Form 433 B, Collection Information Statement for Businesses 2024-2026

What is the Form 433 B, Collection Information Statement For Businesses

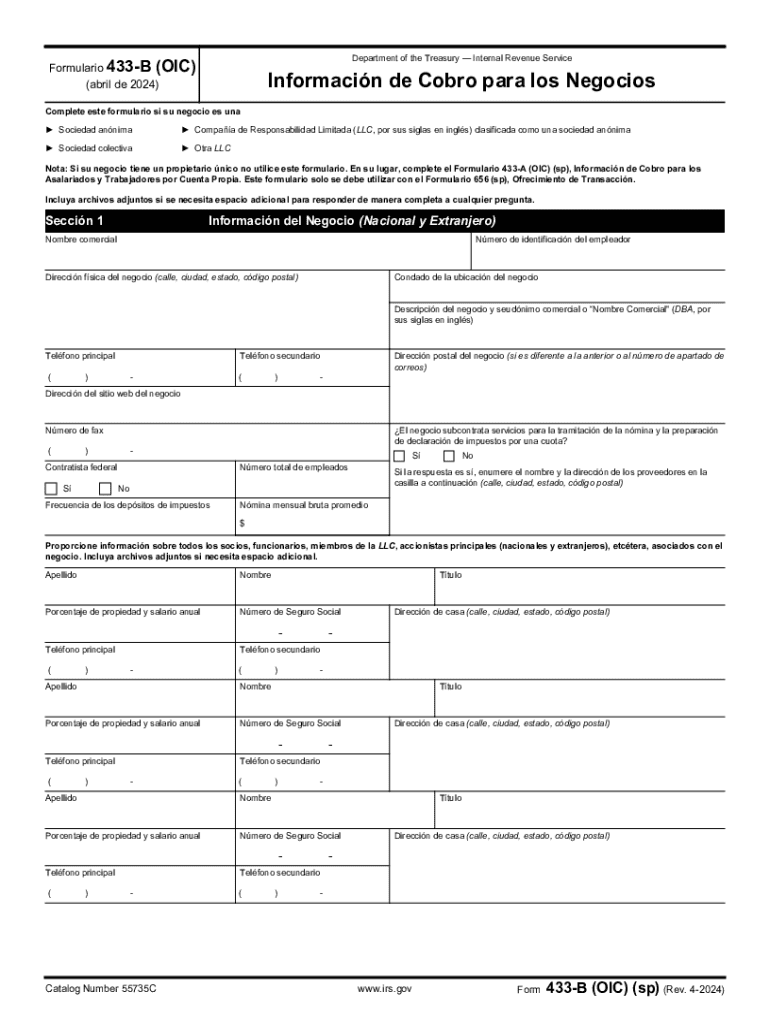

The Form 433 B, Collection Information Statement for Businesses, is a document used by the Internal Revenue Service (IRS) to collect financial information from businesses. This form is essential for businesses that owe taxes and are seeking to establish a payment plan or negotiate their tax liabilities. It provides a comprehensive overview of a business's financial situation, including income, expenses, assets, and liabilities. By accurately completing this form, businesses can facilitate communication with the IRS and potentially secure more favorable terms for tax repayment.

How to use the Form 433 B, Collection Information Statement For Businesses

Using the Form 433 B involves several key steps. First, businesses must gather all necessary financial information, including bank statements, profit and loss statements, and details about any outstanding debts. Once this information is collected, businesses can accurately fill out the form, ensuring that all sections are completed thoroughly. After completing the form, it should be submitted to the IRS, either by mail or electronically, depending on the specific requirements outlined by the IRS. Proper use of this form can lead to a better understanding of a business's tax obligations and available options for resolution.

Steps to complete the Form 433 B, Collection Information Statement For Businesses

Completing the Form 433 B requires careful attention to detail. The following steps can guide businesses through the process:

- Gather financial documents: Collect all relevant financial statements, including income statements, balance sheets, and cash flow statements.

- Fill out the form: Accurately enter information regarding business income, expenses, assets, and liabilities in the designated sections of the form.

- Review for accuracy: Double-check all entries to ensure that the information provided is correct and complete.

- Submit the form: Send the completed form to the IRS through the appropriate submission method, following any specific guidelines provided.

Key elements of the Form 433 B, Collection Information Statement For Businesses

The Form 433 B includes several critical sections that must be completed to provide a full picture of a business's financial status. Key elements include:

- Business Information: Basic details about the business, including the name, address, and Employer Identification Number (EIN).

- Income Information: A detailed account of the business's income sources, including sales revenue and other earnings.

- Expense Information: A breakdown of monthly expenses, such as rent, utilities, and payroll costs.

- Asset Information: A list of business assets, including cash, inventory, and equipment, along with their estimated values.

- Liability Information: Details regarding any outstanding debts or obligations the business holds.

Filing Deadlines / Important Dates

Filing deadlines for the Form 433 B can vary based on individual circumstances, but it is crucial for businesses to submit the form promptly when requested by the IRS. Generally, if a business is under audit or has received a notice of tax liability, the form should be submitted within the timeframe specified in the IRS correspondence. Staying aware of these deadlines helps businesses avoid penalties and ensures compliance with IRS regulations.

Required Documents

When completing the Form 433 B, businesses must provide various supporting documents to substantiate the information reported. Required documents typically include:

- Recent bank statements for all business accounts.

- Profit and loss statements for the current year and previous year.

- Balance sheets that reflect the business's financial position.

- Documentation of any outstanding debts or liabilities.

- Any other relevant financial records that provide insight into the business's operations.

Create this form in 5 minutes or less

Find and fill out the correct form 433 b collection information statement for businesses

Create this form in 5 minutes!

How to create an eSignature for the form 433 b collection information statement for businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 433 B, Collection Information Statement For Businesses?

Form 433 B, Collection Information Statement For Businesses, is a document used by the IRS to collect financial information from businesses. This form helps the IRS assess a business's ability to pay tax debts. Completing this form accurately is crucial for negotiating payment plans or settlements.

-

How can airSlate SignNow help with Form 433 B, Collection Information Statement For Businesses?

airSlate SignNow streamlines the process of completing and submitting Form 433 B, Collection Information Statement For Businesses. Our platform allows you to easily fill out the form, eSign it, and send it securely to the IRS. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 433 B?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that simplify the completion of Form 433 B, Collection Information Statement For Businesses. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing Form 433 B?

With airSlate SignNow, you can easily create, edit, and eSign Form 433 B, Collection Information Statement For Businesses. Our platform includes templates, cloud storage, and collaboration tools, making it simple to manage your documents efficiently. These features enhance productivity and ensure compliance.

-

Is airSlate SignNow secure for submitting Form 433 B?

Yes, airSlate SignNow prioritizes security and compliance when handling Form 433 B, Collection Information Statement For Businesses. Our platform uses advanced encryption and secure servers to protect your sensitive information. You can trust us to keep your data safe during the submission process.

-

Can I integrate airSlate SignNow with other software for Form 433 B?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for Form 433 B, Collection Information Statement For Businesses. Whether you use CRM systems or accounting software, our integrations help streamline document management and improve efficiency.

-

What are the benefits of using airSlate SignNow for Form 433 B?

Using airSlate SignNow for Form 433 B, Collection Information Statement For Businesses, provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. Our user-friendly interface makes it easy to navigate the form, while eSigning features expedite the approval process.

Get more for Form 433 B, Collection Information Statement For Businesses

Find out other Form 433 B, Collection Information Statement For Businesses

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document