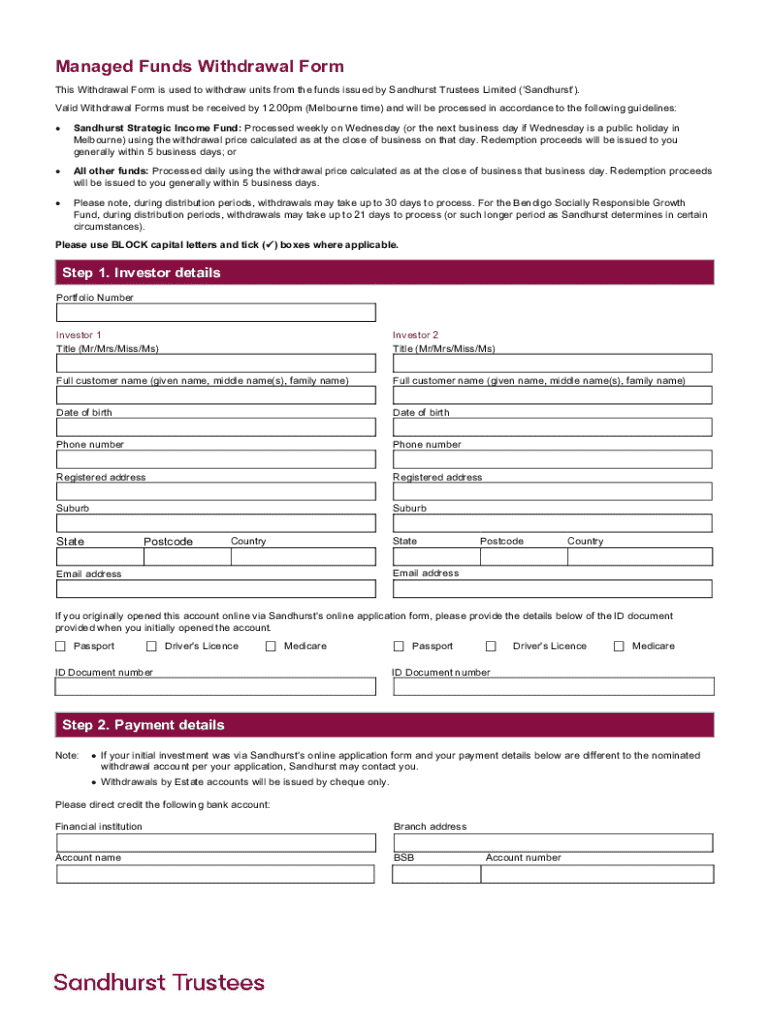

The Kingbet9 Withdrawal Form is a specific document designed for individuals who wish to withdraw funds from their retirement plans or Individual Retirement Accounts (IRAs). This form is essential for ensuring that the withdrawal process complies with federal regulations and is processed efficiently. The form typically requires information about the account holder, the type of retirement plan or IRA, and the amount to be withdrawn. Understanding this form is crucial for anyone looking to access their retirement savings in a compliant manner.

How to Use the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required

Using the Kingbet9 Withdrawal Form involves several steps to ensure accurate completion and submission. First, gather all necessary personal information, including your Social Security number and details about your retirement account. Next, fill out the form carefully, providing the required details about the withdrawal amount and the purpose of the withdrawal. It is important to review the form for any errors before submission to avoid delays. Finally, submit the completed form according to the instructions provided, whether online, by mail, or in person.

Key Elements of the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required

The key elements of the Kingbet9 Withdrawal Form include the account holder's personal information, details about the retirement plan or IRA, the specific amount being withdrawn, and the reason for the withdrawal. Additionally, the form may require the signature of the account holder to authorize the transaction. Understanding these elements is vital for ensuring that the form is filled out correctly and meets all necessary legal requirements.

Steps to Complete the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required

Completing the Kingbet9 Withdrawal Form involves a series of straightforward steps:

- Gather necessary documents, including your retirement account details and identification.

- Fill out the personal information section accurately.

- Provide details about the retirement plan or IRA and specify the withdrawal amount.

- Indicate the reason for the withdrawal, as required.

- Review the form thoroughly to ensure all information is correct.

- Sign and date the form to authorize the withdrawal.

- Submit the form according to the specified submission methods.

Legal Use of the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required

The legal use of the Kingbet9 Withdrawal Form is essential for compliance with federal and state regulations regarding retirement accounts. This form ensures that withdrawals are processed in accordance with the law, preventing potential penalties or issues with the Internal Revenue Service (IRS). It is important to use the form correctly to maintain the tax-advantaged status of the retirement account and to avoid any legal complications that may arise from improper withdrawals.

Required Documents for the Kingbet9 Withdrawal Form, Retirement Plan, and IRA Required

When completing the Kingbet9 Withdrawal Form, certain documents may be required to verify your identity and account details. Typically, you will need:

- A valid government-issued ID, such as a driver's license or passport.

- Your Social Security number for identification purposes.

- Documentation of your retirement account, including account numbers and plan details.

- Any additional forms or documentation required by the retirement plan administrator.

Create this form in 5 minutes or less

Find and fill out the correct kingbet9 withdrawal formretirement plan and ira required

Create this form in 5 minutes!

How to create an eSignature for the kingbet9 withdrawal formretirement plan and ira required

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kingbet9 Withdrawal Form and how does it relate to retirement plans?

The Kingbet9 Withdrawal Form is a crucial document for individuals looking to withdraw funds from their retirement accounts. It ensures that all withdrawals comply with the regulations governing retirement plans and IRAs. Understanding this form is essential for managing your retirement funds effectively.

-

Are there any fees associated with the Kingbet9 Withdrawal Form?

Fees may vary depending on the financial institution handling your retirement plan. Typically, there are no direct fees for submitting the Kingbet9 Withdrawal Form itself, but it's important to check with your provider for any potential charges related to withdrawals. Being informed can help you avoid unexpected costs.

-

What features does airSlate SignNow offer for managing the Kingbet9 Withdrawal Form?

airSlate SignNow provides a user-friendly platform for electronically signing and managing documents like the Kingbet9 Withdrawal Form. With features such as templates, secure storage, and easy sharing, you can streamline the withdrawal process for your retirement plan and IRA. This enhances efficiency and ensures compliance.

-

How can I integrate airSlate SignNow with my existing retirement plan management tools?

Integrating airSlate SignNow with your retirement plan management tools is straightforward. The platform supports various integrations that allow you to connect with popular financial software. This ensures that your Kingbet9 Withdrawal Form and other documents are seamlessly managed within your existing workflow.

-

What are the benefits of using airSlate SignNow for the Kingbet9 Withdrawal Form?

Using airSlate SignNow for the Kingbet9 Withdrawal Form offers numerous benefits, including time savings and enhanced security. The platform allows for quick electronic signatures, reducing the turnaround time for withdrawals. Additionally, it provides a secure environment for your sensitive retirement information.

-

Is there customer support available for questions about the Kingbet9 Withdrawal Form?

Yes, airSlate SignNow offers robust customer support to assist you with any questions regarding the Kingbet9 Withdrawal Form. Whether you need help with the signing process or understanding the requirements, their support team is available to guide you. This ensures you have the assistance you need for your retirement plan and IRA.

-

Can I track the status of my Kingbet9 Withdrawal Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Kingbet9 Withdrawal Form in real-time. You can see when the document has been viewed, signed, and completed, providing you with peace of mind as you manage your retirement plan and IRA withdrawals.

Get more for Kingbet9 Withdrawal FormRetirement Plan And IRA Required

Find out other Kingbet9 Withdrawal FormRetirement Plan And IRA Required

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself