West Virginia Direct Pay Consumers Sales and Use Tax Return WV Gov 2017

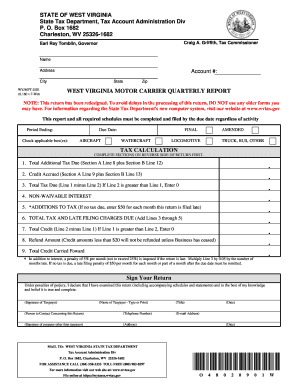

What is the West Virginia Direct Pay Consumers Sales And Use Tax Return

The West Virginia Direct Pay Consumers Sales And Use Tax Return is a specific tax form used by consumers in West Virginia to report and pay sales and use tax directly to the state. This form is particularly relevant for businesses and individuals who purchase goods or services that are subject to sales tax but do not pay it at the point of sale. Instead, they are responsible for reporting and remitting the tax directly to the West Virginia State Tax Department.

How to use the West Virginia Direct Pay Consumers Sales And Use Tax Return

To effectively use the West Virginia Direct Pay Consumers Sales And Use Tax Return, individuals and businesses must first gather all relevant purchase information. This includes details about the items or services acquired, the purchase price, and any applicable tax rates. Once this information is compiled, users can fill out the form accurately, ensuring that all sections are completed to reflect their tax obligations. After completing the form, it should be submitted to the appropriate state department along with any required payment.

Steps to complete the West Virginia Direct Pay Consumers Sales And Use Tax Return

Completing the West Virginia Direct Pay Consumers Sales And Use Tax Return involves several key steps:

- Gather all necessary documentation, including receipts and invoices for taxable purchases.

- Determine the total amount of sales and use tax owed based on your purchases.

- Fill out the return form, ensuring that all required fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with payment to the West Virginia State Tax Department by the designated deadline.

Required Documents

When filling out the West Virginia Direct Pay Consumers Sales And Use Tax Return, it is essential to have the following documents on hand:

- Receipts or invoices for all taxable purchases.

- Any previous tax returns that may provide context for your current filing.

- Documentation of any exemptions or deductions that may apply.

Filing Deadlines / Important Dates

Timely filing of the West Virginia Direct Pay Consumers Sales And Use Tax Return is crucial to avoid penalties. The typical deadline for submission is usually aligned with quarterly or annual tax periods. It is advisable to check the West Virginia State Tax Department’s official schedule for specific due dates and any changes that may occur.

Penalties for Non-Compliance

Failing to file the West Virginia Direct Pay Consumers Sales And Use Tax Return on time or inaccurately reporting tax obligations can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to adhere to all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct west virginia direct pay consumers sales and use tax return wv gov

Create this form in 5 minutes!

How to create an eSignature for the west virginia direct pay consumers sales and use tax return wv gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov?

The West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov is a tax return form that allows consumers in West Virginia to report and pay sales and use tax directly to the state. This form is essential for businesses and individuals who make taxable purchases and need to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov?

airSlate SignNow provides a streamlined solution for businesses to eSign and send the West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov. With our platform, you can easily prepare, sign, and submit your tax documents, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and larger organizations. Our cost-effective solutions ensure that you can manage your West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov without breaking the bank.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as customizable templates and secure storage. These features make it easy to manage your West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov and other important tax documents efficiently.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your financial documents. This integration can simplify the process of filing your West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov and keep your records organized.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your tax returns, including the West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov, provides numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for your sensitive tax information.

-

Is airSlate SignNow secure for handling tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your tax documents, including the West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov, are protected. Our platform uses advanced encryption and security measures to safeguard your information.

Get more for West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov

Find out other West Virginia Direct Pay Consumers Sales And Use Tax Return WV gov

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer