2018MFT USE Annual Tax Schedule for Split Rate WV State 2018-2026

Understanding the 2018MFT USE Annual Tax Schedule For Split Rate WV State

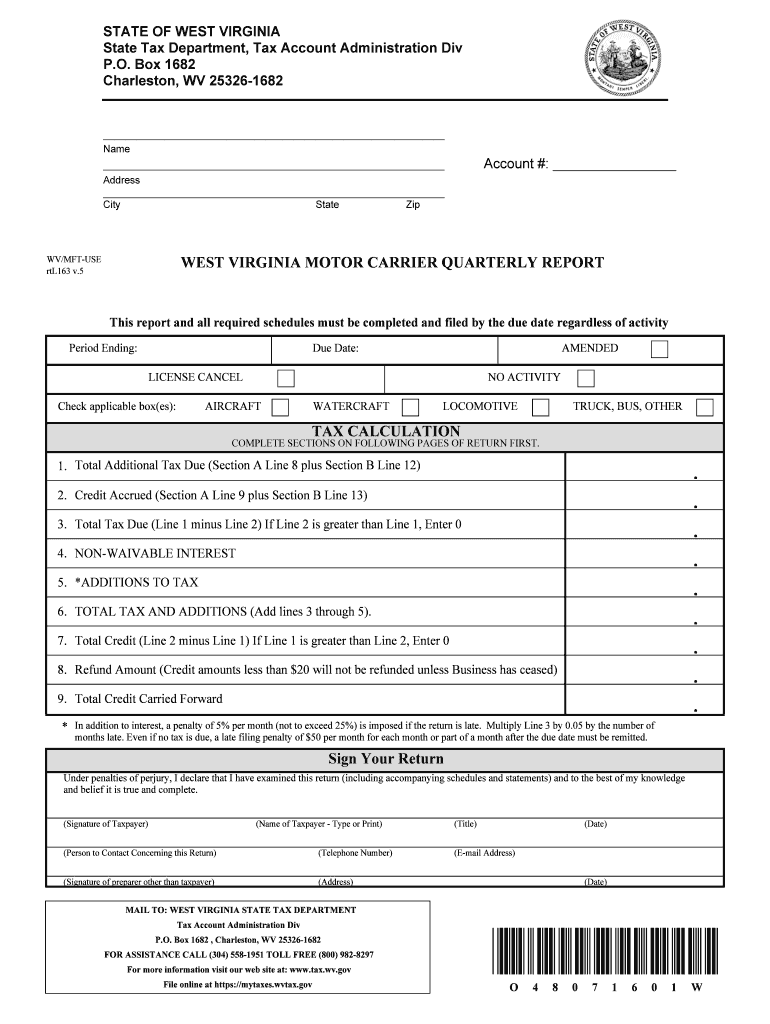

The 2018MFT USE Annual Tax Schedule For Split Rate in West Virginia is a specialized form used by businesses and individuals to report and calculate the state’s motor fuel tax. This schedule is essential for those who engage in activities related to the distribution or sale of motor fuel, ensuring compliance with state tax regulations. It outlines the necessary calculations for determining the applicable tax rate based on the split rate system, which differentiates between various types of fuel and their respective tax obligations.

Steps to Complete the 2018MFT USE Annual Tax Schedule For Split Rate WV State

Completing the 2018MFT USE Annual Tax Schedule involves several key steps:

- Gather all relevant financial documents, including sales records and fuel purchase invoices.

- Review the split rate tax structure to understand the applicable rates for different fuel types.

- Calculate the total fuel sold and the corresponding tax owed based on the split rates.

- Fill out the schedule accurately, ensuring all calculations are correct and all required fields are completed.

- Review the completed form for accuracy before submission.

How to Obtain the 2018MFT USE Annual Tax Schedule For Split Rate WV State

The 2018MFT USE Annual Tax Schedule can be obtained from the West Virginia State Tax Department's official website or through local tax offices. It is advisable to download the most current version of the form to ensure compliance with any recent updates or changes in tax regulations. Additionally, many tax preparation software programs may provide access to the necessary forms for electronic completion and submission.

Key Elements of the 2018MFT USE Annual Tax Schedule For Split Rate WV State

This schedule includes several critical components that taxpayers must complete:

- Taxpayer Information: Basic details about the taxpayer, including name, address, and identification number.

- Fuel Sales Information: Sections dedicated to reporting the total gallons of fuel sold and the corresponding tax rates applied.

- Calculations: Areas for calculating total tax owed based on the split rates for different fuel types.

- Signature Section: A declaration that the information provided is accurate, requiring the taxpayer’s signature.

Filing Deadlines and Important Dates for the 2018MFT USE Annual Tax Schedule For Split Rate WV State

Taxpayers must adhere to specific deadlines for filing the 2018MFT USE Annual Tax Schedule. Typically, the form is due on the last day of the month following the end of the tax year. For the 2018 tax year, this would mean filing by January thirty-first of the following year. It is crucial to stay informed about any changes to these deadlines, as late submissions may incur penalties.

Legal Use of the 2018MFT USE Annual Tax Schedule For Split Rate WV State

The legal use of the 2018MFT USE Annual Tax Schedule is governed by West Virginia tax laws. Taxpayers are required to use this form to accurately report their motor fuel sales and comply with state tax obligations. Failure to file or inaccuracies in reporting can lead to penalties, including fines or interest on unpaid taxes. Understanding the legal implications of this form is essential for maintaining compliance and avoiding potential legal issues.

Create this form in 5 minutes or less

Find and fill out the correct 2018mft use annual tax schedule for split rate wv state

Create this form in 5 minutes!

How to create an eSignature for the 2018mft use annual tax schedule for split rate wv state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018MFT USE Annual Tax Schedule For Split Rate WV State?

The 2018MFT USE Annual Tax Schedule For Split Rate WV State is a tax form used by businesses to report and pay their motor fuel taxes in West Virginia. This schedule helps ensure compliance with state regulations and provides a clear breakdown of tax obligations based on fuel usage.

-

How can airSlate SignNow assist with the 2018MFT USE Annual Tax Schedule For Split Rate WV State?

airSlate SignNow simplifies the process of completing and submitting the 2018MFT USE Annual Tax Schedule For Split Rate WV State by allowing users to eSign and send documents securely. This streamlines the workflow, reduces paperwork, and ensures timely submissions to avoid penalties.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the completion of documents like the 2018MFT USE Annual Tax Schedule For Split Rate WV State, ensuring cost-effective solutions for all users.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing the efficiency of managing documents like the 2018MFT USE Annual Tax Schedule For Split Rate WV State. These integrations allow for easy data transfer and improved collaboration among team members.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are particularly beneficial for managing the 2018MFT USE Annual Tax Schedule For Split Rate WV State, ensuring that all necessary steps are completed efficiently.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption and secure cloud storage to protect sensitive documents like the 2018MFT USE Annual Tax Schedule For Split Rate WV State. This ensures that your information remains confidential and safe from unauthorized access.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage and eSign documents like the 2018MFT USE Annual Tax Schedule For Split Rate WV State on the go. This flexibility ensures that you can complete your tax obligations anytime and anywhere.

Get more for 2018MFT USE Annual Tax Schedule For Split Rate WV State

Find out other 2018MFT USE Annual Tax Schedule For Split Rate WV State

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document