Form 15ca Download

What is the Form 15ca Download

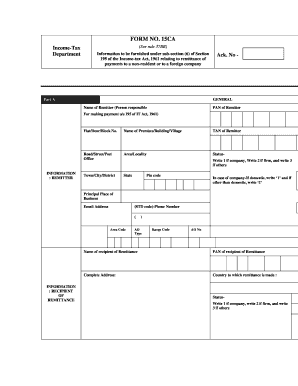

The Form 15CA is a crucial document used for reporting remittances made outside the United States. This form is necessary for individuals and businesses that are required to declare foreign payments to ensure compliance with U.S. tax regulations. The form serves as a declaration that the payment does not violate any provisions of the Income Tax Act and provides necessary details to the Internal Revenue Service (IRS).

How to obtain the Form 15ca Download

The Form 15CA can be easily obtained online through the official IRS website or authorized tax preparation software. Users can search for the form by its name or number, ensuring they download the most current version. It is available in PDF format, which allows for easy printing and completion. For those who prefer digital solutions, many tax software options also provide the form in a fillable format.

Steps to complete the Form 15ca Download

Completing the Form 15CA involves several straightforward steps:

- Download the form from a trusted source.

- Fill in the required information, including the details of the remittance and the recipient.

- Ensure that all sections are completed accurately to avoid delays.

- Review the form for any errors or omissions.

- Sign and date the form as required.

Once completed, the form can be submitted electronically or printed for mailing, depending on the requirements of the specific transaction.

Legal use of the Form 15ca Download

The legal use of the Form 15CA is essential for compliance with U.S. tax laws. Submitting this form ensures that all foreign remittances are reported correctly, which helps avoid potential penalties. The form must be filed accurately to validate the remittance and confirm that it adheres to tax regulations. Using a reliable platform like signNow can facilitate the signing process, ensuring that the document meets all legal requirements.

Key elements of the Form 15ca Download

Key elements of the Form 15CA include:

- Remittance details: Information about the payment amount and purpose.

- Recipient information: Name and address of the foreign entity receiving the payment.

- Tax identification: Necessary tax identification numbers for both the payer and recipient.

- Declaration of compliance: A statement confirming adherence to U.S. tax laws.

Each of these elements is critical for ensuring that the form is valid and accepted by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 15CA can be submitted through various methods:

- Online: Many tax software programs allow for electronic submission directly to the IRS.

- Mail: The completed form can be printed and sent via postal service to the appropriate IRS address.

- In-Person: Some individuals may choose to deliver the form personally to local IRS offices, although this is less common.

Choosing the right submission method can depend on the urgency of the payment and personal preference.

Quick guide on how to complete form 15ca download

Easily prepare Form 15ca Download on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents swiftly without delays. Manage Form 15ca Download on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 15ca Download effortlessly

- Locate Form 15ca Download and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign Form 15ca Download and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15ca download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 15ca pdf, and why do I need it?

The form 15ca pdf is a declaration form used for reporting foreign remittances under the Foreign Exchange Management Act (FEMA). It's crucial for businesses engaged in international transactions, as it ensures compliance with regulatory requirements and avoids penalties.

-

How can airSlate SignNow help me fill out the form 15ca pdf?

airSlate SignNow offers an intuitive interface that simplifies the process of filling out the form 15ca pdf. With our platform, users can easily input the required information and eSign the document, ensuring accuracy and compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for the form 15ca pdf?

Yes, there is a subscription fee for using airSlate SignNow, but it remains a cost-effective solution for businesses. Our pricing plans are designed to accommodate various needs, offering features tailored for seamless management of documents like the form 15ca pdf.

-

What features does airSlate SignNow offer for managing the form 15ca pdf?

airSlate SignNow includes features such as template creation, eSignatures, secure document storage, and easy sharing options specifically for the form 15ca pdf. These tools enhance efficiency and help ensure that your documents are compliant and readily accessible.

-

Can I integrate airSlate SignNow with other software for handling the form 15ca pdf?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRMs and cloud storage services, which can enhance your workflow when managing the form 15ca pdf. This integration allows for easy data transfer and document management across platforms.

-

What are the benefits of using airSlate SignNow for the form 15ca pdf?

Using airSlate SignNow for the form 15ca pdf streamlines the documentation process, reduces errors, and ensures timely compliance. Our platform enables users to send, sign, and manage documents efficiently, thereby saving valuable time and resources.

-

Is the form 15ca pdf secure with airSlate SignNow?

Yes, security is a priority at airSlate SignNow when handling the form 15ca pdf. We implement advanced encryption and security protocols to safeguard your documents, ensuring that sensitive information is protected during transmission and storage.

Get more for Form 15ca Download

- Form do 21b njgov

- Hsmv 81095 mhrv complaint registration form

- Lp 203 form

- Statement of foreign qualification illinois secretary of state form

- Search results for bill of sale for vehicle sale localtous form

- Notice of resignation of registered agent state forms

- 20 printable vehicle maintenance record forms and templates

- Pdf cosmetology salon license application instructions tdlr texasgov form

Find out other Form 15ca Download

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple