Form433 B OIC Sp Rev 4 Collection Information Statement for Businesses Spanish Version 2023

What is the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

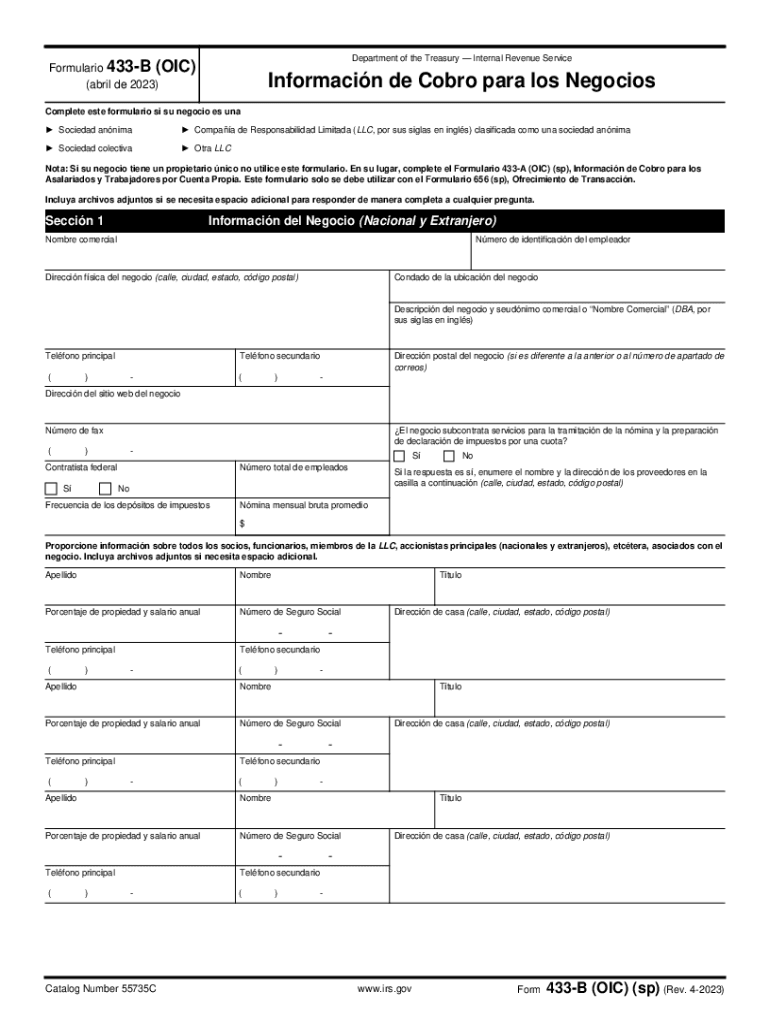

The Form433 B OIC sp Rev 4 Collection Information Statement for Businesses is a crucial document used by businesses in the United States to provide the IRS with detailed financial information. This form is specifically designed for businesses seeking to negotiate an Offer in Compromise (OIC) with the IRS, allowing them to settle their tax debts for less than the full amount owed. The Spanish version ensures that Spanish-speaking business owners can accurately complete the form and understand its requirements. The information collected includes income, expenses, assets, and liabilities, which helps the IRS assess the taxpayer's financial situation and determine eligibility for an OIC.

How to use the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

Using the Form433 B OIC sp Rev 4 involves several steps to ensure accurate and complete submission. First, gather all necessary financial documents, including income statements, expense reports, and asset valuations. Next, fill out the form with precise information regarding your business's financial status. It is essential to provide honest and comprehensive details to avoid potential penalties. Once completed, review the form for accuracy and ensure all required signatures are included. The final step is to submit the form to the IRS through the appropriate method, which can be online, by mail, or in person, depending on your specific situation.

Steps to complete the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

Completing the Form433 B OIC sp Rev 4 requires careful attention to detail. Follow these steps for successful completion:

- Gather financial documents: Collect all relevant financial records, including bank statements, tax returns, and profit and loss statements.

- Fill out the form: Provide accurate information regarding your business's income, expenses, assets, and liabilities. Ensure that all sections are completed.

- Review your entries: Double-check all information for accuracy to prevent any delays in processing.

- Sign the form: Ensure that the form is signed by the appropriate individuals within the business.

- Submit the form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent to the correct IRS address.

Key elements of the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

The Form433 B OIC sp Rev 4 includes several key elements that are vital for IRS evaluation. These elements consist of:

- Income information: Detailed accounts of all income sources, including wages, business revenue, and other earnings.

- Expense details: A comprehensive list of business expenses, such as rent, utilities, payroll, and other operational costs.

- Asset disclosures: Information about business assets, including real estate, equipment, and inventory.

- Liabilities: A summary of any debts or obligations owed by the business, including loans and credit lines.

Eligibility Criteria

To qualify for an Offer in Compromise using the Form433 B OIC sp Rev 4, businesses must meet specific eligibility criteria established by the IRS. These criteria include:

- The business must be in compliance with all filing and payment requirements.

- The business must demonstrate an inability to pay the full tax liability.

- All financial information provided must be accurate and truthful.

- The business should not have a history of non-compliance with tax obligations.

Form Submission Methods

The Form433 B OIC sp Rev 4 can be submitted to the IRS through various methods. These methods include:

- Online submission: If applicable, businesses may submit the form electronically through the IRS website or authorized e-filing services.

- Mail: The completed form can be mailed to the designated IRS address for OIC submissions.

- In-person submission: Businesses may also choose to deliver the form directly to their local IRS office, ensuring receipt confirmation.

Create this form in 5 minutes or less

Find and fill out the correct form433 b oic sp rev 4 collection information statement for businesses spanish version

Create this form in 5 minutes!

How to create an eSignature for the form433 b oic sp rev 4 collection information statement for businesses spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

The Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version is a crucial document used by businesses to provide financial information to the IRS when applying for an Offer in Compromise. This form helps the IRS assess a business's ability to pay its tax liabilities. Understanding this form is essential for businesses seeking to resolve their tax issues effectively.

-

How can airSlate SignNow help with the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

airSlate SignNow simplifies the process of completing and submitting the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version. Our platform allows users to easily fill out the form, eSign it, and send it securely to the IRS. This streamlines the submission process, ensuring that businesses can focus on their operations while we handle the paperwork.

-

Is there a cost associated with using airSlate SignNow for the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version without breaking the bank. We provide a free trial so you can explore our features before committing to a plan.

-

What features does airSlate SignNow offer for managing the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

airSlate SignNow provides a range of features designed to enhance your experience with the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version. These include customizable templates, secure eSigning, document tracking, and integration with popular business applications. Our user-friendly interface ensures that you can navigate the process with ease.

-

Can I integrate airSlate SignNow with other software for the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

Using airSlate SignNow for the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your sensitive information is protected while allowing you to complete and submit forms quickly. This means less stress and more focus on your business operations.

-

Is airSlate SignNow user-friendly for completing the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind. Completing the Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version is straightforward, thanks to our intuitive interface and guided workflows. Whether you're tech-savvy or a beginner, you'll find it easy to navigate and complete your documents.

Get more for Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

Find out other Form433 B OIC sp Rev 4 Collection Information Statement For Businesses Spanish Version

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe