Schedule OI Form 1040 NR Sp Other Information Spanish Version 2024

What is the Schedule OI Form 1040 NR sp Other Information Spanish Version

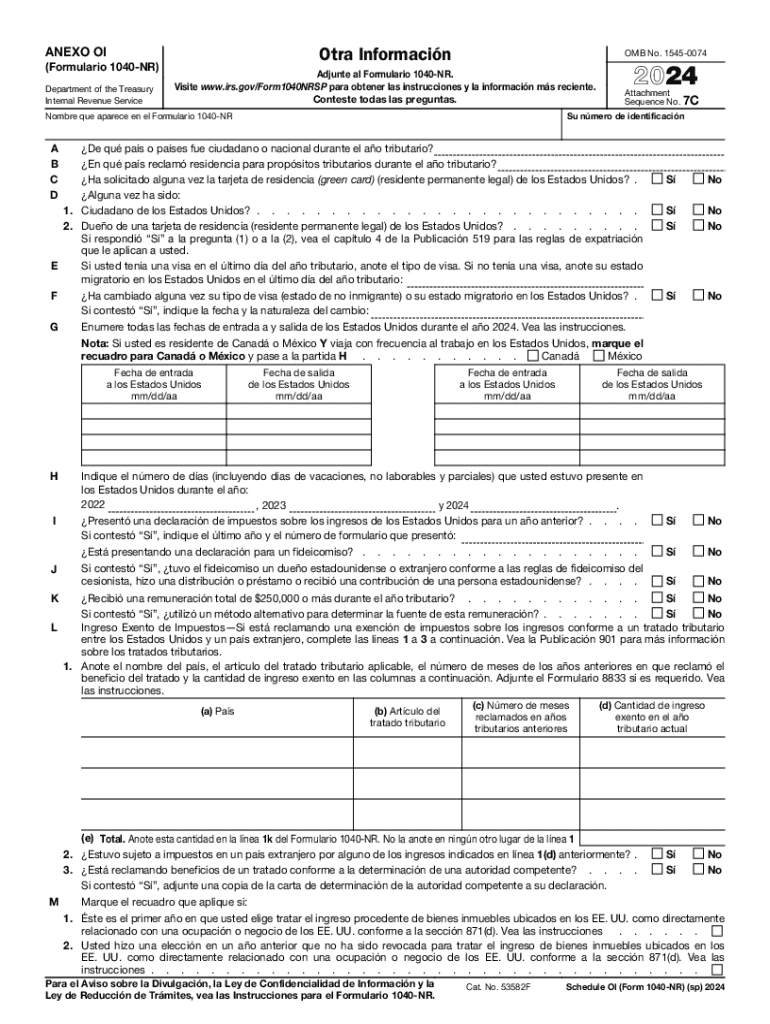

The Schedule OI Form 1040 NR sp Other Information Spanish Version is a supplemental form used by non-resident aliens filing a U.S. income tax return. This form provides additional information required by the IRS, specifically tailored for Spanish-speaking taxpayers. It helps clarify various aspects of income, deductions, and tax liabilities that may not be fully addressed in the standard Form 1040 NR. Understanding this form is essential for compliance with U.S. tax regulations.

How to use the Schedule OI Form 1040 NR sp Other Information Spanish Version

To effectively use the Schedule OI Form 1040 NR sp Other Information Spanish Version, taxpayers should first ensure they have completed the main Form 1040 NR. This supplemental form should be attached to the main return. It is crucial to read the instructions carefully, as they provide guidance on how to fill out each section accurately. The form includes fields for reporting additional information that may affect tax calculations, such as residency status and specific income types.

Steps to complete the Schedule OI Form 1040 NR sp Other Information Spanish Version

Completing the Schedule OI Form 1040 NR sp Other Information Spanish Version involves several key steps:

- Begin by gathering all relevant financial documents, including income statements and prior tax returns.

- Fill out the personal information section, ensuring that your name, address, and taxpayer identification number are accurate.

- Provide detailed information regarding your income sources and any applicable deductions.

- Review the specific questions related to your residency status and other pertinent tax information.

- Attach the completed form to your Form 1040 NR before submission.

Key elements of the Schedule OI Form 1040 NR sp Other Information Spanish Version

Key elements of the Schedule OI Form 1040 NR sp Other Information Spanish Version include:

- Personal Information: This section captures essential details about the taxpayer.

- Residency Status: Taxpayers must indicate their residency status, which affects tax obligations.

- Income Reporting: Detailed reporting of various income types is required.

- Deductions and Credits: Information on any deductions or credits applicable to the taxpayer.

- Signature: The form must be signed to validate the information provided.

Legal use of the Schedule OI Form 1040 NR sp Other Information Spanish Version

The Schedule OI Form 1040 NR sp Other Information Spanish Version is legally required for non-resident aliens to report additional information to the IRS. Failing to complete and submit this form accurately can result in penalties or delays in processing tax returns. It is essential for taxpayers to understand their obligations under U.S. tax law and ensure compliance to avoid legal issues.

Create this form in 5 minutes or less

Find and fill out the correct schedule oi form 1040 nr sp other information spanish version 771104607

Create this form in 5 minutes!

How to create an eSignature for the schedule oi form 1040 nr sp other information spanish version 771104607

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule OI Form 1040 NR sp Other Information Spanish Version?

The Schedule OI Form 1040 NR sp Other Information Spanish Version is a tax form used by non-resident aliens to provide additional information to the IRS. This form is essential for accurately reporting income and claiming deductions. Understanding this form can help ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Schedule OI Form 1040 NR sp Other Information Spanish Version?

airSlate SignNow simplifies the process of completing and eSigning the Schedule OI Form 1040 NR sp Other Information Spanish Version. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can securely send the completed form to relevant parties.

-

Is there a cost associated with using airSlate SignNow for the Schedule OI Form 1040 NR sp Other Information Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our plans are designed to be cost-effective while providing comprehensive features for managing documents like the Schedule OI Form 1040 NR sp Other Information Spanish Version. You can choose a plan that best fits your business requirements.

-

What features does airSlate SignNow offer for the Schedule OI Form 1040 NR sp Other Information Spanish Version?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the Schedule OI Form 1040 NR sp Other Information Spanish Version. These features enhance the user experience by making it easy to manage and track your documents efficiently.

-

Can I integrate airSlate SignNow with other applications for the Schedule OI Form 1040 NR sp Other Information Spanish Version?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Schedule OI Form 1040 NR sp Other Information Spanish Version. This means you can connect with tools you already use, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the Schedule OI Form 1040 NR sp Other Information Spanish Version?

Using airSlate SignNow for the Schedule OI Form 1040 NR sp Other Information Spanish Version provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on other important tasks.

-

Is airSlate SignNow user-friendly for completing the Schedule OI Form 1040 NR sp Other Information Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind. The interface is intuitive, making it easy for anyone to complete the Schedule OI Form 1040 NR sp Other Information Spanish Version without extensive training. Our goal is to provide a seamless experience for all users.

Get more for Schedule OI Form 1040 NR sp Other Information Spanish Version

Find out other Schedule OI Form 1040 NR sp Other Information Spanish Version

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP