Schedule a Form 1040 NR Sp Itemized Deductions Spanish Version 2024

Understanding the Schedule A Form 1040 NR sp Itemized Deductions

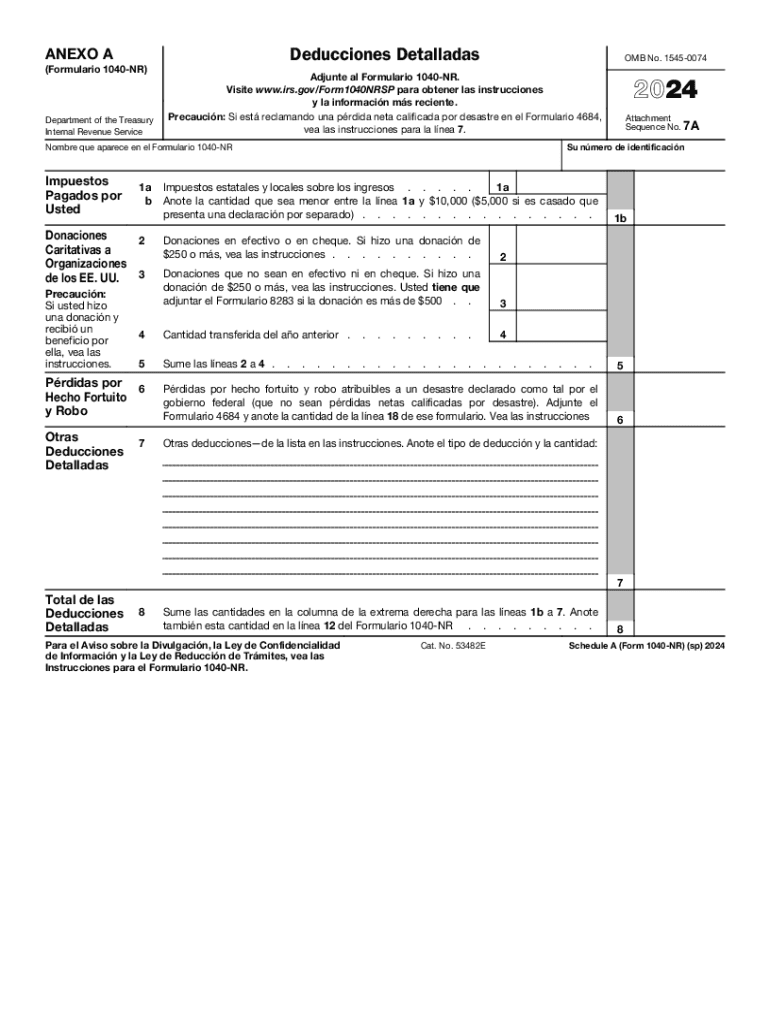

The Schedule A Form 1040 NR sp is specifically designed for non-resident aliens to report itemized deductions on their U.S. tax returns. This form allows eligible taxpayers to deduct certain expenses from their taxable income, potentially lowering their overall tax liability. Common deductions include medical expenses, state and local taxes, and mortgage interest. Understanding the nuances of this form is essential for accurate tax reporting and compliance.

Steps to Complete the Schedule A Form 1040 NR sp Itemized Deductions

Completing the Schedule A Form 1040 NR sp involves several key steps:

- Gather necessary documentation, including receipts and records for all deductible expenses.

- Fill out the form by entering your personal information, including your name and taxpayer identification number.

- List all eligible itemized deductions in the appropriate sections of the form, ensuring accuracy.

- Calculate the total deductions and transfer this amount to your main tax return.

- Review the completed form for any errors before submission.

Legal Use of the Schedule A Form 1040 NR sp Itemized Deductions

The Schedule A Form 1040 NR sp must be used in compliance with IRS regulations. Non-resident aliens are required to follow specific guidelines regarding eligibility for itemized deductions. It is crucial to ensure that all claimed deductions are legally permissible and supported by appropriate documentation. Misuse of this form can lead to penalties and interest on unpaid taxes.

Filing Deadlines and Important Dates

Filing the Schedule A Form 1040 NR sp must align with the annual tax return deadlines. Typically, non-resident aliens must file their tax returns by April fifteenth. However, if you are outside the United States on this date, you may qualify for an automatic extension until June fifteenth. It is essential to be aware of these deadlines to avoid late fees and penalties.

Required Documents for the Schedule A Form 1040 NR sp Itemized Deductions

To accurately complete the Schedule A Form 1040 NR sp, you will need several documents:

- Receipts for medical expenses, state and local taxes, and mortgage interest.

- Any relevant financial statements that detail your income and expenses.

- Documentation proving your non-resident status, such as a visa or immigration paperwork.

Examples of Using the Schedule A Form 1040 NR sp Itemized Deductions

Common scenarios for using the Schedule A Form 1040 NR sp include:

- A non-resident alien who incurred significant medical expenses during the tax year.

- A foreign student who paid state taxes while studying in the U.S.

- An expatriate who holds a mortgage on a property in the United States.

Create this form in 5 minutes or less

Find and fill out the correct schedule a form 1040 nr sp itemized deductions spanish version 771107606

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 nr sp itemized deductions spanish version 771107606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 nr form?

The 1040 nr form is a tax return form used by non-resident aliens in the United States to report their income and calculate their tax obligations. It is essential for individuals who earn income in the U.S. but do not qualify as residents for tax purposes. Understanding how to fill out the 1040 nr form correctly can help ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 1040 nr form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 1040 nr form. With its user-friendly interface, you can easily upload your completed form, gather signatures, and securely share it with the necessary parties. This streamlines the process and saves time during tax season.

-

Is there a cost associated with using airSlate SignNow for the 1040 nr form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of features like document management and eSigning, making it a cost-effective solution for handling the 1040 nr form and other documents. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the 1040 nr form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the 1040 nr form. These features enhance the efficiency of document handling and ensure that you can manage your tax forms effectively. Additionally, the platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other applications for the 1040 nr form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with the 1040 nr form. Whether you use CRM systems, cloud storage solutions, or other productivity tools, you can easily connect them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 1040 nr form?

Using airSlate SignNow for the 1040 nr form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and sign documents electronically, which minimizes the risk of errors and delays. This ensures that your tax submissions are timely and accurate.

-

Is airSlate SignNow secure for handling the 1040 nr form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the 1040 nr form. The platform employs advanced encryption and security protocols to protect your data. You can confidently manage your tax documents without worrying about unauthorized access.

Get more for Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

- Enhanced due diligence form

- Nycha affidavit of income form

- Waterproofing certificate template 476645844 form

- Accuracy and precision worksheet answers pdf form

- Ohio hea 3029 form

- Harlingen police department citizen complaint formdocx

- Haul slip form

- Kayak ampamp paddle board rental form and agreement mansfield ct

Find out other Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement