Instructions for Form 8275 R, Regulation Disclosure Statement 2024-2026

Understanding Form 8275 Disclosure Statement

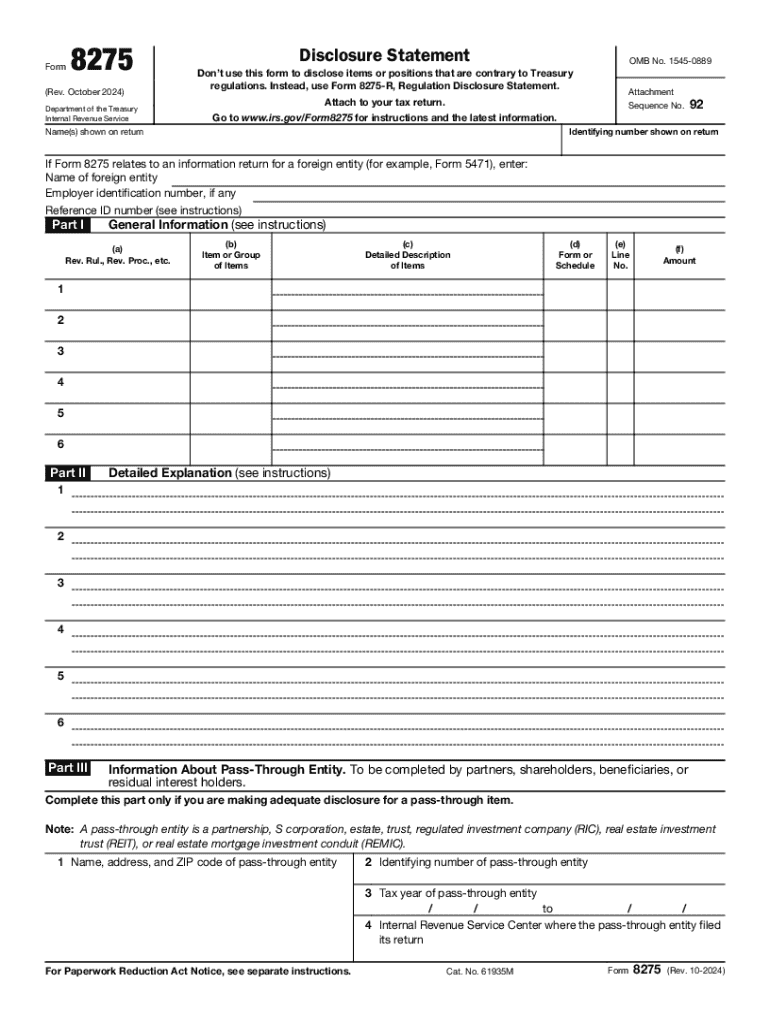

The IRS Form 8275, known as the Regulation Disclosure Statement, is designed to provide taxpayers a means to disclose positions taken on their tax returns that may be contrary to regulations. This form helps to avoid potential penalties for underreporting income or misrepresenting deductions. It is particularly important for taxpayers who are engaging in transactions that could be viewed as aggressive tax positions. By filing Form 8275, individuals and businesses can clarify their stance and support their claims with appropriate disclosures.

Steps to Complete Form 8275

Completing Form 8275 involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information related to the tax position you are disclosing. This may include documentation supporting your claims, such as contracts or financial records. Next, fill out the form by providing your personal details, the specific tax year, and a clear description of the position taken. Be sure to include any relevant facts or circumstances that support your disclosure. Finally, review the completed form for accuracy before submitting it with your tax return.

Key Elements of Form 8275

Form 8275 includes several important sections that require careful attention. The form starts with basic taxpayer information, including name, address, and taxpayer identification number. The main body of the form requires a detailed description of the tax position being disclosed, including the relevant tax code sections. Additionally, taxpayers must indicate whether the disclosure relates to a specific transaction or a general position. Providing a thorough and clear explanation is crucial, as it helps the IRS understand the rationale behind the disclosed position.

Legal Use of Form 8275

The legal use of Form 8275 is essential for taxpayers who wish to disclose their positions transparently. By utilizing this form, individuals and businesses can protect themselves from penalties associated with non-disclosure of tax positions. It is advisable to consult with a tax professional to ensure that the form is used correctly and that all relevant information is disclosed. Proper use of Form 8275 can demonstrate good faith in tax reporting and may mitigate the risk of audits or disputes with the IRS.

Filing Deadlines for Form 8275

Filing deadlines for Form 8275 align with the deadlines for submitting your tax return. Generally, individual taxpayers must file their returns by April 15 of the following year, while businesses may have different deadlines based on their entity type. If you are unable to meet the deadline, it is possible to request an extension, which also applies to Form 8275. However, it is important to ensure that the form is submitted along with your tax return to avoid any potential penalties.

Examples of Using Form 8275

Form 8275 can be utilized in various scenarios. For instance, if a taxpayer claims a deduction for a business expense that may not be explicitly allowed under IRS regulations, filing Form 8275 can provide clarity and support for that position. Another example is when a taxpayer engages in a complex investment strategy that may not fit neatly within established tax guidelines. By disclosing these positions through Form 8275, taxpayers can demonstrate their intent to comply with tax laws while asserting their rights to specific deductions or credits.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8275 r regulation disclosure statement

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8275 r regulation disclosure statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8275 and how can airSlate SignNow help?

Form 8275 is used to disclose positions taken on a tax return that may be contrary to IRS regulations. airSlate SignNow simplifies the process of completing and eSigning form 8275, ensuring that your documents are securely signed and easily shared.

-

Is there a cost associated with using airSlate SignNow for form 8275?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the eSigning process for documents like form 8275, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing form 8275?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for managing form 8275. These tools enhance efficiency and ensure that your documents are handled with care and precision.

-

Can I integrate airSlate SignNow with other software for form 8275?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8275 alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

How does airSlate SignNow ensure the security of my form 8275?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your form 8275 and other documents, ensuring that your sensitive information remains confidential.

-

Can I track the status of my form 8275 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 8275 in real-time. You will receive notifications when the document is viewed, signed, or completed, providing you with peace of mind throughout the process.

-

Is airSlate SignNow user-friendly for completing form 8275?

Yes, airSlate SignNow is designed with user experience in mind. The platform is intuitive and easy to navigate, making it simple for anyone to complete and eSign form 8275 without any technical expertise.

Get more for Instructions For Form 8275 R, Regulation Disclosure Statement

Find out other Instructions For Form 8275 R, Regulation Disclosure Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors