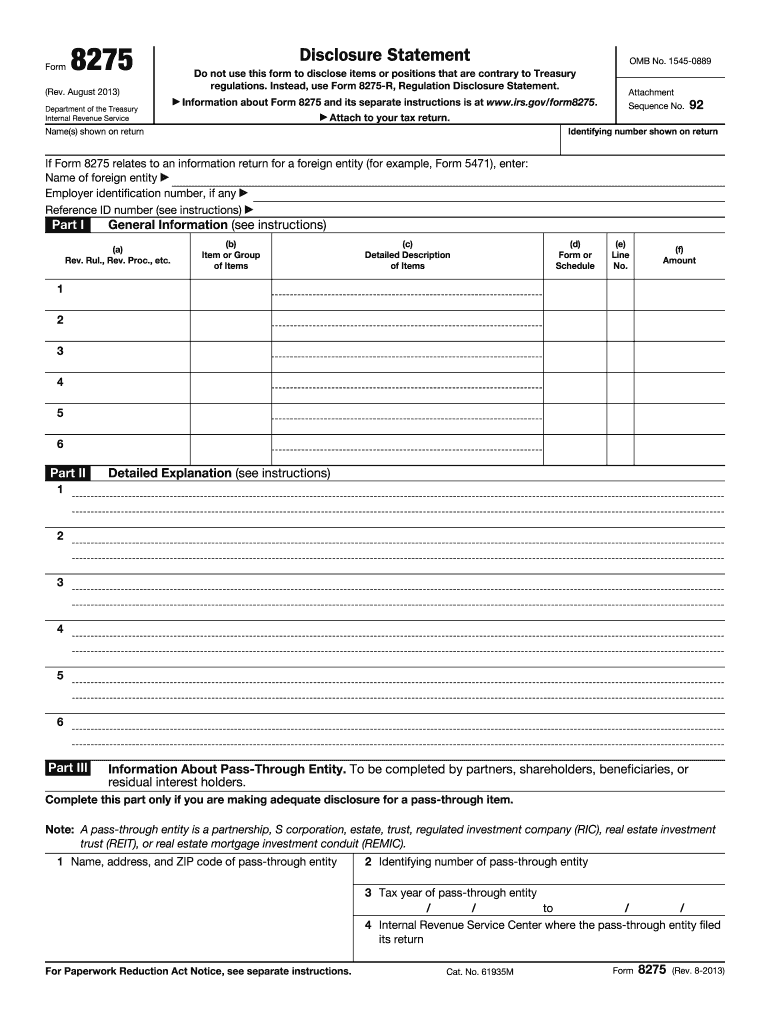

Irs Form 8275 2013

What is the IRS Form 8275?

The IRS Form 8275, also known as the disclosure statement, is a document used by taxpayers to disclose positions taken on a tax return that may be contrary to IRS regulations. This form helps taxpayers avoid penalties by providing transparency regarding their tax positions. It is particularly useful for those who are claiming deductions or credits that may not be explicitly supported by the tax code. By filing the 8275, taxpayers can communicate their rationale to the IRS, which can be beneficial in case of an audit.

How to use the IRS Form 8275

Using the IRS Form 8275 involves several steps to ensure proper completion and submission. Taxpayers should first determine if their tax situation requires disclosure. If so, they can fill out the form by providing detailed information about the specific tax positions they are taking. This includes a clear explanation of the facts and circumstances surrounding the position, as well as references to relevant tax laws or IRS rulings. Once completed, the form should be attached to the taxpayer's income tax return when filed.

Steps to complete the IRS Form 8275

Completing the IRS Form 8275 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the IRS Form 8275, which can be downloaded from the IRS website.

- Provide your name, address, and taxpayer identification number at the top of the form.

- In the main section, describe the tax position you are disclosing, including the relevant facts and legal basis for your position.

- Ensure that your explanation is clear and concise, avoiding unnecessary jargon.

- Review the completed form for accuracy and completeness before submission.

Legal use of the IRS Form 8275

The IRS Form 8275 is legally recognized as a means for taxpayers to disclose positions that may not align with IRS guidelines. By using this form, taxpayers can protect themselves from potential penalties associated with underreporting income or claiming improper deductions. The legal validity of the form is supported by compliance with IRS regulations, ensuring that the disclosures made are transparent and well-documented.

Examples of using the IRS Form 8275

There are various scenarios in which a taxpayer might need to use the IRS Form 8275. For instance, a self-employed individual claiming deductions for business expenses that are not explicitly outlined in the tax code may file this form to explain their rationale. Another example includes a taxpayer who is taking a unique tax position based on a recent IRS ruling that has not yet been widely adopted. In both cases, the form serves to clarify the taxpayer's intentions and protect against penalties.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8275 align with the standard tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If additional time is needed, taxpayers can file for an extension, which allows for an extended deadline of October 15. It is crucial to file the form by these deadlines to ensure that the disclosures are considered valid and to avoid potential penalties.

Quick guide on how to complete irs form 8275 2019

Effortlessly Prepare Irs Form 8275 on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 8275 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Irs Form 8275 with Ease

- Find Irs Form 8275 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irs Form 8275 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8275 2019

Create this form in 5 minutes!

How to create an eSignature for the irs form 8275 2019

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 8275 and why do I need it?

Form 8275 is a tax form used to disclose positions taken on your tax return that may not conform to IRS regulations. Utilizing airSlate SignNow to create and eSign Form 8275 simplifies the process, ensuring compliance and accuracy. It's essential for taxpayers who want to avoid penalties and explain their positions clearly to the IRS.

-

How does airSlate SignNow enhance the eSigning process for Form 8275?

With airSlate SignNow, you can easily upload, customize, and eSign Form 8275 from any device. The user-friendly interface allows you to complete your form quickly while ensuring secure transactions. This streamlines the filing process, adding efficiency to tax preparation.

-

What are the pricing options for using airSlate SignNow for Form 8275?

airSlate SignNow offers competitive and flexible pricing plans based on your business needs. Whether you're an individual or a large enterprise, our features for managing Form 8275 will fit your budget. Sign up for a free trial to explore how our solutions can meet your eSigning needs.

-

Can I integrate airSlate SignNow with other software for filling out Form 8275?

Yes, airSlate SignNow supports integration with various software platforms to help you manage Form 8275 efficiently. Whether using CRM or accounting software, our integrations facilitate seamless workflows. This helps in streamlining your document management process.

-

What security measures does airSlate SignNow implement for Form 8275?

airSlate SignNow employs advanced security protocols to protect your sensitive information associated with Form 8275. We use encryption, secure cloud storage, and user authentication to ensure that your documents are safe from unauthorized access. Trust us to safeguard your tax forms efficiently.

-

Is it possible to track the status of my Form 8275 after eSigning?

Absolutely! airSlate SignNow allows you to track the status of your Form 8275 in real-time. You will receive notifications once the form is signed and can view the progress of the approval process, enhancing accountability and transparency.

-

What are the benefits of using airSlate SignNow for tax documents like Form 8275?

Using airSlate SignNow streamlines the completion of Form 8275 with features like easy document sharing and automated reminders. This increases efficiency and minimizes errors, leading to quicker submissions. Experience a hassle-free way to fulfill tax obligations with our innovative eSigning solution.

Get more for Irs Form 8275

- Notice of suit housing code enforcement form

- 1st copy other party form

- Crear un perfil de remitente para su uso con la funcin de form

- Jv 405 continuance dependency detention hearing judicial council forms

- Health care power of attorney wisconsin state law library form

- Repayment agreement if any form

- To be used with question 12 form

- If applicable attach a copy of the form

Find out other Irs Form 8275

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form