About Form 2032, Contract Coverage under Title II of the 2024-2026

Understanding Form 2032: Contract Coverage Under Title II

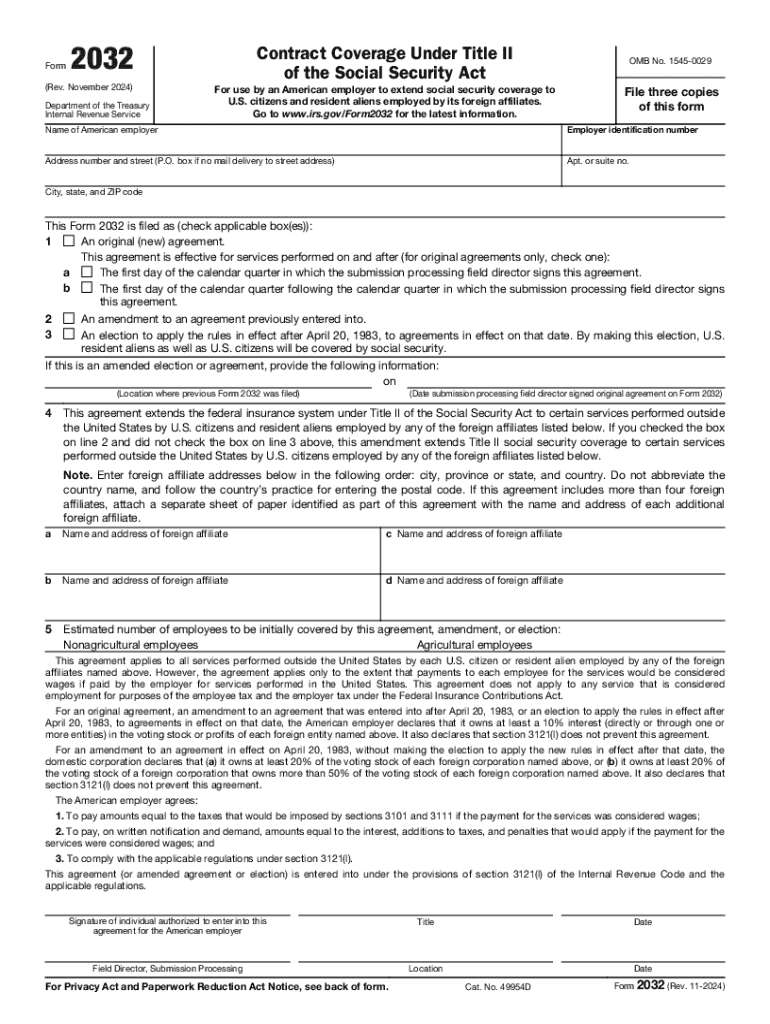

The 2032 form, known as the Contract Coverage Under Title II, is a critical document used by the IRS to determine eligibility for certain benefits. This form is primarily relevant for individuals and entities seeking coverage under specific contracts governed by Title II of the Social Security Act. It outlines the necessary information required to assess coverage and compliance with federal regulations.

Steps to Complete Form 2032

Completing Form 2032 involves several key steps to ensure accurate submission. Begin by gathering all necessary information, including personal identification details and relevant contract specifics. Carefully read through the instructions provided with the form to understand each section's requirements. Fill out the form completely, ensuring that all fields are addressed. Once completed, review the form for accuracy before submitting it to the appropriate IRS office.

Eligibility Criteria for Form 2032

To qualify for coverage under the 2032 form, applicants must meet specific eligibility criteria. This includes being involved in a contract that falls under Title II provisions. Additionally, applicants should demonstrate compliance with all relevant federal guidelines. It is essential to review the eligibility requirements thoroughly to avoid delays or rejections during the application process.

IRS Guidelines for Filing Form 2032

The IRS has established clear guidelines for filing Form 2032. These guidelines include deadlines for submission, required documentation, and acceptable filing methods. Understanding these guidelines is crucial for ensuring compliance and avoiding potential penalties. It is advisable to stay updated on any changes to these regulations to maintain eligibility and compliance.

Form Submission Methods for 2032

Form 2032 can be submitted through various methods, including online, by mail, or in person. Each submission method has its own set of requirements and processing times. For electronic submissions, ensure that you have the necessary software or access to the IRS e-filing system. If submitting by mail, use the correct address as specified by the IRS to ensure timely processing.

Potential Penalties for Non-Compliance

Failure to comply with the requirements associated with Form 2032 can result in significant penalties. These may include fines, denial of coverage, or other legal repercussions. It is important to adhere to all filing deadlines and guidelines to avoid these consequences. Regularly reviewing compliance requirements can help mitigate risks associated with non-compliance.

Required Documents for Form 2032

When submitting Form 2032, certain documents are required to support your application. These may include proof of identity, documentation of the contract in question, and any additional forms that the IRS specifies. Ensuring that all required documents are included with your submission can help expedite the review process and improve the likelihood of approval.

Create this form in 5 minutes or less

Find and fill out the correct about form 2032 contract coverage under title ii of the

Create this form in 5 minutes!

How to create an eSignature for the about form 2032 contract coverage under title ii of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2032 of IRS and how does it relate to eSigning documents?

The 2032 of IRS refers to the guidelines and regulations set by the IRS for electronic signatures. airSlate SignNow complies with these regulations, ensuring that your eSigned documents are legally binding and secure. This compliance helps businesses streamline their document processes while adhering to IRS standards.

-

How does airSlate SignNow ensure compliance with the 2032 of IRS?

airSlate SignNow follows the 2032 of IRS by implementing robust security measures and maintaining audit trails for all eSigned documents. Our platform uses encryption and secure storage to protect sensitive information, ensuring that your documents meet IRS compliance requirements. This gives users peace of mind when managing their electronic signatures.

-

What are the pricing options for airSlate SignNow in relation to the 2032 of IRS?

airSlate SignNow offers flexible pricing plans that cater to various business needs while ensuring compliance with the 2032 of IRS. Our plans are designed to be cost-effective, allowing businesses to choose the features they need without overspending. You can easily find a plan that fits your budget and compliance requirements.

-

What features does airSlate SignNow offer to support the 2032 of IRS?

airSlate SignNow provides features such as customizable templates, secure document storage, and real-time tracking to support the 2032 of IRS. These features enhance the eSigning experience, making it easier for businesses to manage their documents while ensuring compliance. Our platform is designed to simplify the signing process without compromising security.

-

Can airSlate SignNow integrate with other software to help with the 2032 of IRS?

Yes, airSlate SignNow integrates seamlessly with various software applications to enhance your workflow while adhering to the 2032 of IRS. This includes CRM systems, cloud storage solutions, and productivity tools. These integrations allow businesses to streamline their document management processes and maintain compliance effortlessly.

-

What are the benefits of using airSlate SignNow for the 2032 of IRS compliance?

Using airSlate SignNow for the 2032 of IRS compliance offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform simplifies the eSigning process, allowing businesses to save time and resources while ensuring that their documents are compliant with IRS regulations. This ultimately leads to improved productivity and cost savings.

-

Is airSlate SignNow suitable for small businesses concerned about the 2032 of IRS?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses concerned about the 2032 of IRS. Our platform provides all the necessary tools to ensure compliance without overwhelming users with complex features. Small businesses can easily manage their eSigning needs while staying compliant with IRS regulations.

Get more for About Form 2032, Contract Coverage Under Title II Of The

- Come worship with us its in the room shana wilson williams form

- Duquesne transcripsts form

- Federal resume template word download form

- Kuakini online job application form

- Dwc form 83 42560570

- Ckgs disclaimer form

- 25 map crosswords scholastic answer key form

- Usa boxing physical form fill online printable fillable

Find out other About Form 2032, Contract Coverage Under Title II Of The

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple